Nvidia’s vast size and toe-curling rally may now be the daily chit-chat of trading desks and taxi drivers alike, however, in ETF land the question is how the chipmaker has come to drive a third of the returns in some thematic and sector ETFs after quadrupling its footprint in little over a year.

After AI mania and global processing unit (GPU) demand from data centres drove 239% Nvidia price gains last year, Q4 earnings released in February – including an almost $2bn revenue beat – fanned the already healthy flame of investor interest. Shares surged a further 88% in Q1, taking Nvidia to a colossal $2.3trn market cap.

Future theme driver

Naturally, these gains are reflected within passive ETFs holding the stock to the extent that their underlying benchmarks allow.

Among these are thematic ETFs capturing semiconductor and AI megatrends, with the Amundi MSCI Semiconductors ESG Screened UCITS ETF (CHIP) being the posterchild of the Nvidia effect.

CHIP has established itself as the best-performing non-blockchain UCITS ETF over the medium term, skyrocketing 143.1% between the start of 2023 and 22 March this year.

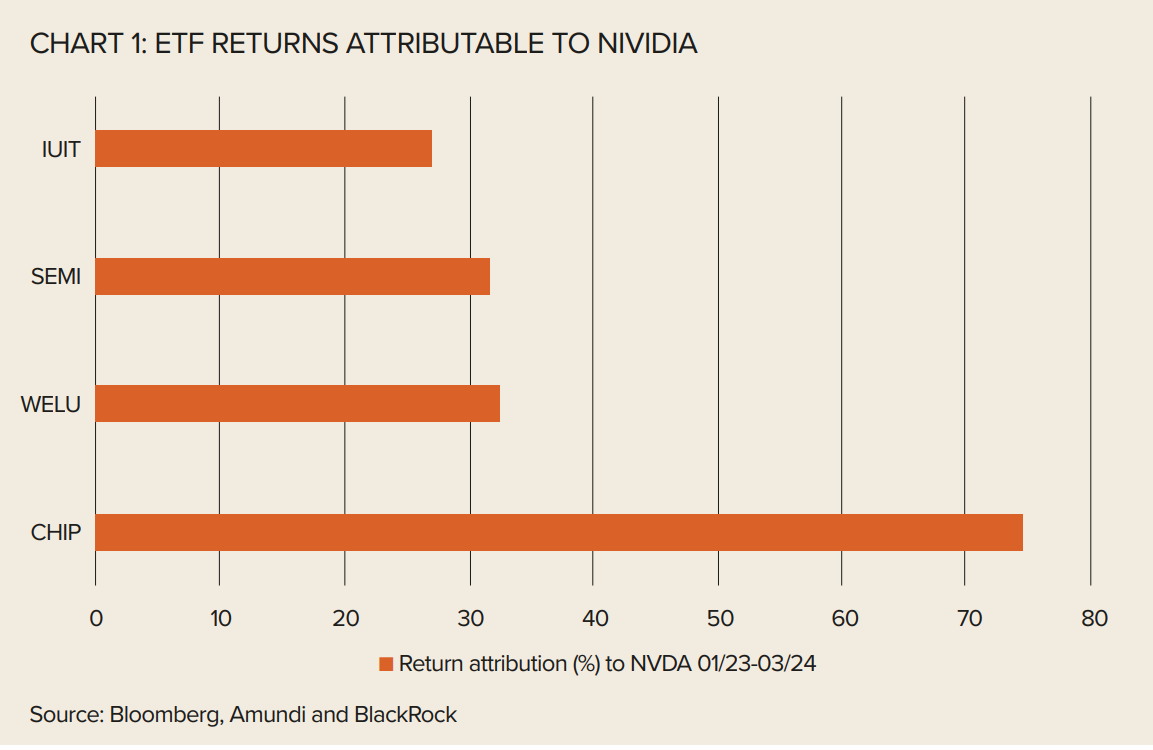

Nvidia’s role in this has been anything from tangential. While its weight in CHIP’s underlying index more doubled from 14.2% to 33.5%, data from Bloomberg and Amundi revealed a considerable 74.4% of the ETF’s gain through the period can be attributed to the chipmaker.

Although ETFs are often chosen as tools to gain diverse exposures to future themes – and Nvidia’s current weighting tests the limits of the 20/35 rule applied to CHIP’s underlying – it is not the only thematic ETF enabling large single stock bets on Nvidia.

In fact, others, such as the Global X Robotics & Artificial Intelligence ETF (BOTZ), have opened the door for such elevated exposures, after the ETF’s top holding cap was raised from 20% to 35% last month to accommodate Nvidia’s growing footprint.

