Investors have long been familiar with ESG and climate funds, which can encompass a wide variety of sustainability-linked themes and objectives.

Following the UN’s COP 15 Biodiversity Conference in December 2022 and the recent advent of the Taskforce on Nature-related Financial Disclosures (TNFD), biodiversity has emerged as an investment theme.

The fund management industry has heard the call, and several biodiversity funds have sprung up in the past year.

A grassroots movement, for now

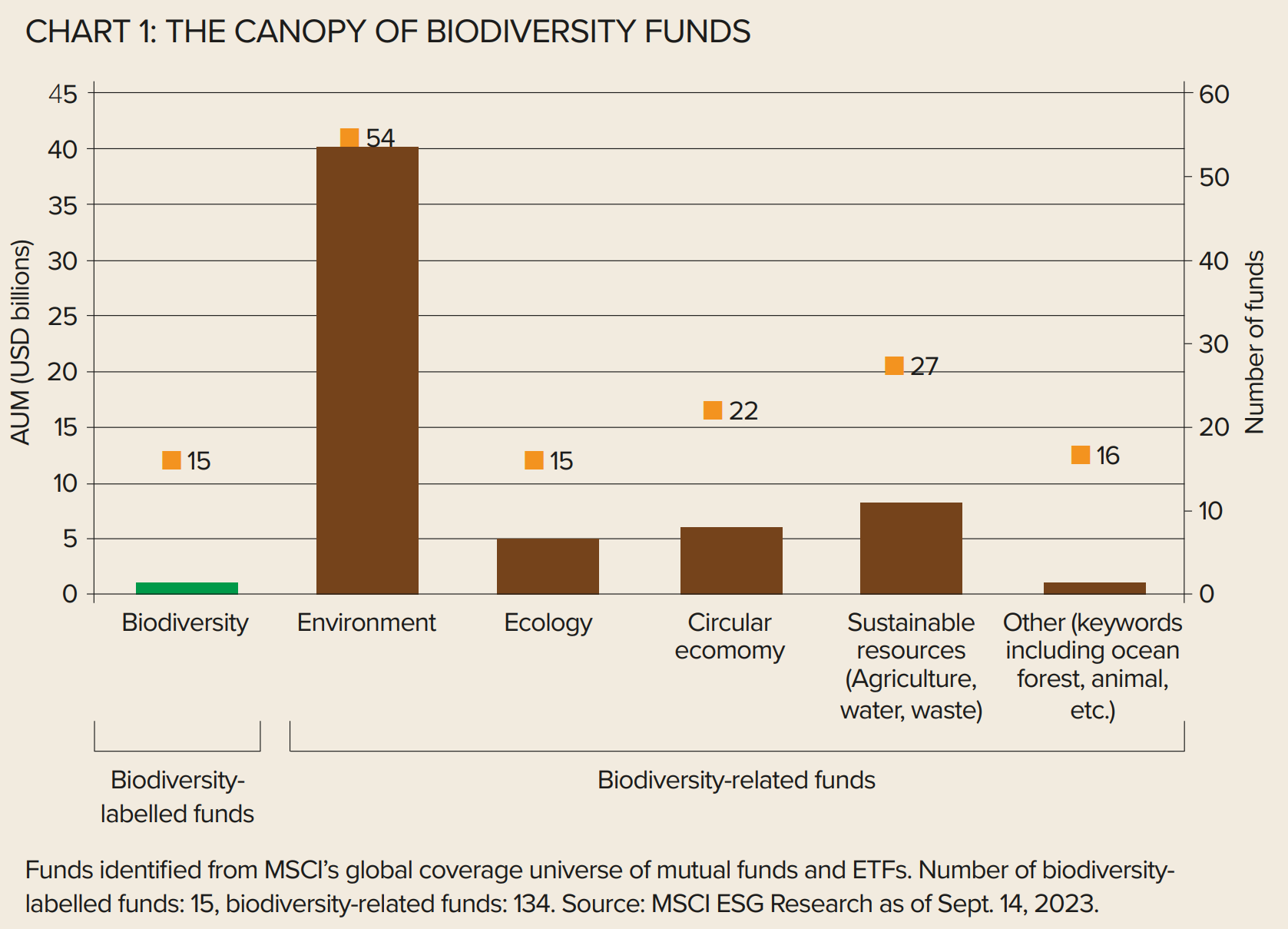

We identified 149 funds globally that are thematically linked to biodiversity based on the fund name and investment strategy. These funds collectively held approximately $60bn, or around 2%, of the estimated $3trn invested in sustainable funds as of September 2023.1

Among these, there were 15 pure-play biodiversity-labelled funds with just over $1bn AUM, the majority of which were mutual funds launched in 2022.2

The remaining funds were biodiversity-related with a broader environmental or associated thematic mandate such as strategies focusing on the circular economy that aim to provide exposure to firms that minimise waste, circulate resources, address water scarcity and regenerate nature.3

