As stewards of capital, institutional asset owners (AOs) play an incredibly important role in the global market ecosystem. As fiduciaries, AOs oversee some of the world’s largest pools of invested assets.

To better understand the motivations, challenges and attitudes of AOs in the current environment, Morningstar, through its Indexes and Sustainalytics teams and with assistance from Collie ESG, has embarked on a global multi-phase survey.

The survey findings provide an interesting lens into the evolving role of AOs and the substantial and growing influence ESG and sustainable considerations have had on the global market ecosystem. They present a global group of AOs who are diverse in nature yet unified in the growing pressure faced from stakeholders and the rising urgency to act amid complex global challenges like climate change, inequality and accelerated biodiversity losses.

Phase one – qualitative analysis

Prior to a quantitative survey, that was completed in August, Morningstar conducted a broader quantitative analysis leading to a number of interesting points that warranted further investigation and validation:

It is material AOs resoundingly understand that ESG considerations are material to the investment process.

It is messy and evolving While AOs agreed that ESG considerations are important, they also expressed the view that ESG addresses complicated and multifaceted issues.

ESG data, indices and ratings – good but need to get better ESG investing has called forth an industry that provides specialised data and analysis necessary for the integration of ESG factors into the investment process.

Read the full qualitative analysis

Phase two – quantitative analysis

During the second phase of the survey, Morningstar drilled down deeper into these key areas through a quantitative survey of 500 individuals working at AOs spanning the insurance, OCIO, family office, sovereign wealth, pension, endowment, foundation and charitable sectors across 11 countries (100 from North America, 200 each from Europe and Asia-Pacific). The findings added more depth and nuance to the analysis while staying largely consistent with the qualitative findings:

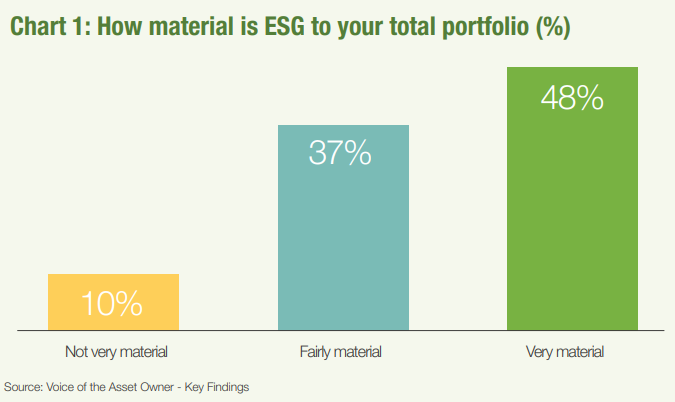

ESG factors are widely acknowledged to be material among asset owners. But despite their materiality, ESG considerations are still not applied across all assets. A vast majority (85%) of respondents believe that ESG factors are either “very” (48%) or “fairly” (37%) material (see Chart 1). This pattern held not only at the total portfolio level, but for each asset class queried: listed equity, fixed income, alternatives and real estate. Most respondents (70%) feel that ESG factors have become more material in the past five years. This is testimony to the dynamic nature of materiality and the success of investors in raising ESG factors to materiality.

Asset owners have a diverse range of philosophies and approaches to the implementation of their ESG programs. Respondents were asked to characterise their organisations’ approach to ESG. A majority (59%) indicated that ESG considerations were taken into account only to the extent they were deemed to be financially relevant. The remaining 41% saw ESG considerations as being valid objectives in their own right, with most doing so only to the extent it did not require any financial compromise. Just 11% of respondents were willing to sacrifice some financial return in order to pursue ESG objectives, presumably among more mission-driven asset owners. The range of responses to this question speaks to how fiduciary duties vary by types of asset owners and jurisdiction.

There was no single dominant motivation behind the adoption of ESG. Influential factors that were cited ranged from senior management to external pressure to regulation to ethical considerations. Barriers to the pursuit of an ESG strategy also varied, with the potential impact on returns the most cited barrier (38%).

