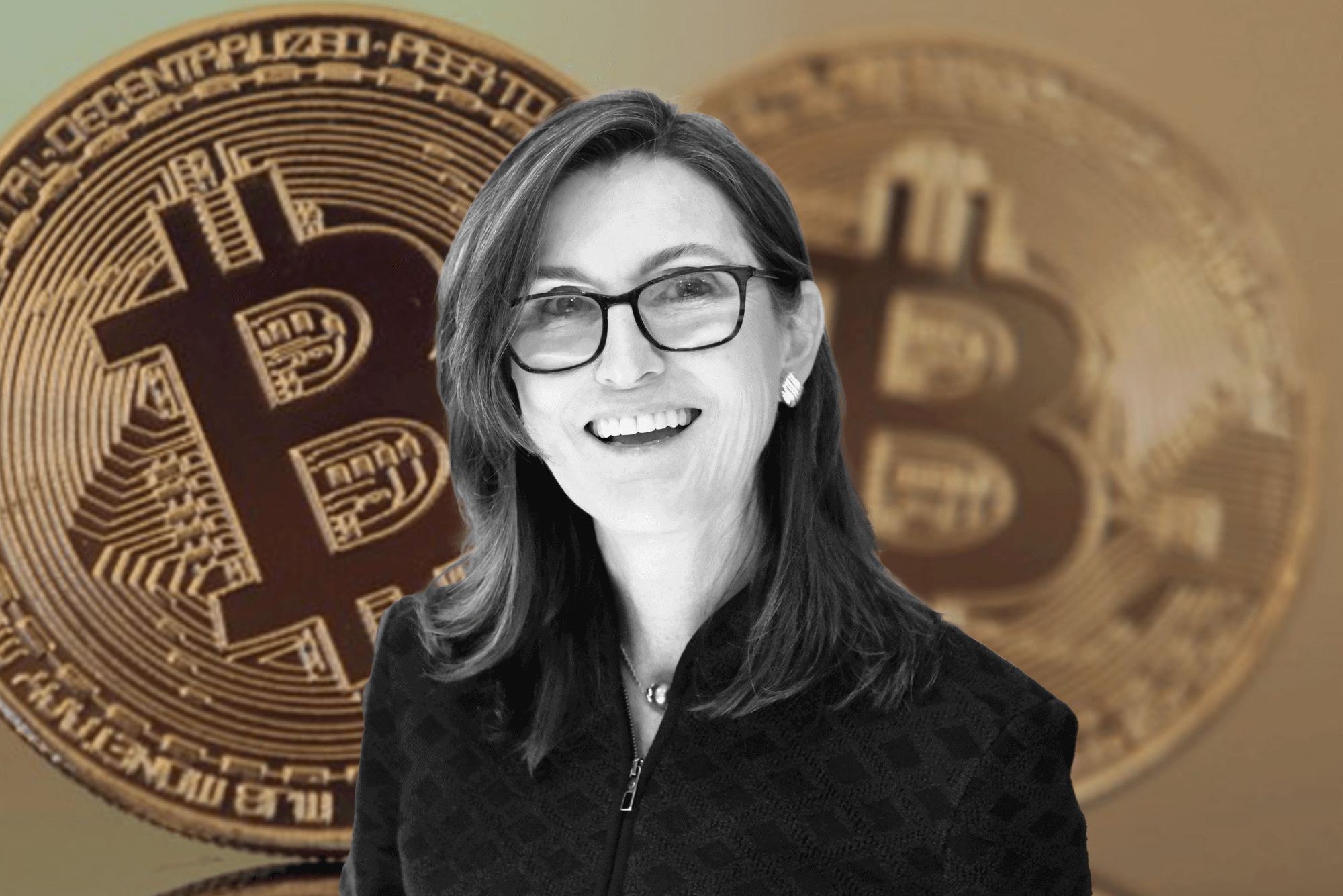

Cult investor Cathie Wood gave the European crypto market a boost last month by investing in and joining the board of exchange-traded product (ETP) issuer, 21Shares. This new venture by the founder, CEO and CIO of ARK Invest prompts a number of questions, not least of which being: why did she do it and what does this tell us about the future of crypto ETPs?

