BlackRock has expanded its synthetic range with the launch of a global equity ETF.

The iShares MSCI World Swap UCITS ETF (IWDS) is listed on Euronext Amsterdam with a total expense ratio (TER) of 0.20%.

IWDS tracks the MSCI World Net TR index which offers exposure to 1,480 equities across 23 developed market countries.

It operates an unfunded swap model where a counterparty pays the index total return in exchange for a swap fee.

The ETF has multiple swap counterparties which BlackRock said ensures best execution given multiple parties are bidding for the swap contract while also avoiding overconcentration to one counterparty.

Companies in IWDS's substitute basket must be in the MSCI World, cannot have a larger weighting than 5% and the number of any share must not exceed 100% of the 30-day average day trading volume (ADV) of such equity security.

Bank, dividend-paying or corporate action stocks are excluded from the swap basket.

Synthetic ETFs, such as IWDS, have a performance advantage over physical ETFs when offering exposure to US equities. IWDS currently has a 70% weighting to the US.

They do not pay withholding tax on dividends as the substitute basket of the ETF is restricted to non-dividend paying stocks.

US equity dividends from physical ETFs domiciled in Ireland are subject to 15% tax while other jurisdictions such as Luxembourg pay 30% tax.

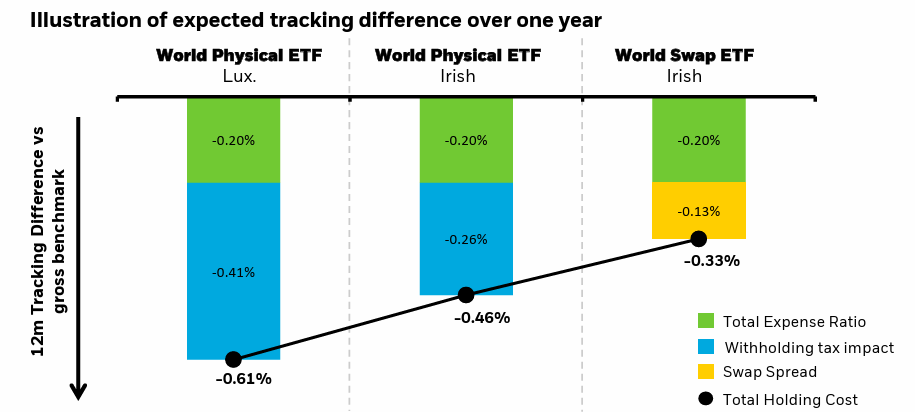

As a result, a synthetic global ETF will deliver an annual tracking difference of 0.33% versus 0.46% and 0.61% for physical ETFs domiciled in Ireland and Luxembourg, respectively, according to BlackRock.

Chart 1: Differences between domicile and replication

Source: BlackRock

BlackRock follows rivals Invesco and DWS in launching a synthetic global ETF.

IWDS is the second cheapest on the market after the $4.7bn Invesco MSCI World UCITS ETF (MXWS) which has a TER of 0.19% while the $6bn Xtrackers MSCI World Swap UCITS ETF (XMWO) carries a fee of 0.45%.

It is the world's largest asset manager's third synthetic ETF following the launch of two US equity ETFs, the iShares MSCI USA Swap UCITS ETF (MUSA) and the iShares S&P 500 Swap UCITS ETF (I500).

BlackRock's decision to launch synthetic ETFs in 2020 represents a U-turn in the world's largest asset manager's view on the product structure.

Following its acquisition of iShares from Barclays in 2009, BlackRock CEO Larry Fink called out European rivals Lyxor and SocGen at a conference in New York for its use in synthetic ETFs. At the time, BlackRock exclusively offered physical ETFs.