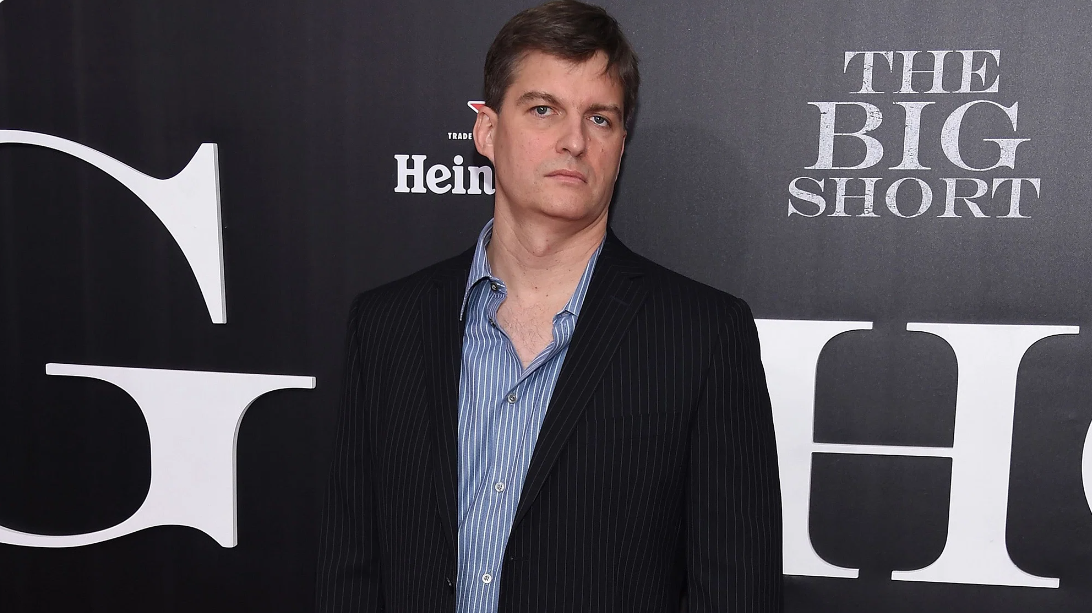

Michael Burry, the famous hedge fund manager that inspired Michael Lewis’s book The Big Short, marked the end of the festive period with a bleak roadmap for markets, predicting a recession followed by a second spike in inflation.

The founder of Scion Asset Management took to Twitter on Monday to state the current round of elevated inflation – which hit 40-year-highs in H2 last year – will continue to fall as the US economy enters a recession “by any definition”, only for a reversal in the Federal Reserve’s now-hawkish monetary policy to cause inflation to rear its head once again.

“Inflation peaked. But it is not the last peak of this cycle,” Burry (pictured) said. “We are likely to see CPI lower, possibly negative in H2, and the US in recession by any definition.

“The Fed will cut and government will stimulate. And we will have another inflation spike. It is not hard.”

Inflation peaked. But it is not the last peak of this cycle. We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and government will stimulate. And we will have another inflation spike. It's not hard.

— Cassandra B.C. (@michaeljburry)

The ‘Powell pivot’ – referring to Fed Chair Jerome Powell ending interest rate hikes – has been widely telegraphed by markets, with many investment banks predicting the Fed will end its tightening cycle by Q2.

Such a timeline seems likely given Deutsche Bank forecast “stagflation to define 2023 even more than it did 2022” and International Monetary Fund (IMF) managing director Kristalina Georgieva recently warned “the big three economies – the US, the European Union and China – are all slowing down simultaneously”.

However, if the Fed turns dovish to give companies and consumers the chance to borrow money at lower cost, this alongside China reopening and strained supply chains will only send the price of goods and resources, chiefly oil, on an upward trajectory.

