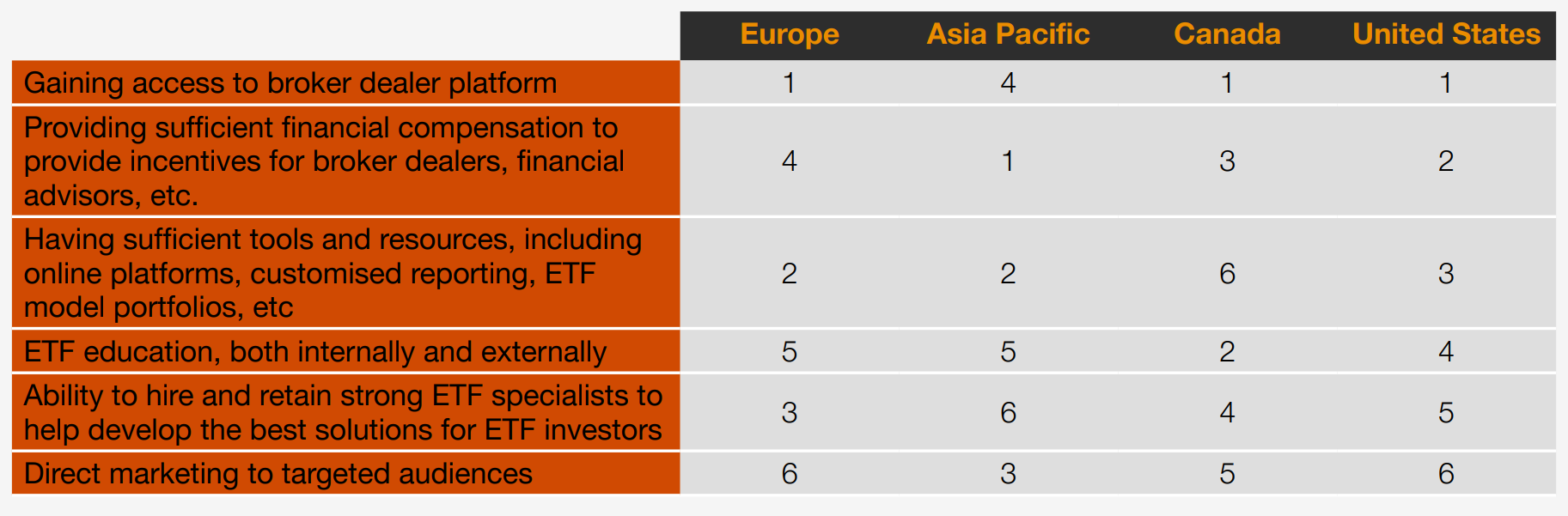

European ETF issuers see gaining access to broker-dealer platforms as one of the biggest distribution challenges, according to a survey by PwC.

The report, titled ETFs 2028: Shaping the future, said access to platforms – key in developing a strong distribution channel in Europe – was their number one challenge.

The survey, which questioned 70 executives globally, found that 85% believe distribution was the most significant factor in the success of their ETF business.

Having sufficient tools and resources, including online platforms, customised reporting and ETF model portfolios ranked as the second biggest challenge for European providers.

This is particularly pertinent in Europe, where respondents noted the value of ETF savings plans in attracting retail investors.

European asset managers said it was the most important factor for attracting retail, with 76% believing it was ‘very important’, followed by investor education (67%) and customer experience (61%).

It comes as the generational shift of wealth from boomers to millennials is tipped to reach $68bn globally by 2030, driving the European ETF market to $3trn by June 2028, up from $1.8trn at the end of 2023.

Marie Coady, global ETF leader at PwC, said: “Firms will need to find ways to reach those millennial investors who typically manage their own investments. Marketing through social media platforms, podcasts and apps will be important to target these millennials who prefer real-time information.

“The race to keep pace with today’s generational shifts and demands for personalised financial solutions will divide the winners from the losers in this fast-evolving ETF and wider asset management arena.”

Chart 1: Distribution challenges

Source: PwC Global ETF Survey 2023 (1 represents the area with the biggest challenges and 6 represents the area with the least challenges)

Technology capabilities are likely to play a huge role in this, with online platforms and investment apps ranked as having the biggest impact on the ETF industry over the next two to three years, followed by machine learning and artificial intelligence.

“ETF issuers need to lead the way on product innovation and business model transformation, with the unprecedented pace of change due to technological and AI disruption," Coady (pictured), added.

"There are opportunities to expand into new investment strategies, access new investors, new distribution channels and enter new emerging territories for distribution of ETFs."

Despite this, private banks are still expected to be the biggest driver of growth over the next few years (62%), followed by retail investors (57%) and model portfolios (57%).

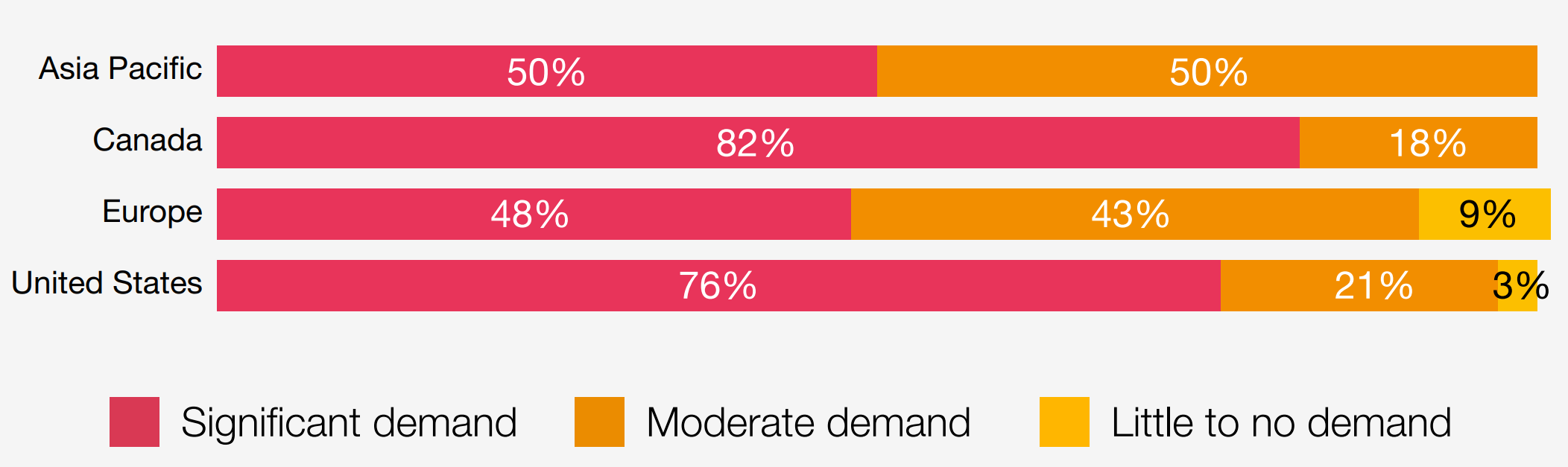

In terms of product trends, there is also expected to be growing demand for active ETFs in the next two to three years, with 91% seeing some sort of demand over the period.

Chart 2: Level of demand by investors expected for active ETFs in the respondents’ regional market over the next 2-3 years

Source: PwC Global ETF Survey 2023

Active ETFs have experienced strong growth in Europe with assets under management (AUM) hitting $32.9bn at the end of 2023, according to ETFbook data.