Over the past three decades, ETFs evolved from niche products to investment mainstays offering convenient and cost-effective access to a myriad of market indices.

As if to banish any lingering doubts over their relevance, net flows to European ETFs shattered records in 2023 and now account for 16% of a $12trn global market.¹

The widespread appeal of ETFs to institutional investors alone should guarantee continued success, but several converging factors hint at an even more optimistic outlook.

Drivers of growth and innovation

FIXED INCOME: Fixed income has long played a leading role in institutional portfolios, and pressure to minimise costs without sacrificing liquidity means ETFs are popular options, especially as investors evaluate less mainstream strategies.

Offering access, transparency, and simplicity to a market that was historically challenging to navigate, the growing array of bond ETFs is understandably appealing to investors keen to uncover sources of yield.

Corporate bond funds are becoming more popular, and at least one alternative strategy can be found among the top 10 bond ETFs ranked by 2023 net flows.

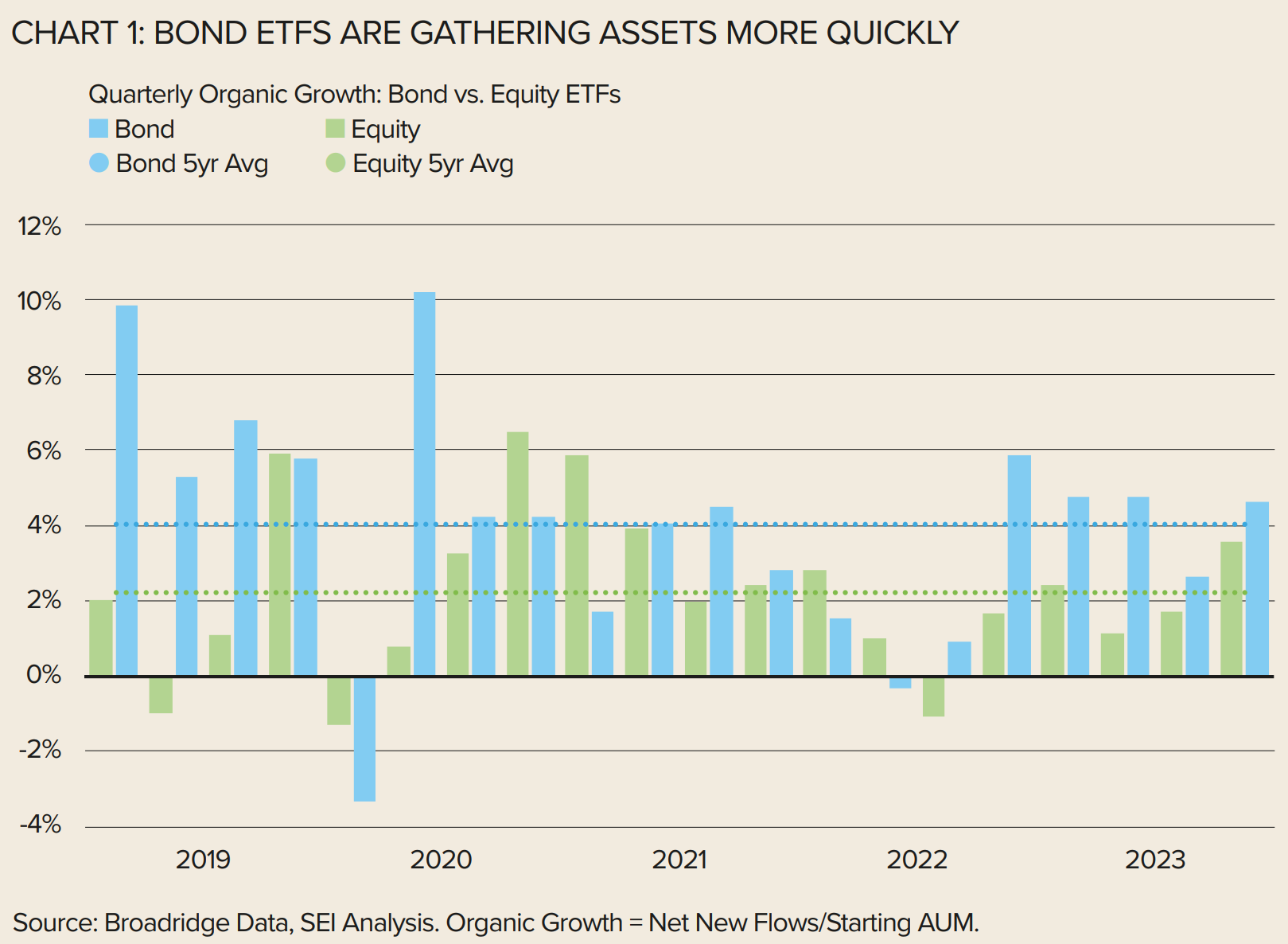

Fixed income accounted for 53% of net new flows to European ETFs in 2023², significantly above their 24% market attracting capital at almost double the rate of equity ETFs (see Chart 1).

ACTIVE MANAGEMENT: The introduction of activity managed ETFs was eagerly anticipated. Now that technical and regulatory hurdles have largely been overcome, investors are ready to consider ETFs for uses beyond simply tracking indices. The attraction of moving beyond beta is two-fold. On the one hand, fund conversions mean access to already familiar strategies in a new format, leading to heightened visibility.

