Cryptocurrency exchange-traded products (ETPs) flipped the script in 2023 after inflows more than doubled year-on-year, driven by bitcoin’s rally last year.

ETPs saw inflows of $2.3bn last year, up from $830m in 2022 – of which bitcoin made up 87% of new assets – boosted by investor sentiment surrounding a potential spot bitcoin ETF approval in the US.

Positive sentiment was redoubled after asset giant BlackRock filed for a spot bitcoin ETF in June 2023, pushing crypto towards earning their place among more traditional asset classes.

ARK Investment Management, WisdomTree and Valkyrie also submitted filings to the SEC.

Crypto ETPs listed in Germany and Switzerland saw inflows of $663m and $434m in 2023, accounting for 22% and 13% of assets under management (AUM), respectively. Notably, US inflows only represented 2% in AUM.

Hector McNeil, co-founder and co-CEO of HANetf said: “There are several reasons for this big pick up in inflows. The first and most obvious was the growing prospect of the SEC finally giving the greenlight to a spot price Bitcoin ETF in the US.”

While bitcoin ETPs brought in an impressive $1.9bn inflows, net new assets across other cryptocurrencies were limited in comparison. Highlighting this, ethereum ETPs only attracted $78m, making up 0.7% of total flows.

In contrast, solana benefitted from investor hesitancy towards ethereum, with inflows hitting $167m, making up 20% of its AUM.

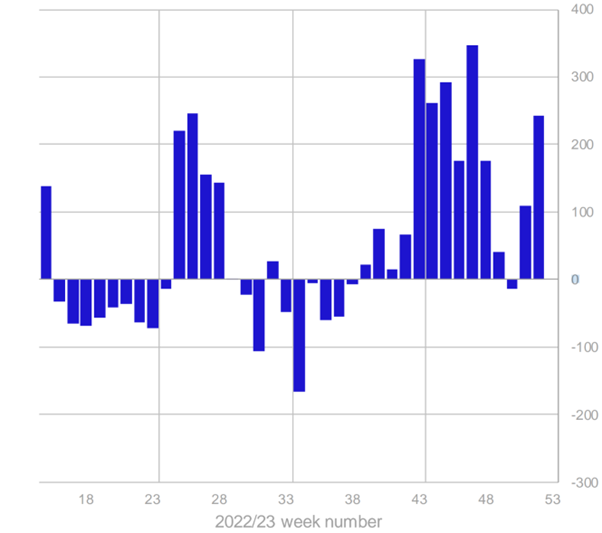

Chart 1: Weekly crypto asset flows ($m)

Source: Bloomberg and CoinShares

Although crypto ETPs staged a comeback 2023, inflows have yet to approach the peak levels seen in previous years, with 2020 recording $6.6bn net new assets and 2021 even higher at $10.7bn.

In a more recent development, market speculation that the SEC may reject a spot bitcoin ETF approval in January led to a sharp 10% drop in bitcoin’s value on Wednesday.

The latest market sell-off has been linked to a weekly research note from Matrixport, a Singapore-based crypto service provider, which raised concerns by suggesting the SEC may reject all ETF applications this month.

André Dragosch, head of research at ETC Group said: “The curious thing about Matrixport’s research note is that Matrixport published a rather contradictory daily research note on the very same day that suggested that an ETF approval is imminent.

“We have even received more evidence throughout the day that point into that direction. For instance, the SEC held meetings yesterday with the New York Stock Exchange, Nasdaq, and Cboe to finalise comments on spot bitcoin ETFs. Moreover, Fidelity filed a registration of securities for its spot bitcoin ETF with the SEC.”

Overall, bitcoin skyrocketed 164% to $42,500 last year.