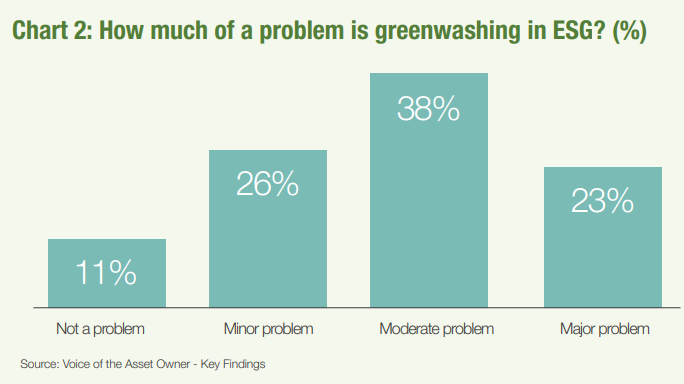

The role of regulation is, on balance, seen as a positive one. Greenwashing is viewed as a particular challenge for regulators to address. ESG regulation is welcomed by many asset owners, with 59% regarding it as either a “slight” or “major” help, with 24% seeing regulation as a “slight” or “major” hindrance. Those who regard it as beneficial identified, for example, the clarity of definition and standardisation that regulation creates.

Those who saw it as a hindrance cited increased bureaucracy and cost as primary concerns. Some 73% indicated support for regulations intended to achieve specific objectives – such as “net zero emissions by 2050” – against only 10% who opposed such regulation.

Asset owners consider greenwashing to be a real, though not overwhelming, concern: 61% see it as a “major” or “moderate” problem while 26% say it is a “minor problem” and 11% feel it is “not a problem.” These results evidence asset owners’ broadly favourable perspective on regulation (see Chart 2).

Ratings, data and tools have improved, but asset owners are asking for more. A majority of respondents felt that ESG ratings, indexes, data, and tools have become either “a lot” (28%) or “somewhat” better (35%) over the past five years, while 13% felt that they had become “worse.” Over the next five years, asset owners expect improvements in quality, relevance, clarity and scope (in that order). These tools are seen as most useful for risk management and the measurement of impact.

When asked who is most responsible for improving ESG data, ratings and tools, asset owners cite a range of institutions including government, service providers (ratings agencies, specialised data providers, index providers), international standard-setting bodies, markets and NGOs; it requires a collective, across-the-board effort. With regulatory efforts to improved data disclosure and quality already underway, standard setting becoming more streamlined globally and service providers continually innovating, the public sector, private sector and NGOs are responding to calls for better quality, relevance, clarity and scope of data and analysis.

While the development of ESG is a global trend, there are many distinct aspects to this, and some local differences across the various regions. Many of the patterns described above held across all the regions surveyed, in some cases remarkably so. There were, however, a few areas where clear distinctions in philosophy or approach could be found. On the question about asset owners’ overall approach, for example, the US was notable for having the greatest proportion of both the highest and the lowest responses, indicating a significant lack of consensus among asset owners. The motivations for pursuing ESG also varied, with external pressure a greater factor in North America than either Europe or AsiaPacific. Regulation has been a particularly strong factor in driving ESG investing in China. Approaches to stewardship and engagement also varied, most likely due to differences in regulations and norms across and, to some extent, within regions.

To summarise, through discussions with asset owners of all shapes, sizes and approaches around the world, ESG investing is complex as well as diverse and is progressing at different speeds and stages. Despite their differences and the fact that each is on a different stage in their own ESG journey, asset owners are quite unified in their ESG commitment. A prime example of this commitment is active stewardship. More than nine out of 10 (91%) asset owners we surveyed report that active stewardship (including proxy voting) plays at least a slightly significant role in their ESG programme.

And it should not go without saying that asset owners can be quite influential to global markets and public policy when they get their minds focused on a topic. ESG is an ecosystem with multiple catalysts, influencers, stakeholders and spheres of influence. The global asset owner community is just one factor in this global ecosystem, but an important one.

Read the full quantitative analysis here.

This article first appeared in ESG Unlocked: Europe out in front, an ETF Stream report. To read the full report, click here.