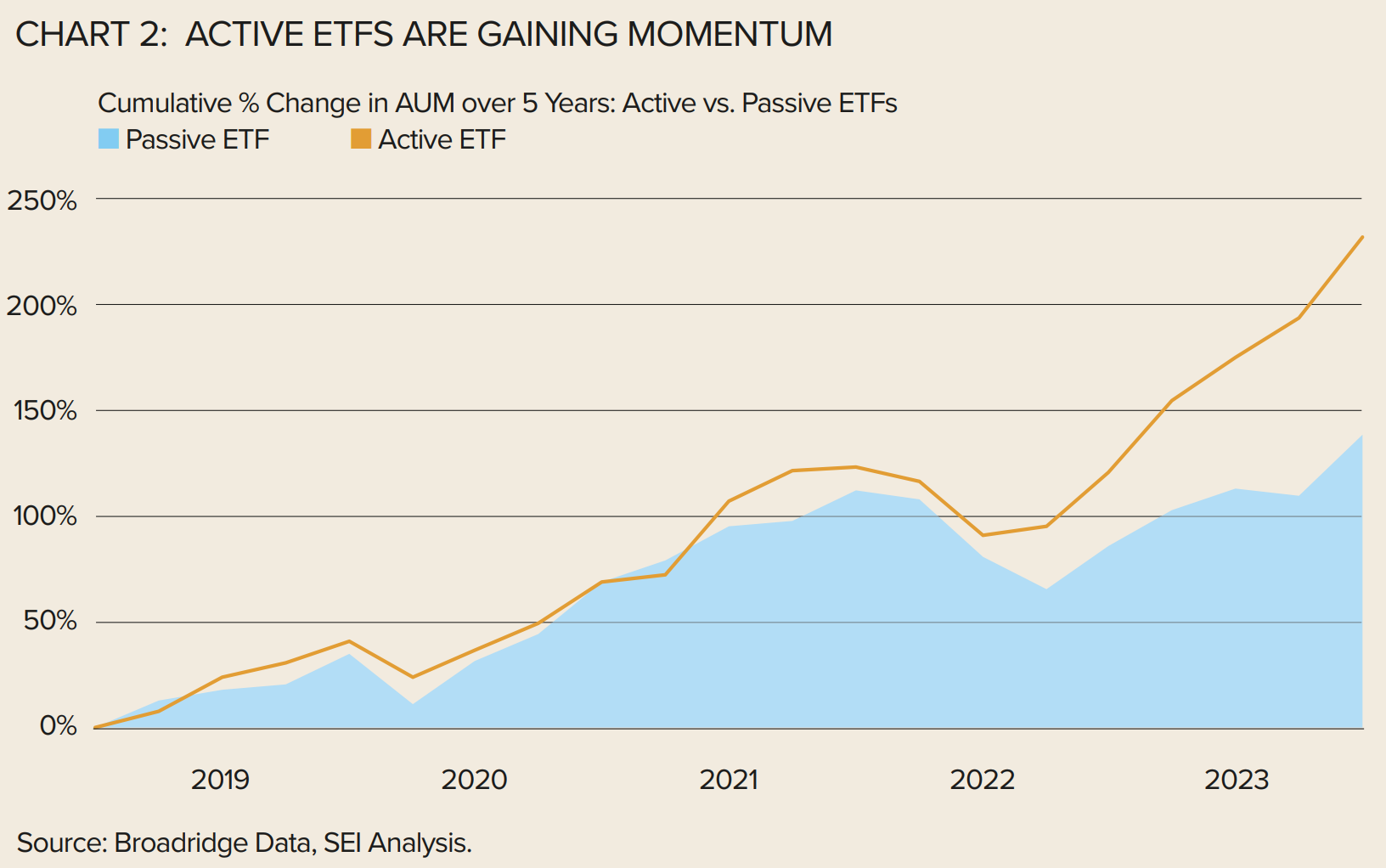

Meanwhile, active management promises to layer sophisticated ideas and techniques on top of investment themes with a proven track record in the ETF market. Starting as a trickle, active ETFs have the potential to quickly transform the landscape by introducing fresh players as well as established asset managers who are simply new to ETFs. Actively managed products now account for 4.2% of all European ETPs and 1.9% of assets.³

Rapid adoption will change things quickly. While both types of ETFs have grown quickly, active ETFs began to outpace their passive counterparts in recent years. Assets grew at almost twice the rate of passive ETFs over the past three years (see Chart 2).

DIGITAL ASSETS: Often overlooked, less regulated cousins of ETFs are beginning to make waves. Designed for less common use cases, ETCs, and ETNs may already be escaping their niche status. Commodities and alternative (e.g., inverse and/or levered) strategies are common applications, but digital assets are the test case de jour. European investors already had access to cryptocurrencies via several ETNs, but products have proliferated.

Five years ago, investors could choose among five funds focused on digital assets. That number rose to 57 by the end of 2023.⁴ Some 11 issuers are now active in this increasingly active space, offering a striking array of exposures that extend far beyond bitcoin and ethereum.⁵

Despite cautious scepticism from the ECB, all eyes are on the US market, where ETFs holding actual bitcoin (as opposed to futures) made a strong debut in early 2024.

The institutional tilt of the European market means growth expectations should be tempered, but it will be interesting to see how large a role these products play in attracting new retail investors to ETPs.

RETAIL ADOPTION: There are already signs that the European ETF market is becoming less reliant on institutional capital.

The rise of retail investing will almost certainly drive more asset flows toward ETFs, which have proven to be particularly well suited as building blocks for individual investor portfolios.

With Germany and Italy leading the way, the number of ETF savings plans in Europe is predicted to quadruple to 32 million by 2028, up from 7.6 million in September 2023.⁶

