Digital assets are in the middle of a deep bear market, as of Q3, and bitcoin’s value has fallen precipitously from its November 2021 all-time high.

The blockchain and digital asset world at this time is focused squarely on the Ethereum merge. But this long-overdue software upgrade for the world’s second-largest digital asset could be quickly overshadowed by another event coming down the pike: the next bitcoin halving, in April 2024.

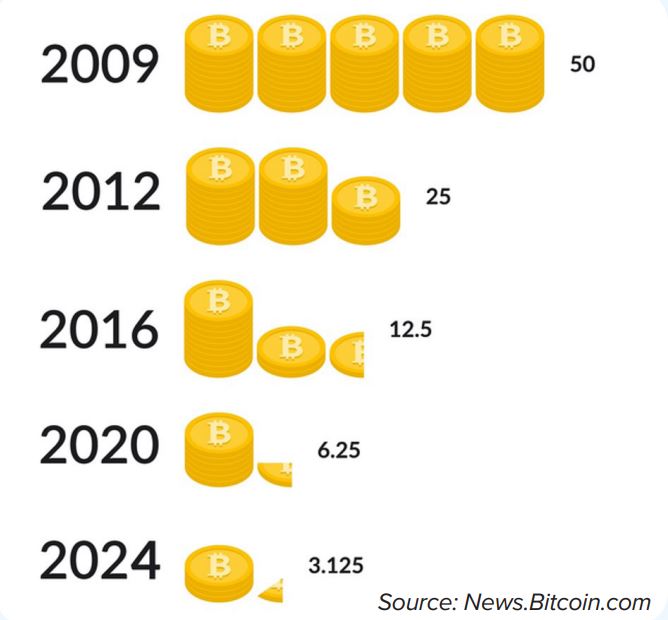

Once every four years, the issuance of new bitcoins onto the market is cut in half. It has been this way since the cryptocurrency was introduced to the public in 2008, and it will continue until the hard cap of 21 million total bitcoins has been reached, by around 2140.

Why are there bitcoin halvings?

There is certainly much to admire about bitcoin’s hardcoded deflationary structure.

Over 91% of bitcoin’s total supply has already been issued into the market. It is estimated that by 2030, 98% of bitcoin’s maximum supply will have been created.

Halvings are a core element of bitcoin’s software protocol, and the process of slicing block rewards in half – thereby gradually reducing the issuance of new BTC onto the market – is a genius way of controlling inflation programmatically.

Chart 1: Bitcoin halving cycle

This simple element of bitcoin’s monetary structure belies its elegance. And it acts as a key narrative counterpoint to the rampant inflation working its way through every major economy today.

Today, bitcoin’s inflation rate stands at 1.78%. After the next halving, in April 2024, this inflation rate will fall to 1.1%. This ever-increasing scarcity has to date coincided with large upswings in the value of the number one digital asset.

The history of bitcoin halvings

Every time that miners successfully process 210,000 blocks, there is a bitcoin halving. This occurs approximately once every four years.

We say ‘approximately’, because blockchains tend to work to their own internal timetable. Events are scheduled not according to dates in the traditional calendar, but instead by block height.

In blockchains, block height is simply the number of blocks that have been successfully added to the chain, and can be used to reference a point in time within a blockchain’s history.

Bitcoin was publicly released in January 2009. At that point in time, the incentive handed to miners for supporting the blockchain and verifying the status of the online ledger was 50 BTC.

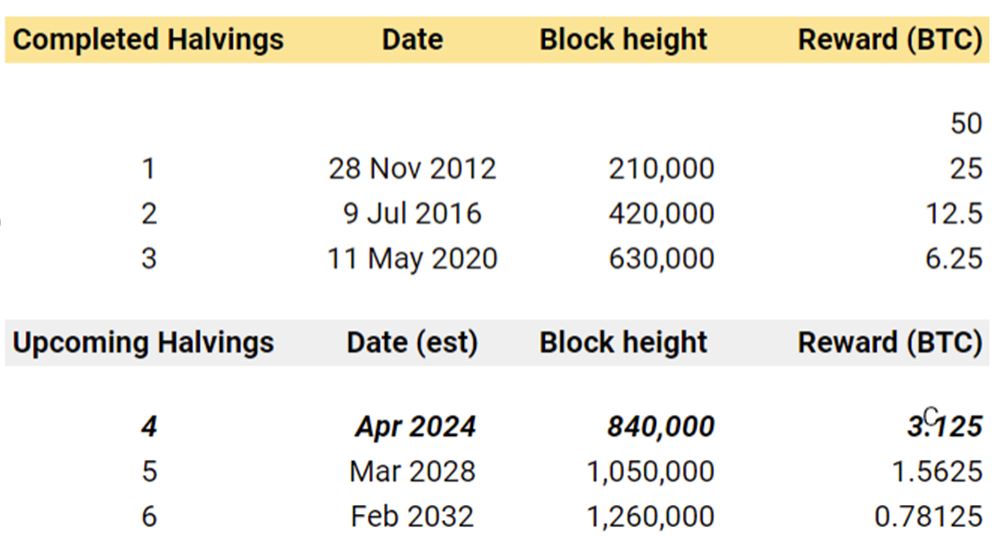

The first bitcoin halving took place when 210,000 blocks had been successfully mined, on 28 November 2012. The first halving cut bitcoin’s block reward from 50 to 25 BTC per block.