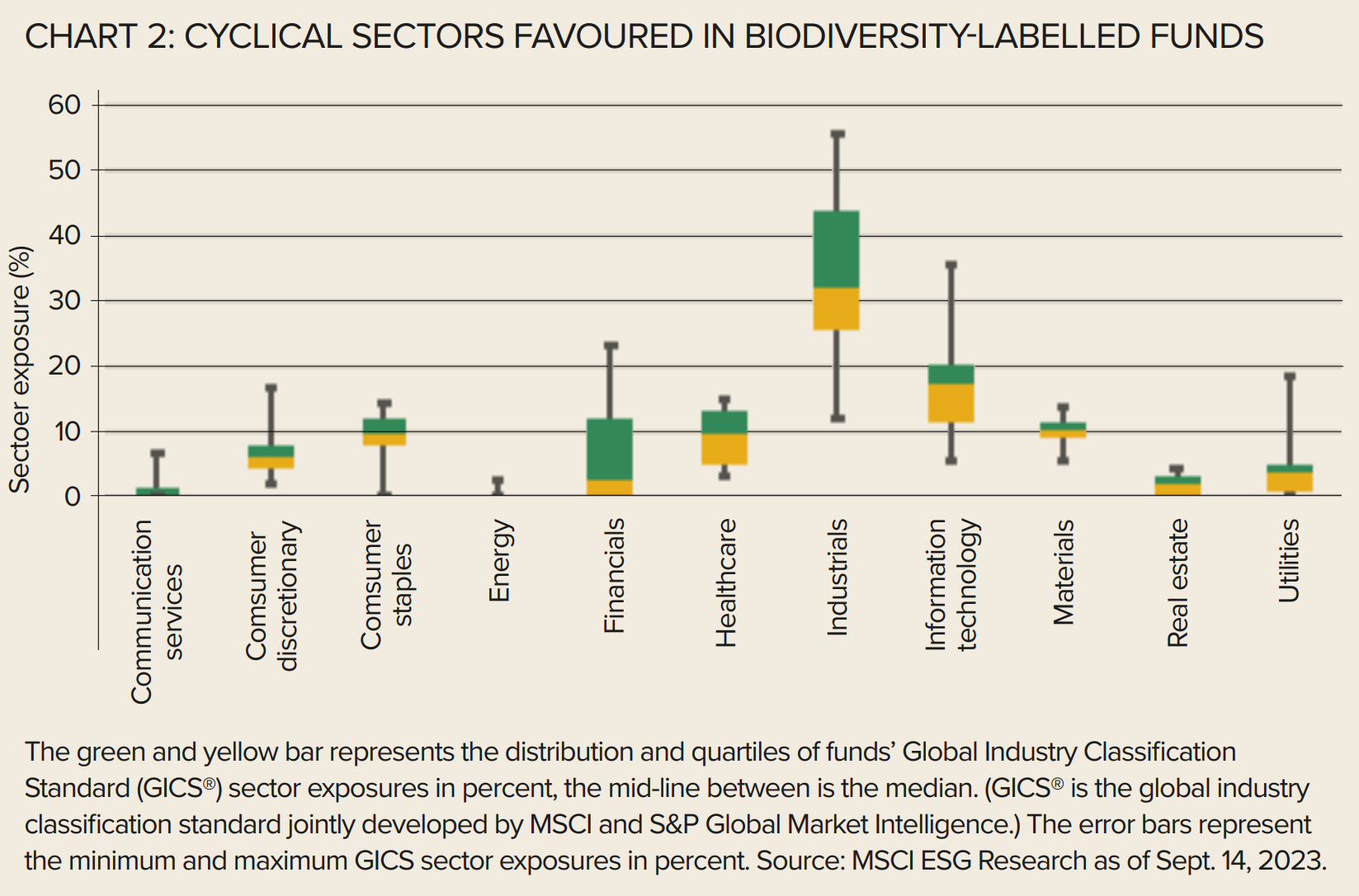

Beneath the foliage, exposure to industrials and IT dominated

Zooming in on the 10 largest biodiversity-labelled funds based on AUM as of September 2023, we observed that cyclical sectors were dominant, with industrials on average accounting for the largest sector exposure, followed by information technology and materials, with virtually no exposure to energy.4

