Bitcoin demand from US-listed spot bitcoin ETFs outstripping new creations has been a nail-biting dynamic for onlookers in recent months, but new questions are surfacing around whether inflows into the products can moderate quickly enough to avoid structural issues following the much-anticipated halving event.

The astronomical pace of asset gathering by the suite of new wrappers – spearheaded by the $17.3bn iShares Bitcoin Trust (IBIT) – has had a mechanical impact on the market of their underlying asset.

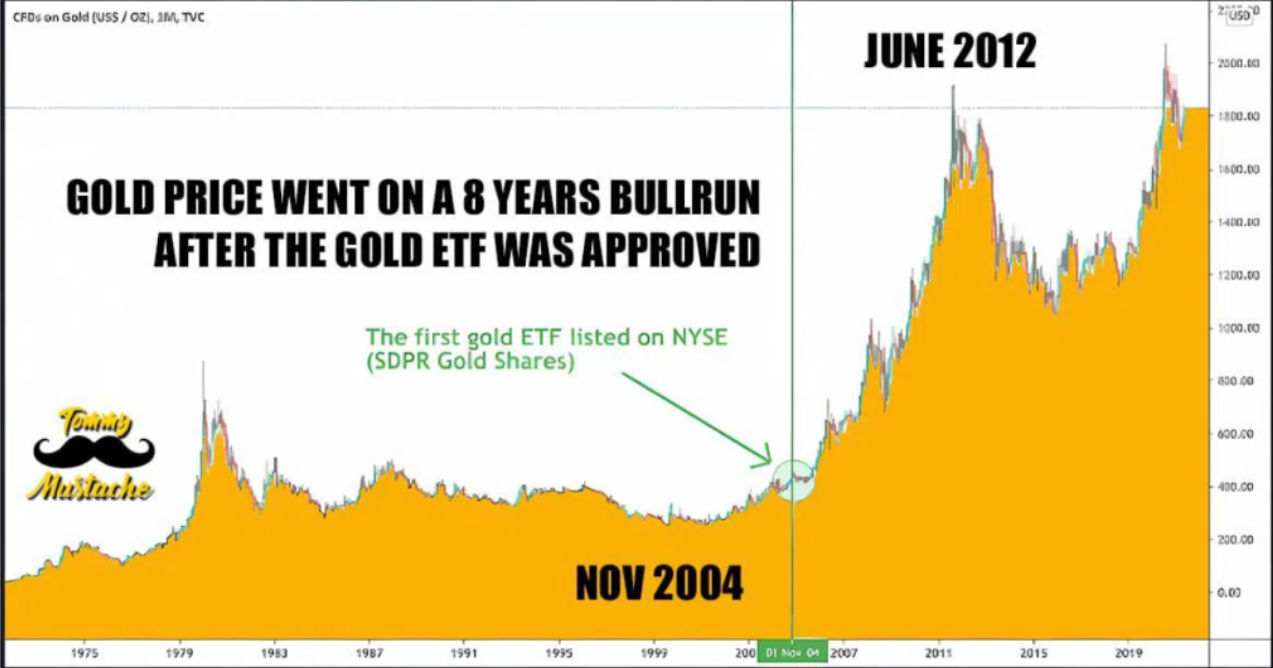

From a price perspective, bitcoin’s rally in early 2024 should cast investors’ minds back to 2004, when the arrival of the SPDR Gold Shares (GLD) preceded a 254% gold price surge within seven years – from around $700 an ounce to $2450 – at which point GLD was the world’s largest ETF with $77.5bn assets under management (AUM) by August 2011.

