Authorised participants (APs) have compiled new evidence to suggest concentration risk in the European ETF market is not systemic following scrutiny from the International Monetary Fund (IMF).

The response comes after the IMF highlighted competition risk within theliquidity provider spacelast September.

In particular, the international policymaker warned two APs – Jane Street and Flow Traders – account for up to 90% of activity for certain BlackRock ETFs domiciled in Ireland.

APs play a vital role within the ETF ecosystem by facilitating the creation-redemption process, a feature that separates ETFs from mutual funds and close-ended vehicles.

In its report, the IMF recommended to the Central Bank of Ireland: “The relevant CBI supervision teams should engage with ETF providers to ensure their arrangements with APs and market makers are robust and promote the smooth functioning of the sector, including in times of market stress.

“There should also be closer cooperation between supervisors of investment funds and the colleagues supervising APs and market makers.”

The recommendations come as part of a wider assessment of Ireland’s fund industry which accounts for approximately 67% of all European-domiciled ETFs, according to data from ETFbook.

The way APs behave during periods of market stress “requires close monitoring”, the IMF concluded, however, added there was no evidence they stepped away during the COVID-19 sell-off, as highlighted by other bodies such as the International Organisation of Securities Commission (IOSCO).

The IMF’s call for the CBI to increase regulatory engagement with the ETF industry prompted a response from Flow Traders earlier this year which argued the body has “overlooked” the numerous other liquidity providers in the market as well as competitive advantages the two leading firms bring.

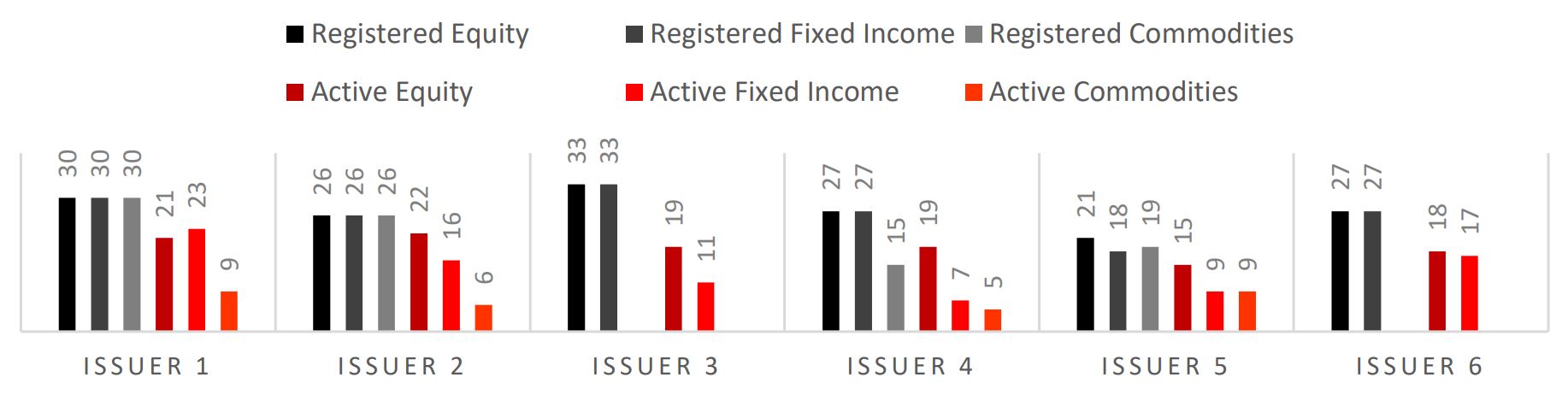

In response to competition risk, Flow Traders data highlighted there can be as many as 30 registered APs globally with an ETF issuer.

Chart 1: Number of APs per issuer – registered versus active

Source: Flow Traders

“Contrary to what the IMF suggests in their report, there is much more competition in the ETF industry,” Flow Traders said. “The entire ETF industry is very much an open system and that if for example, a leading AP would fall out, there are more than enough other APs present to cover.”

Furthermore, the IMF’s data does not highlight the competition for trades on request-for-quote platforms, which account for approximately 80% of volumes across the European ETF market.

The natural advantages of holding a dominant position within a market means Jane Street and Flow Traders can show better prices than their competitors.

“This is a consequence of the global scale that these two market makers bring, as well as their efficiency, superior price execution and their specialisation within the field,” Flow Traders added. “Even though the two market makers play a significant role, this does not mean that other participants are not active in the industry.

“To avoid any panic regarding systemic risk, we would therefore recommend the IMF to in the future also consider the international element when performing a country assessment and to not invoke extra scrutiny on a heavily regulated and extremely competitive industry.”

Over the past decade, the role of APs has been a source of sharp focus for regulators, exacerbated by the exits of IMC and Bluefin from Europe in recent years. Attention now turns to the CBI to assess if further competition is needed and how this will look in practice.

Related articles