MSCI awards higher ESG ratings to top-performing stocks in a bid to make its index offerings appear more attractive, according to new academic research.

A paper from Columbia University and Emory University, titled ESG Ratings of ESG Index Providers, found firms deriving most of their revenues from their indexing business provide higher ESG ratings to stocks boasting stronger returns, allowing these companies to be overweighted in their ESG benchmarks.

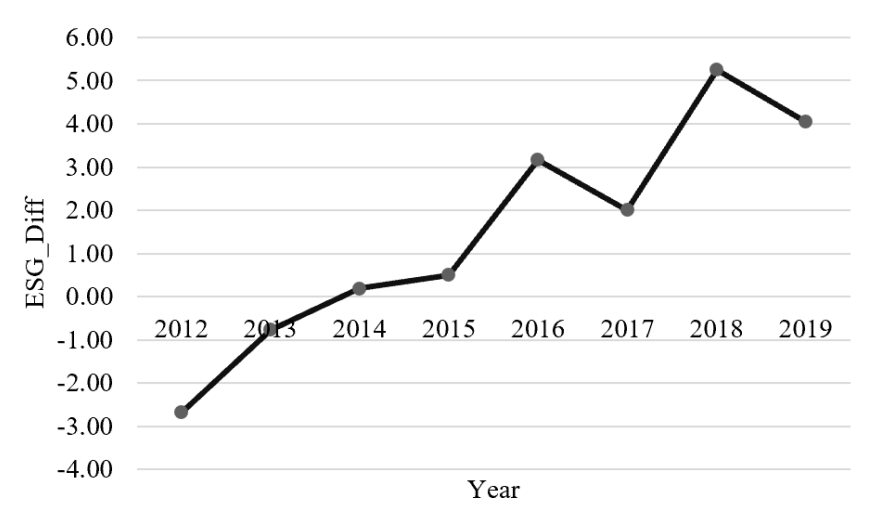

The research compared ESG ratings from two providers, MSCI – which derives 60% of its revenues from its indexing business – and Refinitiv – whose ratings are not relied upon by “any significant ESG index”.

It found ESG ratings from MSCI are systematically higher than those from Refinitiv, with ESG upgrades and downgrades relative to peers not appearing to be explicable using ‘fundamental’ ESG performance.

Chart 1: Difference in ESG ratings between MSCI and Refinitiv (%)

Source: Agarwal et al, 2023

“Collectively, our findings suggest that ESG data providers’ index licensing incentives influence their ESG ratings,” the research said.

In a blog post, Joachim Klement, investment strategist at Liberum Capital, warned such dynamics mean “there may be even monetary conflicts of interest at play in some cases”.

Klement highlighted how “it seems that MSCI ESG ratings change if the share price performance of a company changes”, how companies with higher returns receive higher ESG ratings even with a “lack of change” in ESG data and the fact MSCI ESG index inclusion “is linked to past share price performance”.

Researchers argued there is a general lack of clarity in how ESG data providers determine ESG ratings, raising concerns around the credibility of ESG ratings.

Responding to the findings, MSCI said in a statement: “The design and calculation of MSCI indices is functionally separate from the assignment of ESG ratings.

“MSCI ESG indices utilise ratings sourced from our ESG ratings business but is not involved in the ratings process which is separately managed with editorial independence. MSCI ESG research maintains a strong culture of independence and transparency in providing ESG ratings to global investors.”

The research follows the European Commission proposing new rules for ESG ratings providers in June, in a move to combat opacity and potential conflicts of interest within the space.