Smart beta was back in the ascendancy last year after a decade in the dark, however, multi-factor strategies topping some ETF return charts in recent years could show diversifying investment style is key.

Though modern monetary policy made US market cap-weighted indices tough to beat for either smart beta or actively managed products, aggressive interest rate hikes in 2022 were the abrupt reset button that brought everything that was not large cap tech back into play.

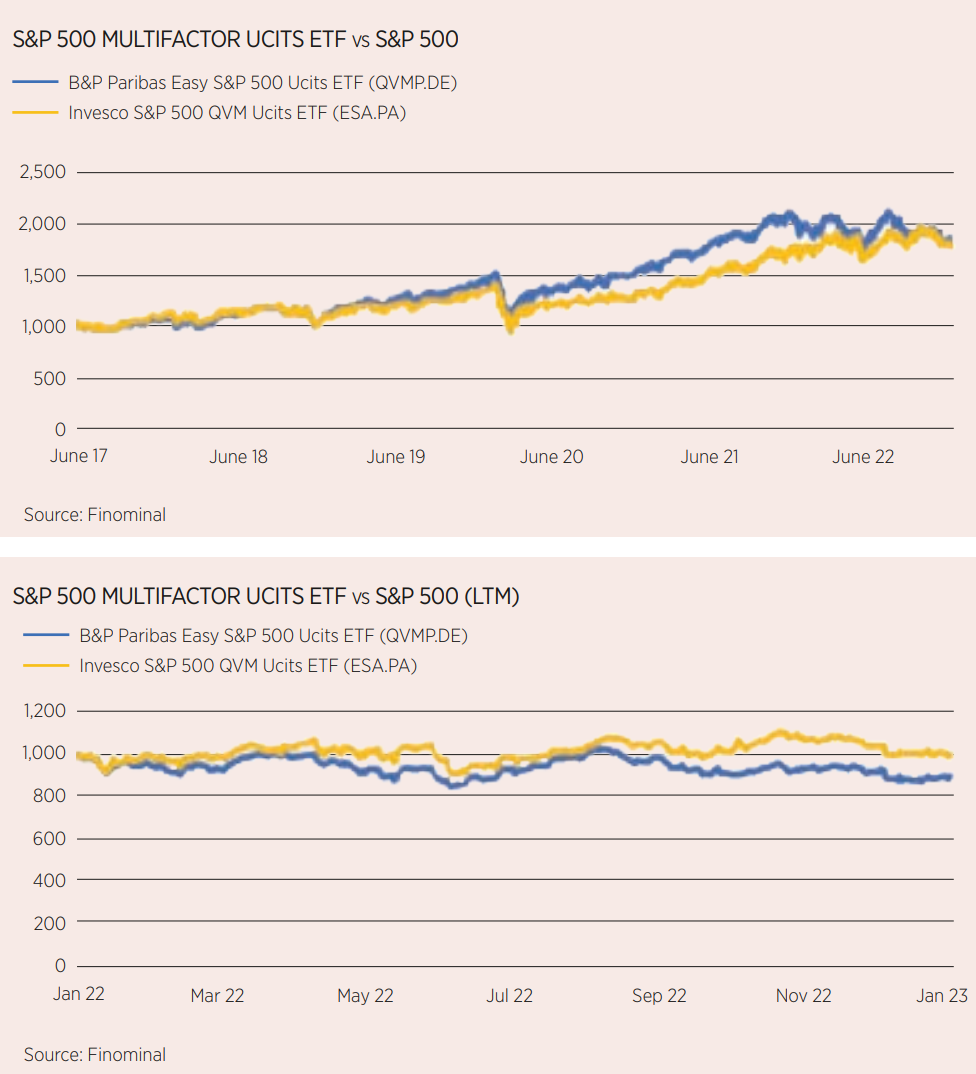

Benefiting from this the most have been multi-factor plays such at the $32m Invesco S&P 500 QVM UCITS ETF (PQVM), which over the three years to 12 January was the best-performing non-sector ETF tracking the US large cap index, beating the performance of the best vanilla S&P 500 ETF by 11%.

Even over the trailing five years, where tech usual suspects soared while being underweighted by PQVM, the ETF boasted returns within a per[1]cent of plain S&P 500 strategies while boasting substantially lower volatility.

Que Nguyen, partner and CIO of equity strategies at Research Affiliates, explained multi-factor ETFs now boast competitive returns but the same analysis done in the five years to 2021 would be less complimentary, given all factors ebbed in unison for a number of years.

