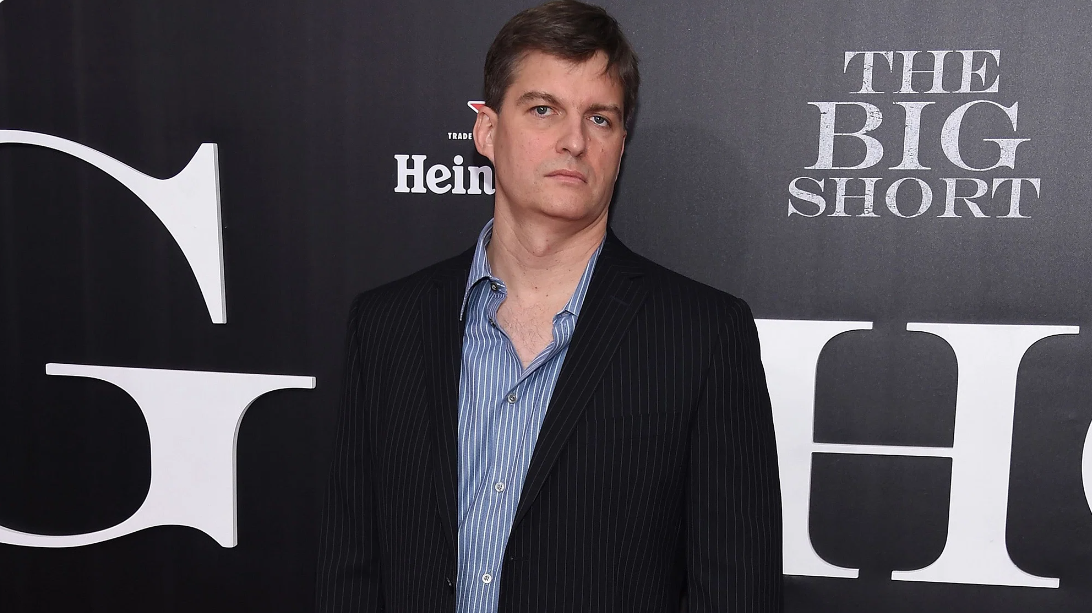

Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short, entered a position in Sprott Asset Management’s gold ETF in Q1 while downsizing US tech allocations in favour of China software and clean energy stocks.

According to 13F filings, Burry’s firm Scion Asset Management invested $7.6m in the Sprott Physical Gold Trust (PHYS), becoming the firm’s top buy in Q1 and claiming a 7.4% position in the firm’s portfolio.

PHYS, now the fifth-largest allocation in Scion AM’s portfolio, returned 16% during the first three months of the year as the precious metal hit an all-time-high, driven by expectations of interest rate cuts and strong buying activity by the People’s Bank of China and Chinese private investors.

By comparison the S&P 500 gained 11% during the quarter, also seeing the index set new record levels.

While increasing its position in the traditional safe haven asset, Burry’s firm slashed its stake in US names including profit taking on ‘magnificent seven’ such as Alphabet and Amazon. The two companies saw their positions cut by $5.4m and $5m or 5.2% and 4.8%, respectively – within Scion AM’s portfolio.

Meanwhile, Burry searched for value in downtrodden renewable energy and China tech names, adding $5.1m to First Solar and $4.4m to Baidu, taking them to 4.9% and 4.1% allocations.

The addition of Baidu adds to Scion AM’s two largest existing positions – 9.5% to JD.com and 8.7% to Alibaba – evidencing the hedge fund manager’s faith in Chinese software companies staging a comeback after four years of declining valuations.

Overall, the firm entered five new positions, increased 11 positions and exited 14 in Q1 while the value of its investments increased from $94.6m to $103.5m.

The addition of PHYS marks just the latest example of Burry turning to ETFs to implement tactical views.

Scion AM bought puts on 100,000 shares of the iShares Semiconductor ETF (SOXX) – equating to $47.4m – in Q3 2023 to enter a short position on the sector.

In Q2 2023, Burry closed a $1.6bn bet held against the S&P 500 and Nasdaq 100 via $886m of puts against the SPDR S&P 500 ETF (SPY) and $739m against the Invesco QQQ Trust ETF (QQQ).