Low-cost passives may have been the foundations of the ETF growth story to-date, however, the future may see Europe shift to more costly, specialist launches as asset managers hunt for profitability in an increasingly competitive market, according to Henry Jim, ETF analyst at Bloomberg Intelligence.

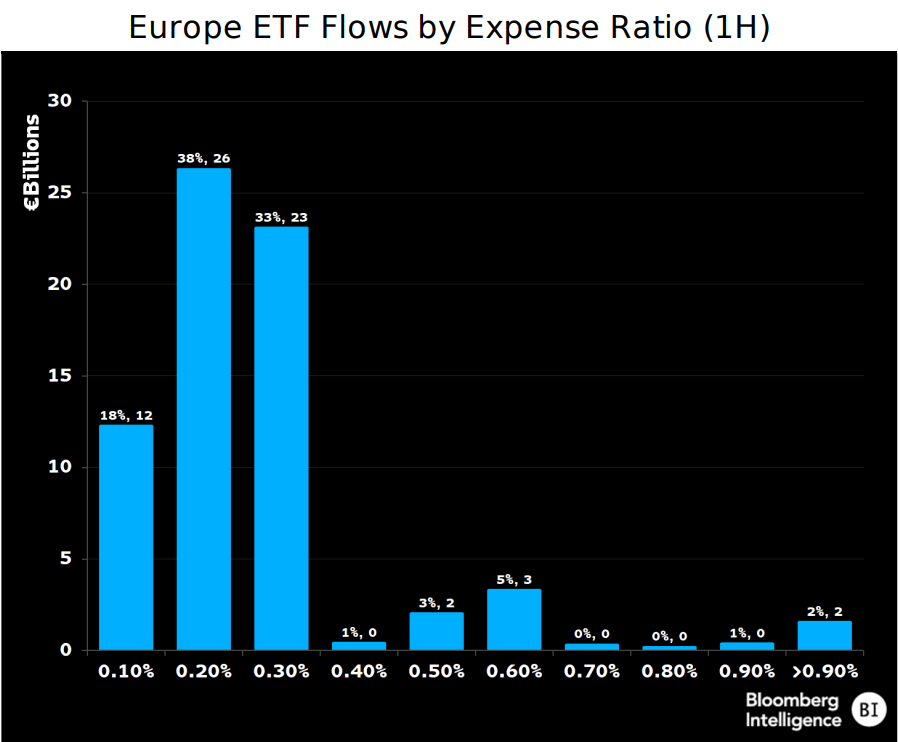

Although 90% of the notable €70bn inflows into UCITS ETFs in H1 went into ETFs with total expense ratios (TERs) below 0.30%, the asset-weighted average fee of these products was 0.26%, above the European average of 0.22%.

An argument can certainly be made that some of these flows were assets shifting from the vanilla exposures favoured in 2022 and into more exotic, risk-on allocations.

The central bank policy backdrop also saw fixed income ETFs book their strongest H1 inflows since 2019, with considerable net new assets entering specialist strategies. For instance, the $2bn Lyxor US Curve Steepening 2-10 UCITS ETF (STPU) has amassed $1.8bn with a fee of 0.30%.

However, while investors moving up the fee spectrum may be partially to do with market timing, Jim noted a deliberate shift by issuers to pricier offerings, with 250 ETFs launched in the last 18 months carrying a TER above 0.30% and focusing on thematic equity and sophisticated fixed income exposures.

“Though ETF issuers in Europe continue to compete on price for broad index ETFs, they are leveraging market demand for value-added areas such as global fixed income to generate higher margins,” he added.

Investors are also not the only ones taking advantage of market timing, with issuers launching new exchange-traded commodities (ETCs), energy transition base metal and even uranium strategies over the past 18 months following Russia’s invasion of Ukraine. The commodity product class in Europe has an asset-weighted average fee of 0.37%.

“ETF issuers are successfully shepherding flows into higher-priced funds offering more esoteric investment strategies,” Jim continued.

“[They] may increasingly look beyond broad index strategies – especially to thematics and global fixed income – for new products as they seek to stay profitable while expanding in the fragmented market.”

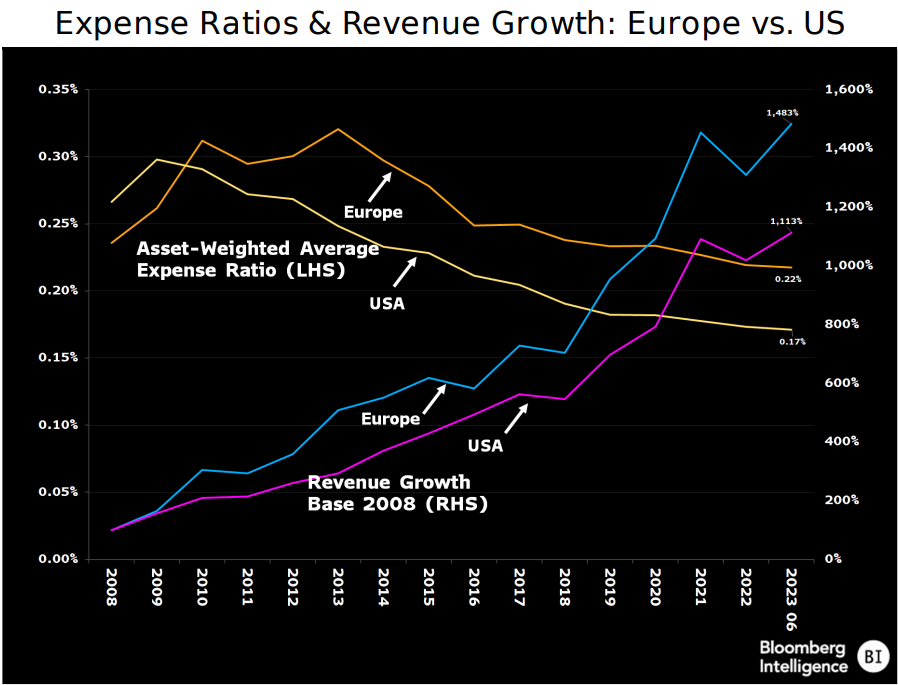

While maintaining pricing power, European ETF assets and revenues have both shot up by 15 times since 2008.

The relative immaturity of the market versus the US means the rate of revenue growth has been faster this side of the pond, despite but also owing to the fact the asset-weighted expense ratio is five basis points higher in Europe.

Though expense ratios may be higher than in the US, European ETFs’ profit margins may not be, Jim suggested. It will be interesting to see whether ETFs can keep their lustre as they stray into higher-fee waters after decades of being driven by cheap beta.

Some innovations in the US such as active ETFs and defined outcome strategies have seen success, with the $26.8bn JP Morgan Premium Equity Income ETF (JEPI) booking $9.7bn inflows in H1, the third-highest ETF so far in 2023. Similar strategies in Europe have yet to inspire the same degree of enthusiasm.