One of the world’s most famous hedge fund managers is at odds with ETF investors. Earlier this week, Bill Ackman, the outspoken billionaire hedge fund manager and founder of Pershing Square Capital Management, said that he is shorting the 30-year Treasury bond.

The short position, which was revealed in a lengthy tweet, runs counter to the view of the many exchange-traded fund investors who have collectively ploughed billions of dollars into the iShares 20+ Year Treasury Bond ETF (TLT).

TLT has seen inflows of $16.2bn this year, the second largest haul of any ETF. Its assets under management have climbed from $27bn at the start of the year to $41bn.

The fund’s massive inflows suggest that ETF investors are bullish on long bonds. The ETF holds Treasuries that mature 20 to 30 years in the future, the same type of bonds that Ackman is bearish on.

Right About Long Bonds?

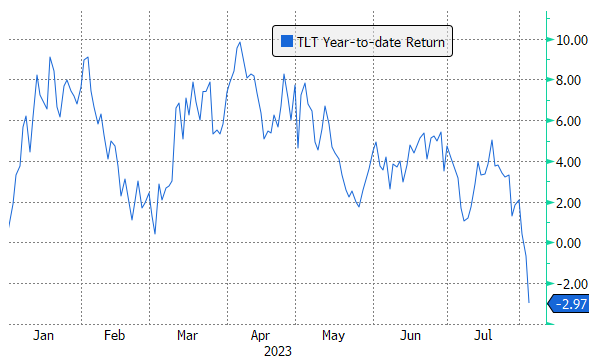

Time will tell whether Ackman or ETF investors are right about long bonds. But so far, investors in TLT have been caught wrong-footed.

They’ve dumped money into TLT, but the ETF has performed poorly. The fund was last nursing losses of 3% on a year-to-date basis.

Much of TLT’s losses came just over the past several trading sessions. As recently as Monday, TLT was up 2% on the year. But prices for long bonds, which move inversely to yields, were hammered in the days that followed.

Explanations for the plunge are numerous, from ratings agency Fitch’s downgrade of the US's credit rating to larger-than-expected federal budget deficits.

But the most likely explanation is the bond market’s acceptance of the idea that interest rates are going to stay higher for longer.

This idea – that the Federal Reserve would hike rates to a level high enough to bring down inflation and then leave them there for a while – is one that the market had long dismissed.

For much of this year, the market’s view was that the economy would weaken significantly due to the Fed’s rapid rate hikes, and that would prompt the central bank to reverse course and cut interest rates.

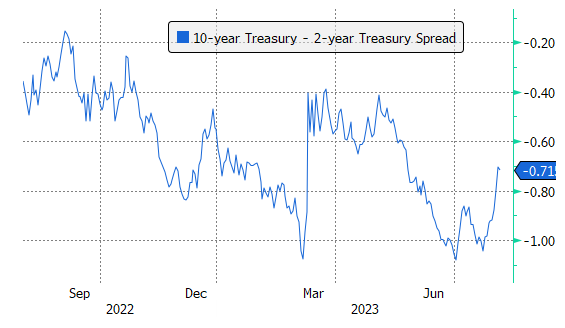

It’s the reason the Treasury yield curve was so inverted, with long-term bonds yielding much less than short-term bonds.

But the economy did not weaken like many had expected, and the rate cuts never materialised. On the contrary, the Fed hiked rates to a level much higher than most investors had thought they would.

And now that it’s looking increasingly likely that the economy might avoid a downturn altogether, the bond market seems to be repricing itself with a new expectation that rates won’t be cut anytime soon (or at least imminently).

That has resulted in a more modest inversion of the yield curve, with the two-year Treasury yielding about 71 basis points (bps) more than the 10-year Treasury, down from more than 100bps two weeks ago.

Bill Ackman’s view

Ackman’s thesis for shorting the 30-year Treasury goes a step further than what we have seen in the bond market so far.

In his tweet, he said that structural changes, including “de-globalisation, higher defence costs, the energy transition, growing entitlements and the greater bargaining power of workers” will lead to higher levels of long-term inflation.

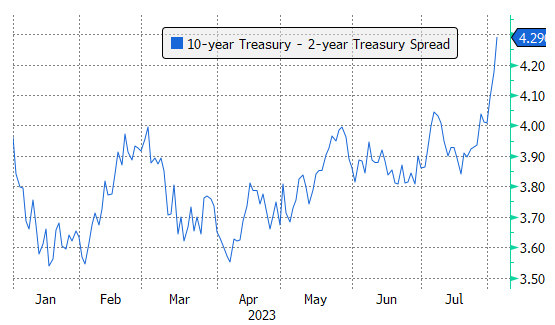

The hedge fund manager noted that he would be very surprised “if we don’t find ourselves in a world with persistent ~3% inflation.” By his calculations, that means long-term bonds could yield 5.5% (3% inflation + a 0.5% real interest rate + a 2% term premium), which compares to the 4.29% they yield today.

If Ackman is right, TLT could fall roughly 20% from here, a large loss that would be painful for the many investors who have invested in the fund this year.

Future ncertain

Still, just because TLT investors have been wrong about rate moves so far does not mean they will continue to be. Nor does it mean their investment thesis is flawed and Ackman’s is bulletproof.

After all, Ackman is making his call after the 30-year Treasury bond has already fallen substantially. At 4.29%, the yield on the bond is up from less than 3% a year ago and less than 2% two years ago.

In fact, it is close to its highest level in a dozen years. That does not mean the yield cannot go higher still, but it means any short position in long bonds has less room for error (not to mention, making bond trades based on macro calls is a dicey proposition to being with).

Moreover, even if rates go up from here, it doesn't mean all TLT investors will be hopelessly devastated.

Not everyone who put money into TLT did so for the same reasons. Sure, some might have been betting on the Fed cutting rates this year and they will probably end up being wrong about that. Short-term traders might end up eating their losses.

But others might have bought TLT as a long-term investment. They could be happy with the yields they’re getting and the potential for price appreciation down the line.

It’s certainly possible that rates on the 30-year bond could go up and then come back down again.

The US economy might have avoided a recession so far, but one day, there will be a downturn, and if bonds act in the way they’ve historically acted, that means their prices will rise, interest rates will go down and TLT will benefit.

Do not get me wrong, if rates shoot up and never come back down again, then TLT investors will probably regret they ever bought the ETF. But that is a much more bearish call than even Ackman is making.

This article was originally published on ETF.com