Elsewhere, some thematic strategies have far lower single stock thresholds. Lukas Ahnert, senior passive product specialist at DWS, said this highlights the ability of such ETFs to manage returns and risk concentration while remaining broadly invested.

However, Nvidia still makes its presence known within these ETFs. Between the start of 2023 and late March this year, the stock comprised 31.7% of gains with a 9.6% weight in the VanEck Semiconductor UCITS ETF (SMH), 23.6% of gains with a 8.6% weight in the iShares MSCI Global Semiconductor UCITS ETF (SEMI) and even 16.9% of gains with just a 5.9% average weighting in the Xtrackers Artificial Intelligence & Big Data UCITS ETF (XAIX).

A similar story in sectors

While thematic ETFs have rightly or wrongly earned a reputation for concentration risk and presenting unique challenges for index construction, Nvidia fanfare has also spread to more conventional corners of the ETF roster including sectors.

Unsurprisingly, a key focus for this discussion is US tech sector benchmarks which have dutifully tracked Nvidia’s rise in lockstep.

This is evidenced by the iShares S&P 500 Information Technology Sector UCITS ETF (IUIT) seeing its allocation to the stock hike from 4.6% to 17.6% within 15 months to the end of March and the Xtrackers MSCI USA Information Technology UCITS ETF (XUTC) seeing its Nvidia weighting jump from 4.1% to 17.3% over the same period.

The chipmaker accounted for 27% and 25.1% of gains across the two ETFs, respectively, over that timeframe, even though both strategies are comprised of at least 65 constituents.

Perhaps more interesting is Nvidia’s journey to becoming a darling within ESG-screened tech sector strategies. This is seen with the Amundi S&P Global Information Technology ESG UCITS ETF (WELU), which saw its Nvidia allocation triple from 7% to 21.3% and 32.4% of its gains owe to the chipmaker in the 15 months to March.

Similarly, an Invesco equivalent ETF tracking the same index saw its allocation to the chipmaker surge from 8.9% at launch in April last year to 19.2% by the end of March, playing a dominant role in the ETF’s 92-strong basket.

Should investors be concerned?

Examining Nvidia’s rise to prominence across equity ETFs, Monika Calay, head of EMEA passive strategies research at Morningstar, suggested it is time for asset allocators to take note.

“The uptick in Nvidia weightings within thematic and sector ETFs is something we have noticed and it should be a material consideration for investors,” Calay said.

However, the stock’s recent tear has not muted appetite for affected thematic ETFs. In fact, CHIP has welcomed $101m inflows over the past 12 months – equivalent to a quarter of its total assets – and SMH, Europe’s largest semiconductor ETF, has seen its assets under management (AUM) swell from $1bn last June to $1.8bn.

For those wishing to sidestep single stock concentration, Calay pointed to equal-weight thematic ETFs as a tool to avoid potential bubbles, but added this does not completely allay the risks of rules-based megatrend strategies.

“Investing in thematic funds is like placing a trifecta bet at the horse track,” Calay argued. “You are trying to get three things right: the theme, the stocks and the valuations. Investors should be aware that much of their enthusiasm may already be priced in by the time thematic funds are brought to market.”

Suggesting an alternative, Andrew Limberis, investment director at Omba Advisory & Investments, said active thematic ETFs would “make a lot of sense” in rotating between themes and individual holdings, but conceded “it is going to be a very difficult job to convince European investors”.

In sector ETFs, a similar trend of performance chasing has played out in flows across strategies with high Nvidia exposure.

BlackRock and DWS’s US tech sector ETFs, for instance, received approximately $700m inflows apiece between the turn of the year and 27 March, according to data from Bloomberg Intelligence.

“These tech ETFs are taking in a considerable amount of flows, relative to the risk-on sentiment we are seeing,” Sebastian Cabral, research associate at Bloomberg Intelligence, said.

“There are still flows going into core S&P 500 ETFs, but what is also interesting is investors are getting more granular in their allocation to Nvidia and they are doing so via their exposure to these tech ETFs.”

The observation of investors steering deeper into Nvidia and the ‘magnificent seven’ may surprise some after fund selectors allocated $2bn to the Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW) in 2023 to downplay US large cap tech exposure.

“It is interesting flows are still transferring into these products rather than steering on a more risk-averse basis,” Cabral added.

Final word

Unlike past issues of small cap overconcentration and oversized stock ownership seen in thematic strategies, Nvidia’s swarm across theme and sector ETFs is a question for investors to answer from an asset allocation perspective, rather than a structural concern for the ETF wrapper.

As also seen in broad equity indices – where Nvidia has risen from 0.7% to 5.1% of S&P 500 products since 2020 – ETFs will continue to reflect the chipmaker's meteoric rise for as long as it continues.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.