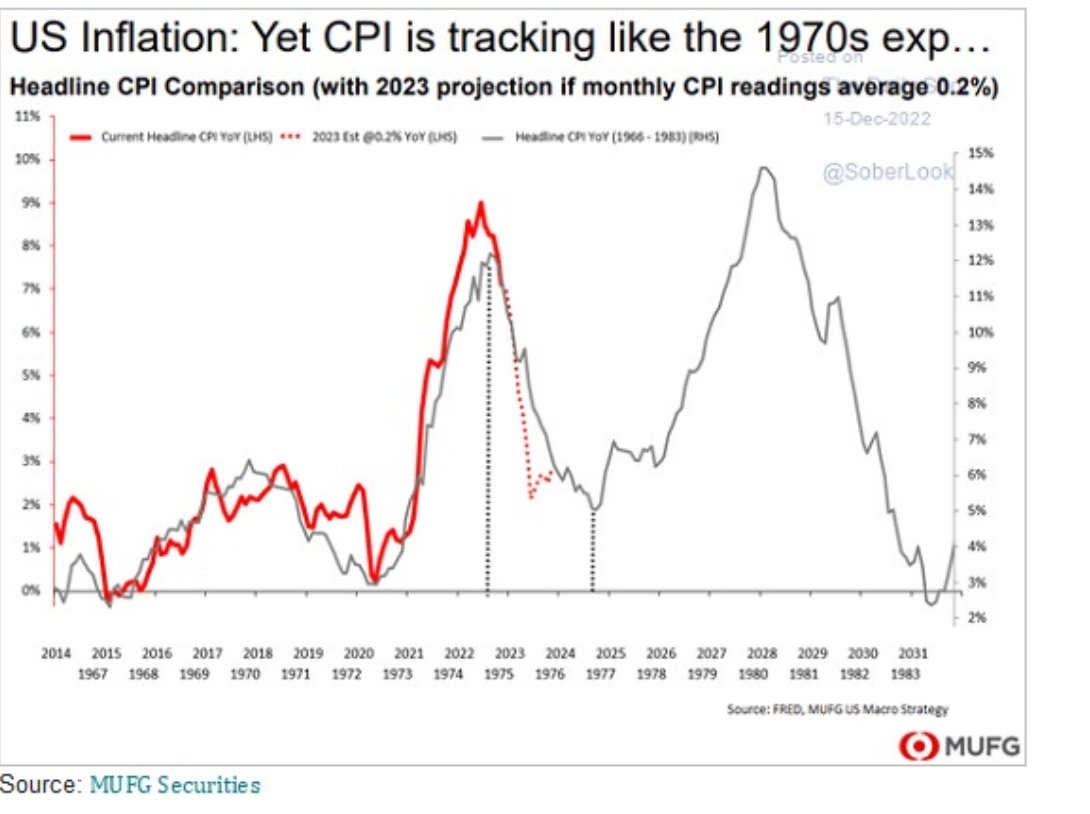

The Fed voiced similar concerns last December and warned a scenario similar to the double inflation peak of the 1970s risks playing out again.

Unfortunately, Burry was ahead of the curve when he warned investors were in the “greatest speculative bubble of all time in all things” in H1 2021 amid the giddy post-COVID-19 lockdown reopening.

He added buyers of meme stocks and cryptocurrencies were headed for the “mother of all crashes”. Over the past year, AMC and bitcoin have fallen 85% and 63%, respectively.

Four weeks ago, Burry took to Twitter with the cryptic message: “Early 2002, investors were asking me why I was not buying WorldCom. Feels like that now.”

At the time, WorldCom was a major name in the telecoms sector that was found to have overstated its profits to the tune of $3.8bn. The company subsequently collapsed a month later.

While offering no expansion, the comparison does not inspire a positive outlook for tech-centric businesses reliant on borrowing over the past decade while being sparse on profit.

This rings particularly true for crypto assets, which Burry previously compared to the credit default swap (CDS) instruments that greased the wheels of the Global Financial Crisis (GFC) in 2008.

When one Twitter user responded, asking which company most resembles WorldCom, Matthew Tuttle, CEO of Tuttle Capital Management, which runs a short strategy on Cathie Wood’s infamous ARKK ETF, said: “Better question is which one does not?”

Related articles