The number of ETF investors across Europe is set to increase by 32% over the next 12 months, according to a survey conducted by YouGov and BlackRock, in a sign of the booming demand for ETFs among retail investors.

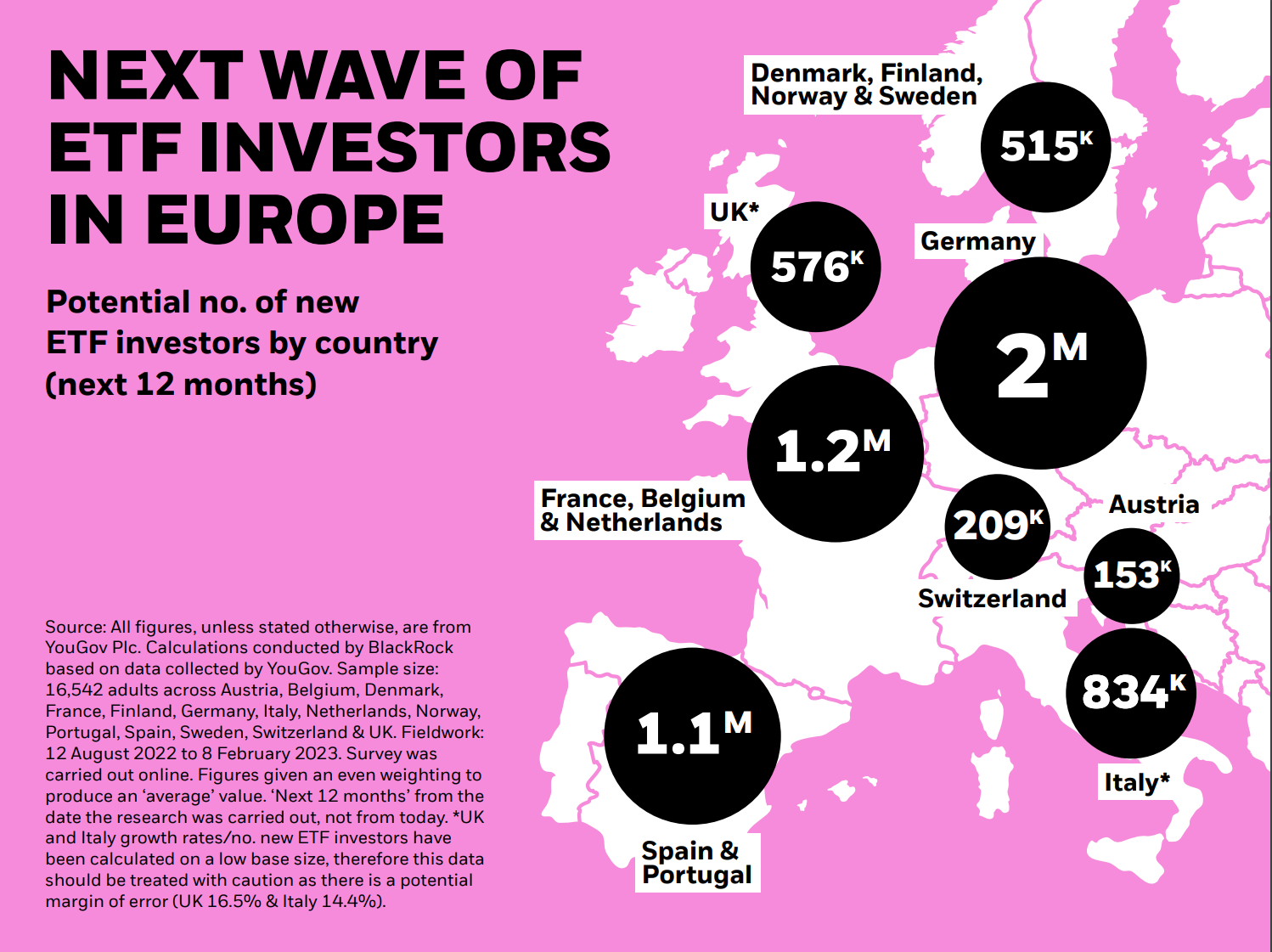

The survey of 16,542 adults based in 14 European countries forecasted as many as 6.6 million new ETF investors in the next year.

In particular, Iberia is expected to see the fastest growth of new ETF investors across all countries surveyed with over one million set to start investing in ETFs, a relative increase of 64%.

The Iberian region of Spain and Portugal currently has one of the lowest ETF market penetration rates in Europe with Spanish-listed ETFs currently taxed on capital gains while mutual funds are not under the Traspasos regime.

Elsewhere, Germany is forecasted to see the strongest growth in absolute terms with two million new ETF investors expected over the next 12 months, a growth rate of 22%.

The growth of retail investors using ETFs in Germany has skyrocketed in recent years amid the rise of online distribution platforms such as Scalable Capital and Trade Republic and the increasing popularity of ETF savings plans.

Last April, BlackRock predicted the number of investors contributing to ETF savings plans is set to hit 20 million by 2026, up from 4.9 million in 2022 and 1.9 million at the end of 2019.

As a result, Germany now has the most amount of assets invested in ETFs, according to Blackwater Search & Advisory, with a European market share of approximately 27%.

Across the rest of Europe, an extra 834,000 ETF investors are expected in Italy over the same period, 1.2 million across France, Belgium and the Netherlands and 576,000 in the UK.

Jane Sloan, head of iShares and index investments, EMEA, at BlackRock, said: “ETFs are already helping millions of European investors build better portfolios but what is really exciting is how fast this number is rising.

“ETFs provide an easy and cost-effective way to begin investing, thanks to low minimum investments, the breadth of exposures available and the growing presence of digital platforms improving accessibility.”

Furthermore, the survey found ETF investors are getting younger with millennials and Gen-Z increasingly eyeing ETFs as useful tools within portfolios.

Investors aged 35 or over currently represent 63% of the ETF market, according to YouGov, but the survey found 54% of the next wave of ETF investors will be aged between 18 and 34 years.

“BlackRock believes that this younger cohort, now participating using ETFs, could be as a result of them being more comfortable with self-directed decision making and the emergence of online investment platforms,” Sloan added.