Chart 1: ETF arrival vs gold price

Source: Trading View

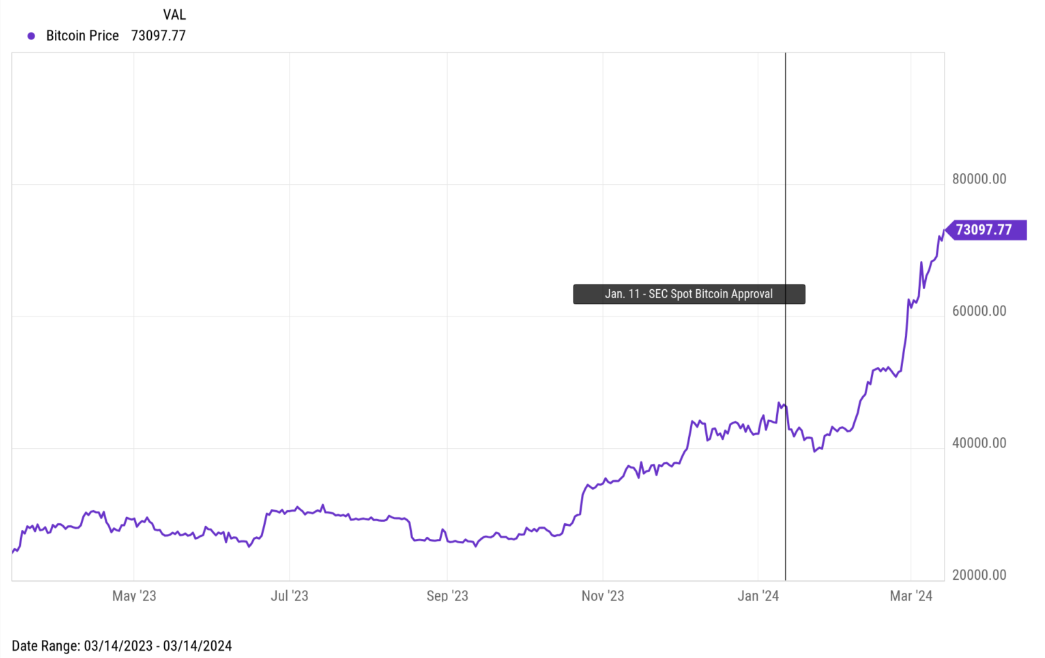

The same dynamic has played out over a more compressed timeframe in US spot bitcoin ETFs, with more than $30bn of asset gathering within their first three months being a key driver in bitcoin’s surge from $45,000 to fresh all-time-highs above $73,000.

Chart 2: Spot ETF arrival vs bitcoin price

Source: CryptoCompare

However, it is important to differentiate between correlation and causation. James Butterfill, head of research at CoinShares, noted a daily average of up to 4,500 bitcoins are being taken out of circulation by spot bitcoin ETFs every day, compared to only 900 new coins being produced each day, owing to daily rewards caps.

While these numbers may sound small in comparison to the estimated 19.6 million bitcoins in circulation, it is important to remember around 70% of bitcoins have not been traded in more than a year – according to Coindesk – and spot bitcoin ETFs had claimed 4% of all bitcoins in circulation by the start of March, let alone those being regularly traded.

The impact of this is also far from purely anecdotal. In fact, the total supply of bitcoins on exchange had declined 28% between 2020 and the end of February this year, a dynamic reflecting a “severe demand shock”, Butterfill said.

Aside from the direct demand conjured by the arrival of US spot ETFs, data from CryptoQuant revealed more than 90,700 bitcoins were withdrawn from major exchanges over the month to 4 April, which The Block warned was reducing the liquid supply of bitcoin as investors were taking their coins into cold storage as part of long-term holding strategies, in light of arrival of the new ETFs.

Stefan Wiederkehr, co-founder and managing director of IMP AG, told ETF Stream his firm has taken profits and “significantly” reduced its bitcoin exposure.

He added it is “absolutely” the case that new spot bitcoin ETFs are creating a supply-demand mismatch. This could result in structural issues, which will be brought into sharp focus by the bitcoin on 20 April.

“IBIT has around $17bn assets and the bitcoin halving will reduce supply even more, so there is definitely going to be an issue. There is also going to be an issue for the custodians such as Coinbase as they will not be able to provide [supply] anymore,” he said.

Last Friday's halving, which saw mining rewards fall from 6.25 bitcoin per block to 3.125 per block, also means the number of new bitcoin produced per day have halved from 900 to 450, Butterfill said.

At the current rate, this would mean bitcoin demand by new spot ETFs would outpace new bitcoin creations tenfold.

However, Butterfill noted the halving event coincides with demand for the ETFs slowing in recent weeks. This highlights how future supply concerns will be contingent on whether ETF inflows find a consistent floor at a multiple ahead of new coin supply.

On the other hand, it may not take a general supply-demand breakdown to create structural issues for ETFs – rather just the ability of key stakeholders to source bitcoin being called into question.

“Coinbase does the custody services for eight of the 10 bitcoin spot ETFs in the US, which is also quite a concentrated risk,” Wiederkehr continued. “If there is a problem with Coinbase and they cannot provide the short-term financing anymore, or they cannot provide the bitcoins themselves, there could be an inherent liquidity problem.”

While such events may remain hypothetical and distant, such ideas should change the question from ‘what are the limits of the ETF wrapper?’ to ‘what are the limits of the assets being wrapped in ETFs?’.