As actively managed exchange-traded funds (ETFs) grow in popularity, it is important for investors to be able to differentiate between active and passive ETF strategies and to understand the ways in which active ETFs can be employed in portfolios.

The benefits of active ETFs

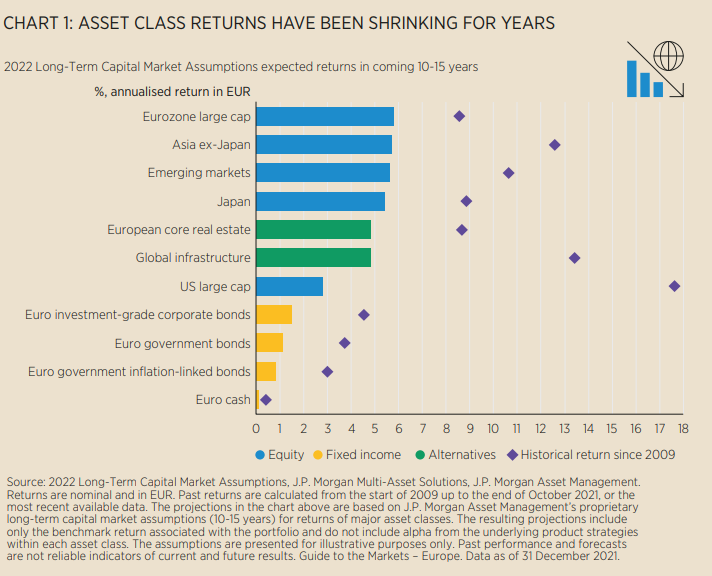

Active ETFs work by tapping into the research skills of professional portfolio managers and analysts, who look to exploit inefficiencies in stock or bond indices to boost risk-adjusted returns. Instead of just generating the market return (beta), an active ETF aims to deliver performance in excess of the benchmark (alpha) while maintaining the attributes of the ETF structure. We expect market returns to be lower in the future, which makes this ability to generate alpha a more important contributor to overall portfolio performance.

Active ETFs can also partly mitigate some of the limitations of market-cap weighted indices, by deviating from benchmark weightings (within certain tracking error limits). Active fixed-income ETFs, for example, have the ability to assess the creditworthiness of individual issuers and deviate from the weighting methodology of traditional fixed income benchmarks, which give larger weightings to issuers with higher outstanding debts.

Finally, active strategies can provide efficient exposure to certain investment criteria, such as securities with strong environmental, social and governance (ESG) characteristics. Rather than simply excluding controversial sectors, active managers can consider sustainability in all investment decisions, through engagement with companies and through rigorous stock analysis.

Growing popularity of active ETFs

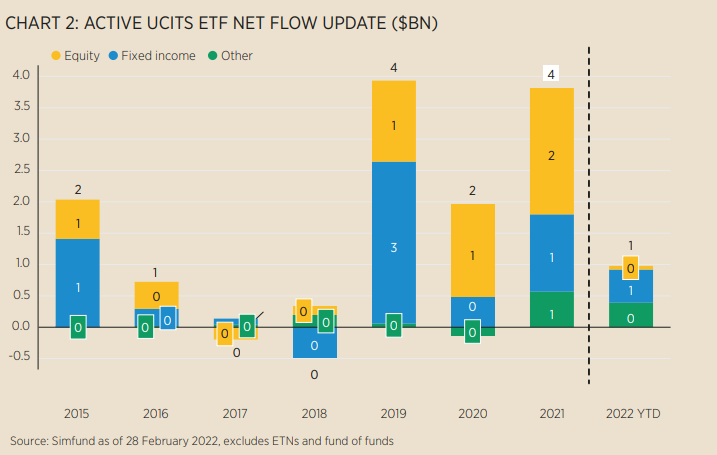

So far active ETFs only make up 2% of the UCITS ETF universe, but this share is likely to rise. While passive strategies continue to dominate flows into European ETFs, investors are increasingly realising that the ETF wrapper is also an ideal home for actively managed strategies.

Active ETFs have already seen quite impressive growth in the US and Europe could follow this trend: 71% of European investors recently said they expect their exposure to active ETFs will increase over the next 12 months, according to the Brown Brothers Herriman 2022 Global ETF survey.

ESG: The active advantage

Over $500bn flowed into ESG-integrated funds in 2021, contributing to a 55% growth in assets under management in ESG-integrated products, according to Morningstar, as of 31 December 2021. We expect ESG investing to continue growing through 2022, and well beyond. The demand for sustainable investing is multifaceted; investors from individual savers through to large institutions are directing an ever-increasing proportion of their portfolios towards ESG strategies as they look to use their capital to help create a more sustainable world.

Passive ESG ETFs typically apply exclusions or, if a sharper ESG focus is required, they track ESG indices like SRI or Paris-Aligned benchmarks. By selecting a passive ESG ETF, investors are fully reliant on the index providers’ ESG analysis. We believe an active approach allows for a more indepth assessment of ESG characteristics. While index trackers can exclude certain categories and may seek to influence companies through proxy voting, our active investment teams embed ESG considerations throughout the investment process and engage with companies to create value, potentially enhancing risk-adjusted returns over the long term.

