There is a trade-off between price impact, urgency and risk of information leakage when trading ETFs in Europe, according to research by BlackRock.

The research seen by ETF Stream, titled Trading ETFs: A practitioners’ guide for trading ETFs in Europe, stressed the importance of avoiding a “one-size-fits-all” approach to ETF execution in Europe.

According to data from Bloomberg Intelligence, European-listed exchange-traded products (ETPs) traded a record €2.5trn in 2022 which accounted for approximately 10% of total European volume.

Request-for-quote (RFQ) platforms remain the “dominant mechanism” for trading ETFs in Europe with 50% market share, up from 48% in 2021 and 44% in 2020, data from Jane Street showed.

“Alongside higher trading volumes and an expanded choice of products, European ETFs have also witnessed an evolution of trading behaviours over time,” Paul Battams, head of EMEA equity trading, Trading & Liquidity Strategies Group, at BlackRock, and co-author of the research, said.

“Today, institutional dealing desks have a diverse set of choices to execute their ETF flow, with each option leading to differentiated outcomes. Understanding the considerations in the execution lifecycle of an ETF can help dealing desks deliver more informed results.”

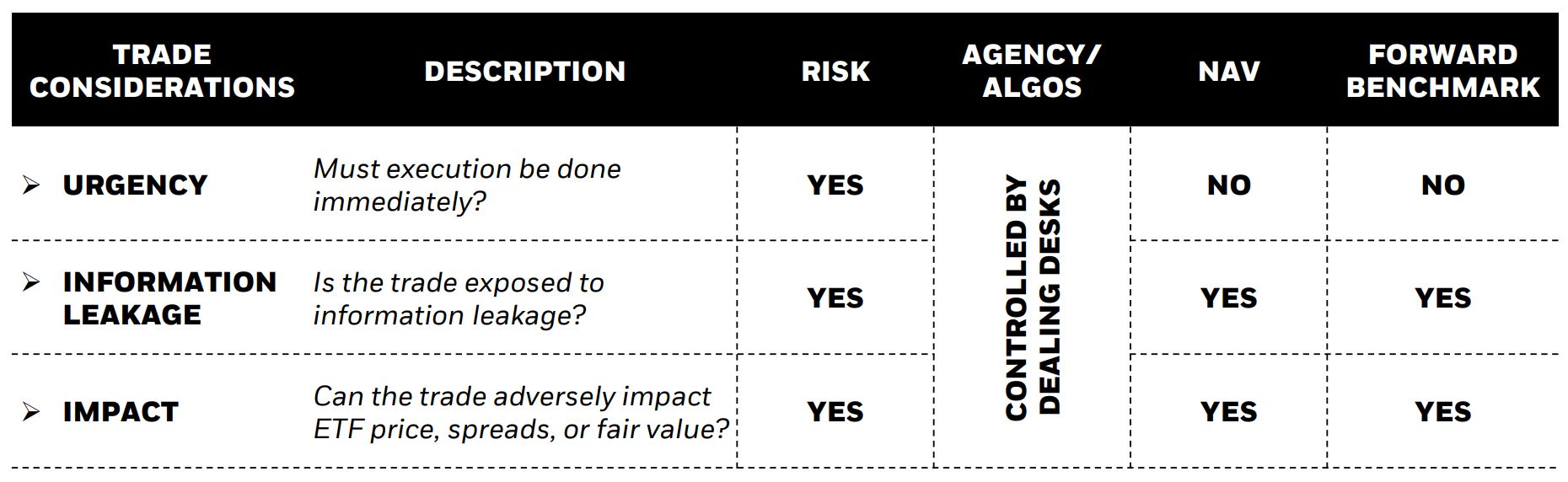

In particular, the BlackRock report highlighted four ETF execution strategies buyside traders can adopt when looking to achieve best execution.

The first – and most widely adopted – is trading at risk, a process where an investor sends a request for immediate execution and puts multiple liquidity providers into competition. The investor receives quotes to execute the entire trade at once and then selects the best price.

The issue with executing at risk is it can lead to information leakage which impacts the final execution price, especially when looking to trade big orders.

Information leakage can occur in the form of pre-hedging, a process where liquidity providers front-run an order to capture the performance of a sizeable trade.

In response, the European Securities and Markets Authority (ESMA) issued a ‘call for evidence’ last July on the practice of pre-hedging.

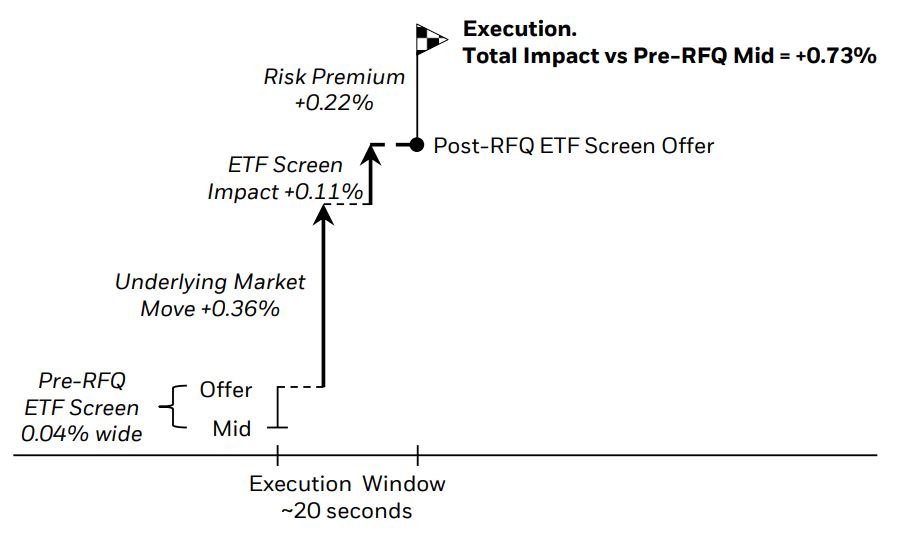

BlackRock highlighted a case study where a client looking to purchase €78m in an ETF tracking Euro Stoxx Banks 30-15 index sent the order to multiple liquidity providers. This information leakage meant the cost of this execution at risk was 0.73% as highlighted by Chart 1.

Chart 1: ETF trading case study

Source: BlackRock

However, ETF traders have other execution options which include appointing an agency broker to limit the impact of execution, especially on large orders, executing via an ETF’s future net asset value (NAV) or requesting execution benchmarked to an ETF’s price at a specific time, known as ‘forward benchmark’.

Chart 2: Common ETF execution strategies

Source: BlackRock

“European ETFs have witnessed an evolution of trading behaviours over time,” Battam continued. “Different execution strategies allow traders to access different components of European ETF liquidity.

“A notable shift in clients’ preference for trading ETFs tied to their future NAVs to a more immediate ‘risk’ transfer approach, and the recent acceleration in optimised trading using algorithms, point to a diverse mix of options when it comes to executing an ETF trade.

“It is crucial that an ETF execution strategy should always match the underlying investment objectives. As such, dealing desks should avoid a one-size-fits-all approach and be able to adapt ETF execution based on the objectives of the trade, characteristics of the ETF, and prevailing market conditions.”