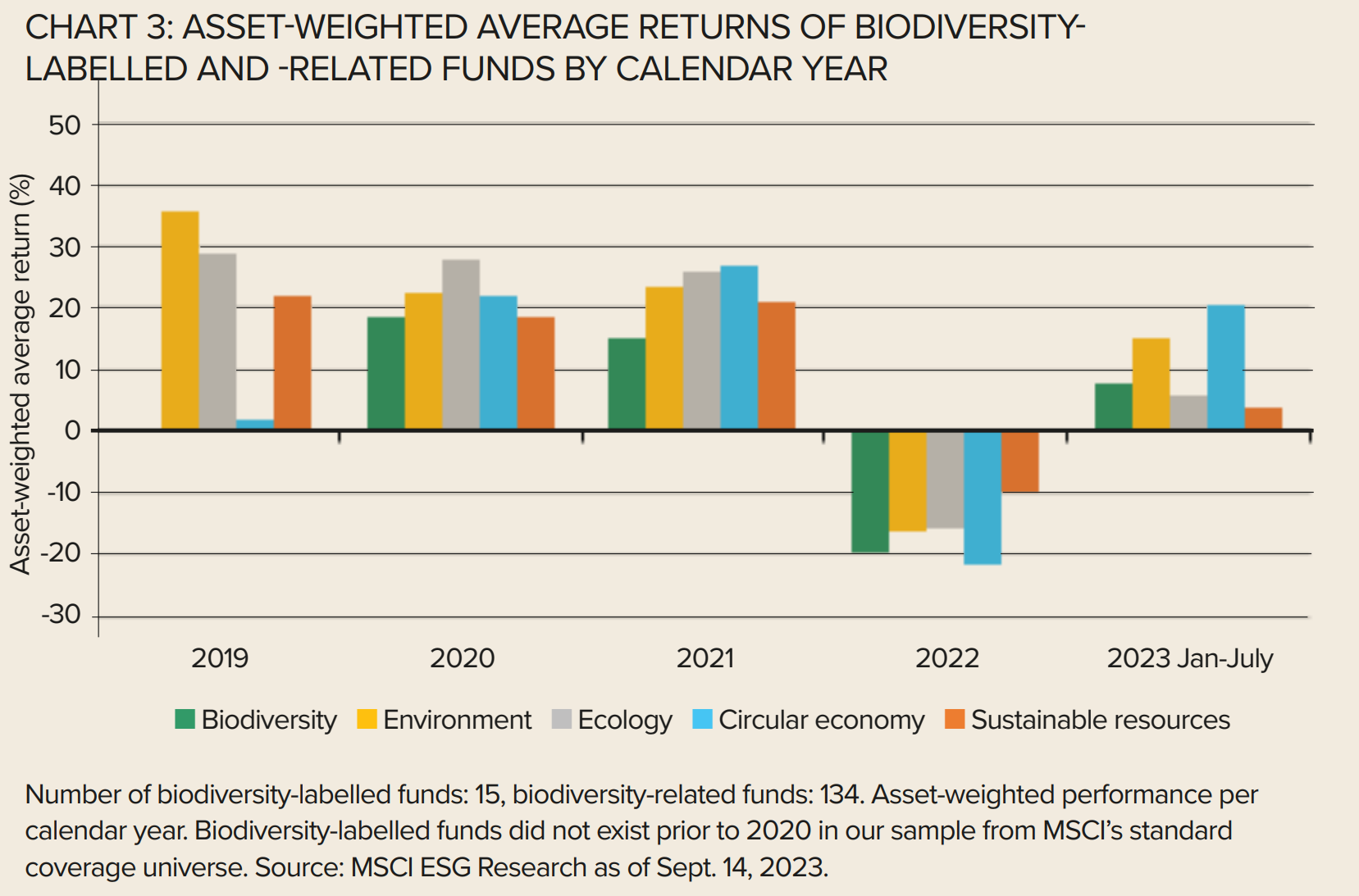

Money does not grow on trees – lower risk-adjusted returns vs. peers

In recent years, biodiversity-labelled funds have, on average, delivered lower risk-adjusted returns versus their peers in the same thematic sphere. This may partly be attributed to the large allocation to cyclical sectors, in particular information technology, which experienced a series of sharp selloffs in 2022.

That being said, the lower correlation to other sustainability themes may serve as a diversifying function for investors. Based on our research, however, asset-class diversification may be a challenge at present, with over 90% of funds being equity strategies focused on developed markets.