Of course, investors should note that in an active ETF, security selection, investment allocations and risk management will be based on the portfolio manager’s investment philosophy, conviction and skill. There can therefore be considerable scope for active ETFs to underperform if investment decisions are consistently wrong. It is therefore vital that investors ensure that chosen active strategies are based on proven, repeatable processes that align with their risk tolerance and overall investment objectives.

Selecting an active ETF provider

As with passive ETFs, active ETF providers need to be backed by a dedicated capital markets team that can deliver efficient pricing at all times while utilising both primary and secondary markets to boost liquidity. However, because active ETFs have the flexibility to trade outside of their normal rebalancing period, it is perhaps even more essential that the ETF provider has the requisite trading expertise and capital markets resources, as well as the technology support, to deliver these extra trading requirements, while also providing best execution and price transparency to investors.

Another major factor in the selection of an active ETF is price. As well as the total expense ratio, investors need to evaluate all the costs incurred for holding an ETF, which include factors such as transaction costs related to portfolio rebalancing, and any costs associated with securities lending. It is also important to consider the potential excess returns from active investing, which can have a large bearing on the total cost of ownership for an active ETF. Also, when evaluating the cost of investing, investors should also include transaction fees charged by financial intermediaries.

Using active ETFs in a portfolio

A blend of active and passive ETFs can provide an attractive balance between risk and return. Both passive as well as active ETFs share similar risks in terms of performance might go down as well as up in response to performance of individual companies or general market conditions. Active ETFs introduce higher index risk, many active ETF strategies are suited to helping investors add alpha to portfolios with core passive holdings or to allocate tactically at different times through the market cycle.

For example, active fixed income ETFs can use sector and security selection to maintain a very similar duration and credit exposure over time, making them ideal for investors looking to quickly and efficiently change their yield curve positioning or sensitivity to credit spreads. Other examples include adding alpha to a passive portfolio or using a growth-style ETF to reduce a portfolio’s value bias at relatively low cost.

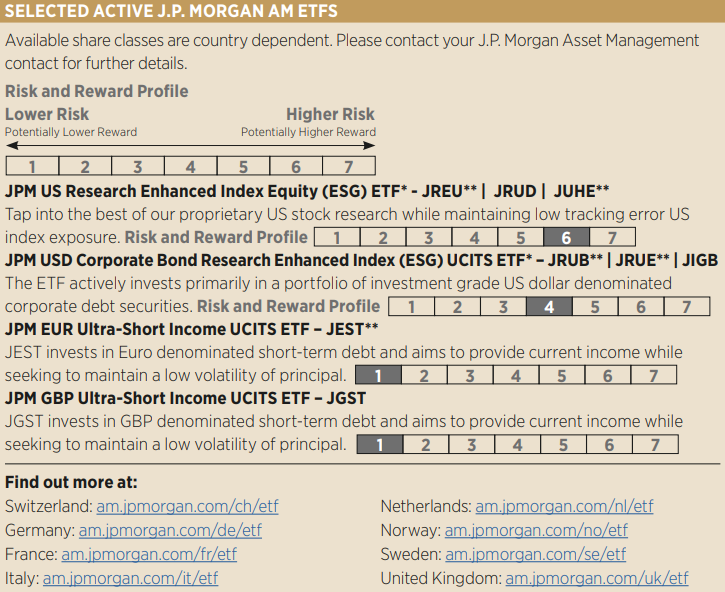

J.P. Morgan AM launched its first UCITS ETF in October 2018. Since then, we have brought many innovations to the ETF market – from our successful Research Enhanced Index Equity strategies to the first active China ETF and an exposure to China Aggregate bonds.

Our innovative ETF solutions leverage J.P. Morgan AM’s global investment capabilities and expert teams. Although active strategies make up a relatively small portion of the ETF market, J.P. Morgan AM is the number one provider for active ETF flows globally on a 12-month basis, according to Bloomberg, as at 31 March. We are also very pleased JPMAM was awarded Best Active ETF Provider with over $500m AUM.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

DisclaimerFor Professional Clients and Qualified Investors only – not for retail use or distribution

This is a marketing communication. Please refer to the prospectus of the ETF and to the KIID before making any final investment decision.

*For France only: Investors should note that, relative to the expectations of the Autorité des Marchés Financiers the ETFs marked with (*) above present disproportionate communication on the consideration of non-financial criteria in its investment policy (Cette presentation convient aux investisseurs parlant couramment anglais).** For Belgium only: Please note this ETF is not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representativefor further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (AutoriteitvoorFinanciëleDienstenenMarkten/Autoritédes Services et MarchésFinanciers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. The Shares may be offered in Belgium only to a maximum of 149 investors or to investors investing a minimum of EUR 250,000 or to professional or institutional investors, in reliance on Article 5 of the Law of August 3, 2012. This document may be distributedin Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Shares or other interests may not be offered to or purchased directly or indirectly by US persons. The latest available Prospectus, the Key Investor Information Document (KIID), any applicable local offering document and sustainability-related disclosures are available free of charge in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Units in Undertakings for Collective Investment in Transferable Securities (“UCITS”) Exchange Traded Funds (“ETF”) purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority.