ETF launches in Europe dropped by a third last year as high interest rates left many asset managers feeling the pinch.

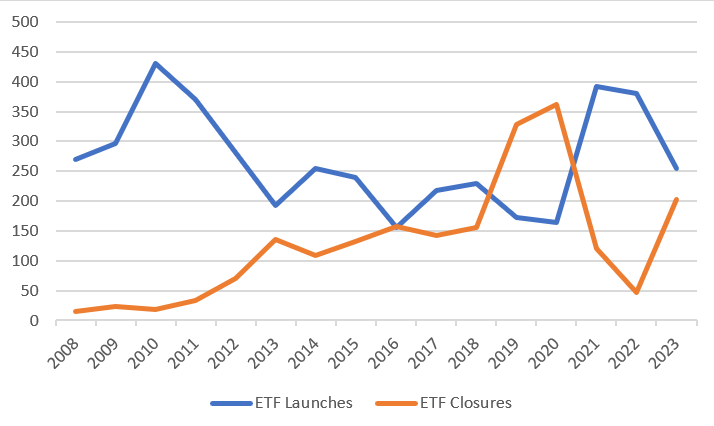

As many as 254 ETFs were launched last year, down from 381 in 2022 and 391 in 2021, according to data from Morningstar, as the cost of capital became more expensive for asset managers.

It means launches over the past 12 months were slightly below the 268 yearly average since 2008.

JP Morgan Asset Management, Invesco, Franklin Templeton and HANetf – to name a few – all closed ETFs last year.

Rising interest rates mean the cost of seeding a newly launched ETF is at its highest point in 16 years while some money market funds currently yield over 5%.

The trend is also apparent for open-ended mutual funds, with launches across Europe falling to their lowest since the 2008 Global Financial Crisis, however, wider factors such as continued outflows could also be at play with launches steadily declining for almost a decade.

Jose Garcia Zarate, associate director for passive strategies at Morningstar, said: “The rising cost of capital is a hurdle for asset managers [when launching new ETFs].

“For active mutual funds there, could be a wider factor at play, namely outflows. The mutual fund industry in Europe experienced another year of substantial outflows in 2023, which is somewhat surprising given the rebound in financial markets.”

This is not the case for ETFs however, with the European market noting inflows of $158bn in 2023, its second highest on record.

Chart 1: ETF launches declined as closures rose in 2023

Source: Morningstar Direct

The cost of holding seed capital also led to a spike in ETF closures last year, with some 203 ETFs closing, the highest amount since 2020 and substantially more than the 47 that shut in 2022.

Andrew Limberis, investment director at Omba Advisory & Investments, said the firm has seen an uptick in issuers unable to hold seed capital in ETFs for an extended period.

“There have been various issuers that have approached us recently because they needed to get rid of seed, which is a concern as it means the fund will almost definitely be closing because it is not sustainable.

“We can see that a lot more, but it is also natural because we have so many more products.”

Many of these closures occurred in thematic space which tends to have a growth-stock bias.

In addition to the high cost of capital, interest rates also created a tough market environment for thematic ETFs in 2022.

It is also possible a flushing out of the market could have also occurred following the breakneck growth of thematic ETFs launches over the past few years.

Andrew Craswell, European head of ETF services at Brown Brothers Harriman, believes the lower number of launches last year is part of the market cycle.

“This is cyclical and aligns with the broader trend in asset management that follows a high point of product launches in recent years,” he said.

“Higher interest rates have given pause for thought for investors, but the ETF industry has responded with short duration fixed income products and some enhanced income strategies that have become increasingly popular.”