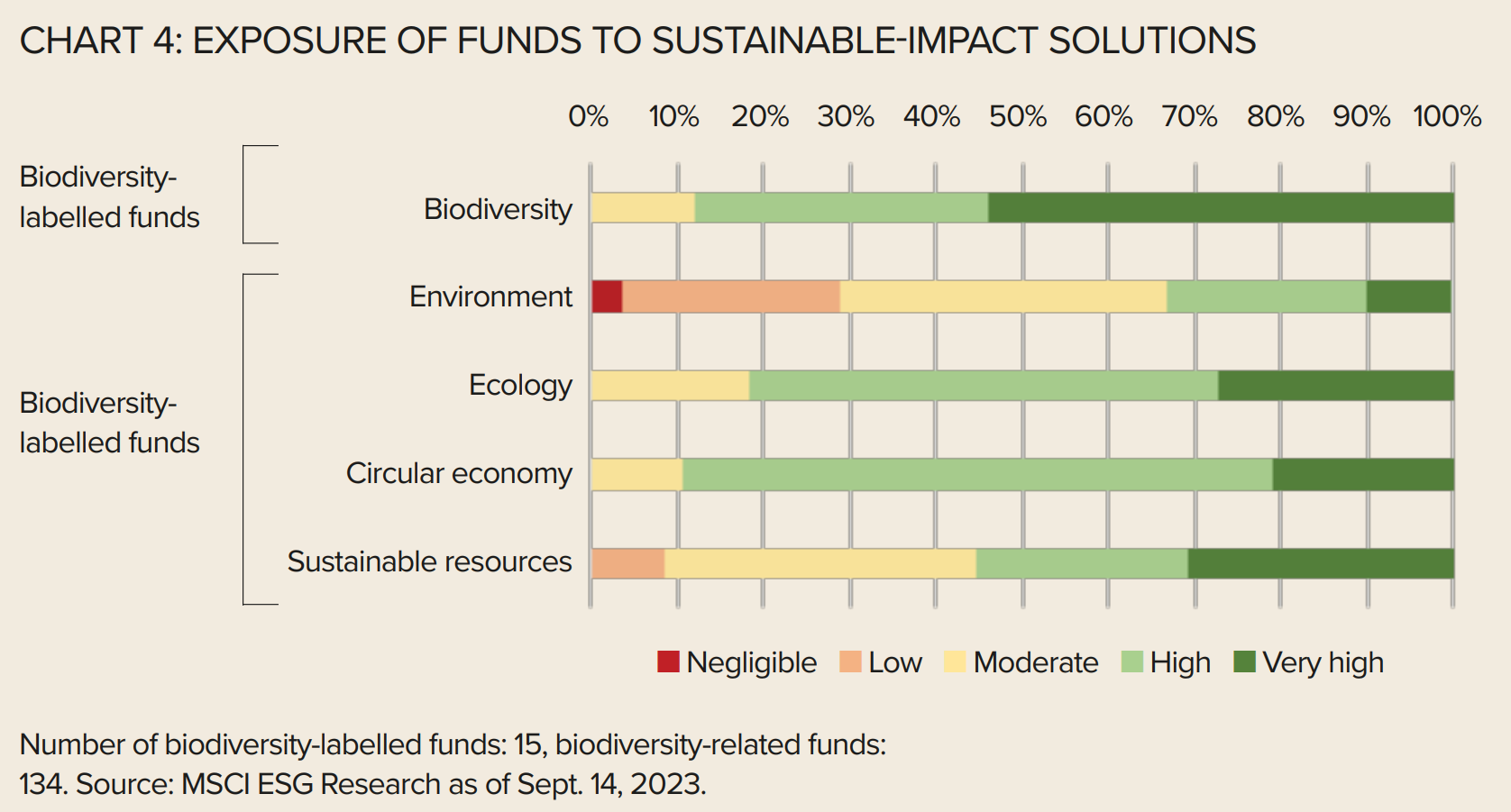

Fruits of labour – higher exposure to sustainable impact solutions vs peers

Using MSCI Sustainable Impact Metrics, we found that, on average, funds that contained the term “biodiversity” in the name exhibited twice the sustainable-impact-solutions revenue exposure as their biodiversity-related peers.

These funds had more exposure to companies that derive revenue from products or services with positive impact on society and the environment, and revenue tied to natural capital and climate change themes.

Navigating the jungle

Overall, biodiversity remains a nascent investment segment, with only a limited number of funds explicitly adopting biodiversity as the core investment theme. Investors may be confronted with a broad mix of different strategies and investment approaches that can vary significantly in terms of their level of complexity and their clear link to global biodiversity goals. They may range from funds based on exclusion criteria, to ones that apply sophisticated metrics with a clear focus on businesses aligned with global biodiversity goals.

Hence, understanding the finer details of biodiversity-labelled funds may be key for investors to successfully navigate this space.

Nonetheless, nature-related risks and opportunities are becoming more important for investors and regulators, and coupled with the emergence of reporting frameworks such as TNFD, biodiversity funds may soon receive greater attention.

Rumi Mahmood is head of ESG and climate fund research, and Shuang Guo is ESG and climate fund analyst at MSCI

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

1 Sustainable funds are defined as any fund that employs any ESG, climate or other sustainability-related considerations in its investment process (values and screening/ranking/exclusions/integration/optimization, etc. and their combinations). In simplest terms, it is the widest possible net under which any and all funds employing any sustainability considerations in security selection are captured, based on the fund prospectus and regulatory filings including claims of focus on sustainability, impact or ESG factors. All fund characterizations based on data from MSCI ESG Research, as of Sept. 14, 2023. 2 Biodiversity-labelled funds are funds with the term “biodiversity” in the fund name, prospectus and investment strategy. 3 Biodiversity-related are funds identified by keywords thematically linked to biodiversity such as environment, ecology, sustainable resources or circular economy in the fund name, prospectus and investment strategy. 4 The financial performance of cyclical sectors fluctuate in tandem with macroeconomic conditions and business cycles.