Expect this trend to gain momentum as younger generations save more. Millennials and Gen Z are more comfortable with self-directed investing via digital trading platforms, which are ideally positioned to offer ETFs.

These interactions will increasingly feature planning and trading software that relies on sophisticated algorithms and AI to offer customised advice via a natural speech interface.

Navigating a perilous path

The ETF opportunity is an open secret. The path forward, however, is less clear. Managers wishing to compete in this market will need to navigate with finesse as they contend with growing competition

Well-established ETF behemoths are being joined by other asset managers with powerful brands and significant resources. Plucky startups will play a role in bringing innovation to the market, and smaller ETF issuers can be expected to make inroads.

A quickly evolving environment means gathering intelligence and avoiding hazards is vital. Significant challenges include placement on buy lists and scaling up profitably.

Such hurdles are better addressed alongside a partner with global ETF expertise that can minimise operational headaches, streamline regulatory compliance, and facilitate distribution in markets featuring many regional nuances.

In our opinion, bringing all these skills to bear is especially critical when introducing more complex tailored and thematic products. SEI, for example, has helped its clients launch UCITS with “covered call”, “buffer” and “tail-hedge” strategies over the last 18 months

Previously reserved for hedge fund investors, these sophisticated strategies are now accessible to a much wider audience through synthetic ETF structures.

ETFs represent a sea change in the global asset management industry. As they strategise with their operational partners, European asset managers aiming to capitalise on this development will want to pay particularly close attention to opportunities in fixed income strategies, actively managed funds, digital assets and retail investors.

Contact: James Wilson, SEI’s European ETF Solutions Leader at: jwilson@seic.com

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

1 ETFGI data as of 6 April 2024 (www.etfgi.com)

2/3/4/5 Broadridge Data, SEI Analysis as of 2 April 2024

6 Markus Jordan, Jens Juttner, The ETF Savings Plan in Continental Europe, extraETF, September 2023