In the four years that followed, the price of each unit of the now scarcer bitcoin supply climbed 10,400%, from $4 to $420.

Chart 2: Bitcoin havings: Higher scarcity, lower inflation

Source: TradingView

Another 210,000 blocks later, on 9 July 2016, the second bitcoin halving took place. Block rewards were cut in half from 25 BTC to 12.5 BTC. Between 2016 and 2020, one BTC jumped in value by 1,590%, from $420 to $7,100.

It could be argued that bitcoin’s predictable supply model makes it a more rational investment than alternative stores of value like gold. While gold contains many of the properties found in bitcoin like durability, fungibility and to an extent, portability; there remain questions over its true scarcity. Recent discoveries, notably 31 million tonnes of gold ore in Uganda in June 2022, aptly demonstrate that the earth may have far more reserves than natural scientists traditionally estimated.

Neither has gold been a particularly effective inflation hedge: in the most inflationary period for over 40 years in most western economies: between March and September 2022, the precious metal lost 15% of its value.

Chart 3: The bitcoin havling schedule

Source: ETC Group

Lightning strikes twice

Bitcoin’s use cases from store of value to cross-border currency have shifted over the past few years as critics have come to appreciate that it is a truly groundbreaking work of computer science, comparable with the protocols that underpin the modern internet.

Recall the title of bitcoin’s whitepaper: A Peer to Peer Electronic Cash System.

To dismiss bitcoin as mere Veblen goods — those luxury, scarce, status symbol items where demand rises as their price rises — is to ignore another key element of bitcoin’s utility: as a way to send value over the internet near-instantly. And quite apart from its store of value credentials, the cost to actually use the bitcoin network is at its lowest since 2020.

Such criticism also conveniently ignores one of bitcoin’s key properties: divisibility. Unlike national currencies, bitcoin is divisible to eight decimal places, and can be divided into units as small as 0.00000001 BTC, which makes it perfect for online micropayments.

And just as ethereum has its own Layer 2 scaling solutions, such as polygon and optimism, that improve transaction throughput and reduce transaction fees, so too bitcoin has its own second technological layer.

This is the Lightning Network, which sits above the bitcoin base layer and dramatically expands its payments capability. The service pulls computationally-intensive transaction processing away from the main bitcoin blockchain, drastically reducing fees to a mere fraction of a cent.

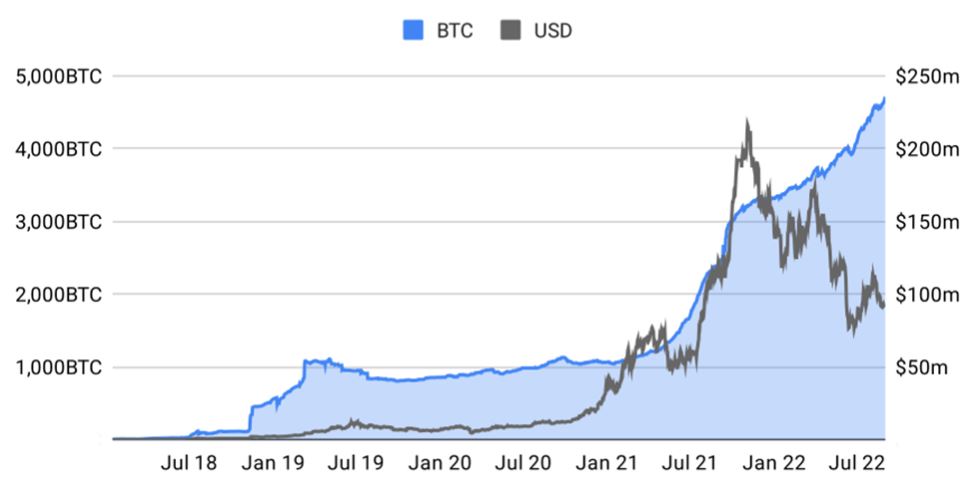

Chart 4: Lightning Netwrok capacity nears 5,000 BTC

Source: Bitcoinvisuals

There remains much work to do. Even while the capacity of the Lightning Network has been growing rapidly, at almost 5,000 BTC it remains a fraction of the total 19 million BTC that currently exist.

But financing is starting to flood into this area. In May 2022, a16z, the largest venture capital funders in the blockchain space, added $175m of Series A financing to the David Marcus-founded development firm Lightspark. Investors may recognise Marcus as the co-creator of Meta’s now shelved Diem project.

There is further value-add in bitcoin’s utility that has not yet been explored to its full potential. And Bitcoin is not a simple static asset: it is a foundational technology layer upon which many new applications can be built.

So while the world will look much different in April 2024, the next bitcoin halving will be upon us. Who would be willing to bet against its success?

Tom Rodgers is head of research at ETC Group

This article first appeared in ETF Stream's Crypto Unlocked: In the bleak midwinter report. Download the full report here.