Asset managers continue to ramp up their ESG integration in commodities, according to a survey conducted by the Index Industry Association (IIA).

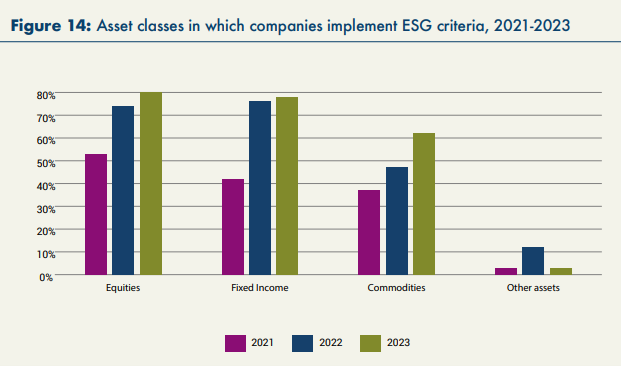

The firm’s third annual ESG survey of 300 asset managers found 62% of respondents now integrate ESG when running both passive and active commodities portfolios, up from 47% in 2022 and 37% in 2021.

The trend was particularly noticeable in France, where 80% of companies use ESG criteria in commodities, while 72% of passive index-based portfolios were also “somewhat more likely” to implement ESG criteria about the asset class.

The report said the uptick of ESG in passive index-based portfolios could be down to the surge in commodity prices over the past two years, leading to a greater weight of ESG-screened commodities in passive portfolios.

Source: IIA

Asset managers cited concerns about ESG factors as the biggest reason for upping ESG commodity exposure, while reputation and regulatory risk and high energy prices were second and third.

“Commodities as a category represents a very broad array of assets, encompassing everything from hydrocarbon fuels and renewable energies to raw materials, foodstuffs, minerals and the rare earth metals that power electric vehicles and other green technologies,” the report said.

“The nature of ESG issues and drivers can therefore vary enormously—carbon impacts, supply-chain issues, labour standards, impacts on local communities, to name but a few.”

There are signs ETF issuers have picked up on the trend with several launching commodity ESG products such as the UBS Carbon Compensated Gold ETF (GLDC02), or switching to a sustainable index such as the Amundi STOXX Europe 600 Energy ESG Screened UCITS ETF (OIL).

Elsewhere, fixed income ESG exposure – which almost doubled from 42% to 76% last year – rose to 78%, closing in on equities at 80%.

The report found ESG integration is set to grow further in asset managers’ portfolios, with 81% of respondents calling ESG a priority in their investment portfolio.

ESG investing is expected to account for half of investors’ portfolios in 2-3 years, hitting 63% in a decade, according to the IIA.

Driving this is US asset managers, which, despite political headwinds, still show strong demand for ESG products, with 88% noting it has become more of a priority over the past 12 months.