Invesco, State Street Global Advisors and UBS Asset Management were the largest ETF issuers to suffer outflows in Q2 despite positive inflows for the European market.

According to data from ETFbook, the European exchange-traded product (ETP) market saw $31bn inflows in Q2 as investors looked to stay diversified through fixed income and global equities.

Highlighting this, fixed income UCITS ETFs captured a record €31bn net new assets in H1 while investors piled $4.1bn inflows into the iShares Core MSCI World UCITS ETF (IWDA) in Q1.

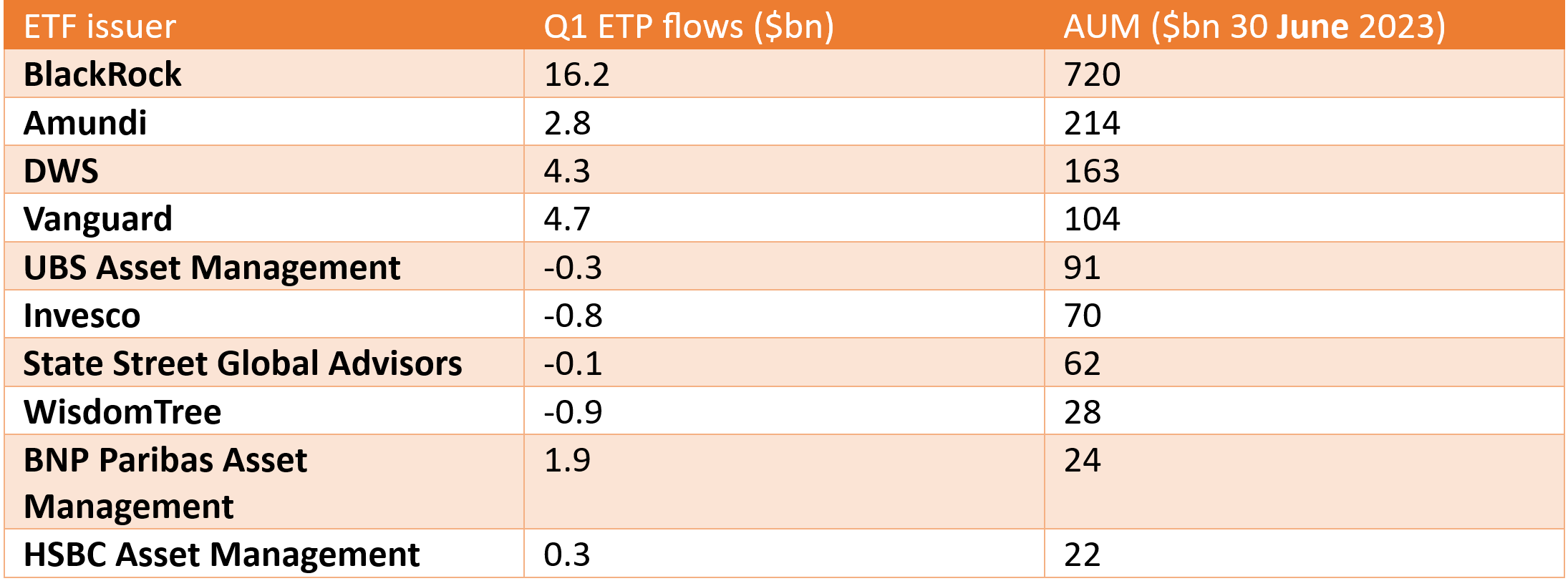

Demand for fixed income ETFs has been a key driver of the strong inflows into BlackRock’s European ETF range which added $16.2bn net new assets in Q2, the most across all issuers, taking its overall assets under management (AUM) to $720bn.

BlackRock’s dominance in the fixed income ETF space in Europe is a key differentiator for the world’s largest asset manager which currently controls a 58.3% market share, according to data from Morningstar.

Elsewhere, DWS continued its strong start to the year with a further $4.3bn inflows in Q2, adding to the $4bn seen in Q1. The German asset manager’s current AUM stands at $163bn, a 10.1% market share.

It was also a strong second quarter for Vanguard which captured $4.8bn net new assets as investors eyed broad equity and fixed income ETFs amid the current market uncertainty.

Amid the other large ETF issuers that saw positive flows, Amundi saw $2.8bn inflows in Q2 while investors poured $1.9bn into BNP Paribas Asset Management’s range.

Meanwhile, JP Morgan Asset Management and Ossiam punched above their weight with $1.2bn and $941m inflows, respectively.

Source: ETFbook

At the other end of the spectrum, the weakening demand for commodity ETPs – which suffered $2.7bn outflows in Q2 – was a key driver behind the outflows for Invesco ($831m) and WisdomTree ($856m), in particular.

Furthermore, UBS AM and Credit Suisse Asset Management suffered a combined $616m outflows while investors pulled $105m from SSGA.