At the start of May, shareholders of 21Shares held an extraordinary general meeting (EGM) where Wood was welcomed to the board and a week later, a fundraising round concluded where Wood’s investment was joined by backing from Collaborative Ventures, Quiet Ventures and Anthony Pompliano, co-founder of Morgan Creek Digital.

However, her involvement appeared to get off to an inauspicious start as the price of bitcoin fell from $59,350 on 10 May to $31,250 on 23 May, its largest drop in percentage terms since March 2020.

Not concerned by this, Todd Rosenbluth, head of ETF and mutual fund research at CFRA, said Wood’s ambitions are likely more long-term, with a focus on cryptos’ staying power.

“Cathie Wood believes the long-term potential of cryptocurrencies and has been investing in the bitcoin trust in her ETFs for years,” Rosenbluth continued. “Shorter weakness is likely seen by her as a buying opportunity.”

To view Wood’s investment in 21Shares as a move to gain exposure to a particular cryptocurrency is probably inaccurate, as the 5.78% weighting to the Grayscale Bitcoin Trust BTC in her ARK Next Generation ETF (ARKW) already does exactly that.

Instead, her personal investments tend to back who she sees as the key players in the crypto industry itself – as seen with her recent $580m backing of Coinbase, the leading crypto exchange in the US.

As far as her latest investment is concerned, 21Shares is one of Europe’s largest dedicated crypto ETP issuers, with $2bn assets under management (AUM) across 14 strategies, as at 11 May.

Matthew Hougan, CIO at Bitwise Asset Management – who has an ETF listed in Switzerland in partnership with 21Shares – said: “I have not spoken with her about her decision to invest in and join the board of 21 Shares, but 21Shares is clearly one of the leaders in developing crypto-asset investment products that make it easier for investors to access this exciting space.”

What 21Shares offers Wood is exposure to the expanding European crypto ETP space. By providing the added security of on-exchange trading, these products have benefitted from the tentative growth of institutional involvement in crypto, with investment professionals seeking out assurances they would not have if trading the underlying currencies.

However, some sceptics question crypto ETPs’ ability to continue their current momentum, given the apprehension of regulators in the US and UK and some heat coming off cryptos’ recent, feverish rallies.

Philip Lovegrove, partner of the asset management arm at law firm, Matheson, noted the lack of consistency in regulation across the European continent, with Swiss and German regulators more lenient towards digital assets while the Irish Central Bank and the UK’s Financial Conduct Authority give ETP applications the cold shoulder.

“It will take some form of activity at EU level before we see too much movement in this space in the EU and I also wonder whether the momentum in the space will be maintained if the heat continues to drift out of the market with prices declining,” Lovegrove said.

The wind has not completely left crypto ETPs’ sails yet, though. Only last week, 21Shares joined other ETP issuers in gaining listings of their products on the Euronext Paris and Euronext Amsterdam exchanges.

On Monday, the issuer became the second firm to gain admission of a bitcoin product to the Aquis exchanges in London and Paris via clearing at the SIX Swiss Exchange. It will only be a matter of time until 21Shares and others find avenues into similarly unforthcoming regions.

UK regulator under renewed pressure to rethink crypto stance

This will be one of Wood’s key motivations. Given 21Shares’s status as an early entrant to the crypto ETP space, the company not only has an established presence with European investors but will be at the forefront of issuers slowly wearing down regulators’ resistance as crypto products become a more established part of the status quo.

Another consideration is the eventual arrival of the Securities and Exchange Commission’s (SEC) verdict on crypto ETPs. In a best-case scenario, 21Shares’s experience and recent backing could mean it joins some of its European peers in considering a US roll-out, which would see the company tap a vast market of retail and institutional clients.

Even in a worst-case scenario, Wood will still have a direct hand in shaping one of the key players in European crypto ETPs – though its success will depend on cryptos’ ability to retain much of its newfound support.

“It will be interesting to see whether the market will mature and become more stable and sustainable – maybe that is where big investments like [this one] can help, by creating a narrative around the asset class that is not about hot (and maybe dirty) money just chasing quick returns,” Lovegrove concluded.

Further reading