“Your starting point matters a lot,” Nguyen said. “Starting to invest in a factor such as value in 2007, the next decade would not look so good. It also depends on your time horizon. If it is 30 years that is fine, but three or five years may be a different story.”

Nicolas Rabener, founder and CEO of Finominal, also warned the performance of most multi-factor ETFs can sometimes mirror well-known single factors such as value or momentum.

“Given that most of these underperformed over the last five years where investors preferred growth stocks, such ETFs underperformed,” Rabener said. “In 2022 this changed as the growth bubble imploded, which led to multi-factor products to outperform.”

While true that these products underperformed in a regime tilted in favour of one type of company underweighted by their factor metrics, it is worth noting their outperformance when this regime shifted.

In fact, PQVM outperformed even equal weight S&P 500 ETFs by four percent in the last year, while another product, the $311m Invesco S&P 500 High Dividend Low Volatility UCITS ETF (HDLV) was only one of four S&P 500 ETFs in Europe – and the only non-sector product – boasting positive returns over the trailing twelve months.

The multi-factor use case and where it works

Explaining why multi-factor ETFs might be considered ahead of single factors, Monika Dutt, director of passive strategies research at Morningstar, said factor performance tends to be cyclical, even if individual factors sometimes ebb and flow in tandem.

“The merit of a multi-factor strategy is diversifying your exposure to factors, which will hopefully enable investors to withstand bouts of underperformance, especially when the strategy captures factors which are uncorrelated like quality and value or small caps.

“Unless they are very adamant believers in a particular factor, I think investors are more likely to stick with a multi-factor fund through thick and thin than they are a single factor fund.”

Dutt added these benefits come with some concessions. For instance, multi-factor ETFs will inevitably have greater tracking error versus a vanilla index than their market cap-weighted equivalents, meaning investors have to accept higher active risk in their portfolio.

Also, factor ETFs carry notably higher costs. Invesco’s PQVM, for example, carries a fee of 0.35%, seven times the 0.07% charged by the $33bn Vanguard S&P 500 UCITS ETF (VUSA).

However, Research Affiliates’ Nguyen praised PQVM for capturing quality, value and momentum, which she said are factors “with a strong structural advantage”, meaning they should outperform in the long-term.

She added the factors that are most discounted will likely outperform over the next five years, in this case value and size. With this in mind, picks such as the $335m SPDR MSCI USA Small Cap Value Weighted UCITS ETF (USSC) could be “very strong”.

Only as good as the index

Due to their complexity, the issue of index construction is even more of a priority in multi-factor ETFs, which tend to use one of two methodologies.

First, is the equal weight or ‘sleeve’ approach that slices a portfolio into separate mini baskets, each capturing a group of stocks corresponding to a single factor.

The other approach is an algorithmic or ‘integrated’ one, which captures stocks that score well based on all factors being targeted by an index.

While Dutt said the former approach has the advantage of greater transparency and explain[1]ability, the latter may offer greater factor purity as each factor is being accounted for at least partially across the entire portfolio. However, she did not state which method was preferable overall.

Nguyen, on the other hand, prefers the ‘integrated’ approach.

“What you really want are the momentum stocks that have good value and vice versa. And the quality stocks that have good momentum and so on. The better multi-factor products will try to do that – choosing stocks that perform well across three categories.

“PVMQ takes an average of all three factors. It has a well-defined quality factor, a tradable momentum factor and a basic but credible value factor.”

Are passive ETFs the right vehicle?

However, Nguyen said while multifactor can be a “highly credible” strategy, she questioned whether index-tracking ETFs were the right tool for the job.

In fact, she suggested institutional investors may prefer using managed accounts for their multi-factor exposure, owing to their lower cost base for large pools of money, as well as the ability to instruct a manager whether to include or exclude certain securities.

She also argued being more agile with factor exposures could be beneficial, for instance by using dynamic weighting to shift between factors that are outperforming and those that are cheapest.

In fact, setting multi-factor aside, Nguyen prefers systematic active equity overall and said these strategies are “a great place to be right now”. However, BlackRock’s US-focused systematic active, the $2.8bn Advantage Large Cap Core Fund (MALRX), underperformed Invesco’s PQVM by at least 20% on a one, three and five-year comparison to the end of last year.

Finomal’s Rabener, meanwhile, said passive multi-factor strategies’ academic backing could offer professional investors a way of outperforming in the long-term, while active may be less reliable.

“Multifactor might go through long periods of underperformance but are still better bets than active-managed products where the excess returns are negative on average,” he concluded.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles