This year has been defined by stratospheric returns among tech-focused ETFs, however, Europe’s thematic darling the BlackRock clean energy ETF continues to fall from the lofty heights of years gone by.

Europe's largest thematic ETF, the $5.1bn iShares Global Clean Energy UCITS ETF (INRG), was within 1.7% of its price three years ago and 50.3% down from its all-time-high on 7 January 2021, as at 16 August.

The clean energy posterchild became a staple of professional and retail investor portfolios alike after booking electric 144.3% gains in 2020, with the election of Democrat President Joe Biden promising to breathe new life into renewable energy investment and financial incentives.

While this support has been realised in the form of $470bn of tax credits for the roll-out of renewable energy utilities and energy storage via the American Jobs Plan and Inflation Reduction Act, monetary policy and geopolitical realities have since added reticence to the heavily priced-in optimism at the start of Biden’s term.

Kenneth Lamont, senior fund analyst at Morningstar, said “nothing can go up forever” and although the Biden administration remains committed to the green agenda, the fastest Federal Reserve funds rate hiking cycle since Fed Chair Paul Volcker in the 1980s has proven a “significant headwind”.

“Alternative energy projects often require significant upfront investment, much of which is borrowed, making them particularly sensitive to rises in rates,” Lamont said.

He added many energy transition stocks sit within the growth style box.

“All else held equal, raising the rate used for discounting expected future cashflows hits growth stocks particularly hard because those expected cash flows are expected later and therefore get discounted more than companies with stronger current revenues, but with less growth potential.”

Andy Merricks, portfolio manager at IDAD Funds, said INRG’s surge following Biden’s election victory “defied gravity” and investors have since learned a strong ideological movement does not directly translate into realised profits, at least in the medium-term.

“It has become clearer that the cost of bringing the various clean energy alternatives into the mainstream is enormous,” Merricks said.

“Coupled with a global cost of living crisis and more immediate concerns for various countries’ citizens – not everyone buys the ‘it is already too late’ argument – together with a year in 2022 when those invested in the great demon that is oil actually did pretty well, it has led to a reassessment of what actually offers a bit of value.”

The Russian invasion of Ukraine also prompted fresh questions about the source and price of energy.

While initiatives such as the €315bn RePowerEU will support reshored clean energy generation in the longer-term, energy prices falling their peak in Q2 last year has compressed margins for some utilities operators, according to Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence.

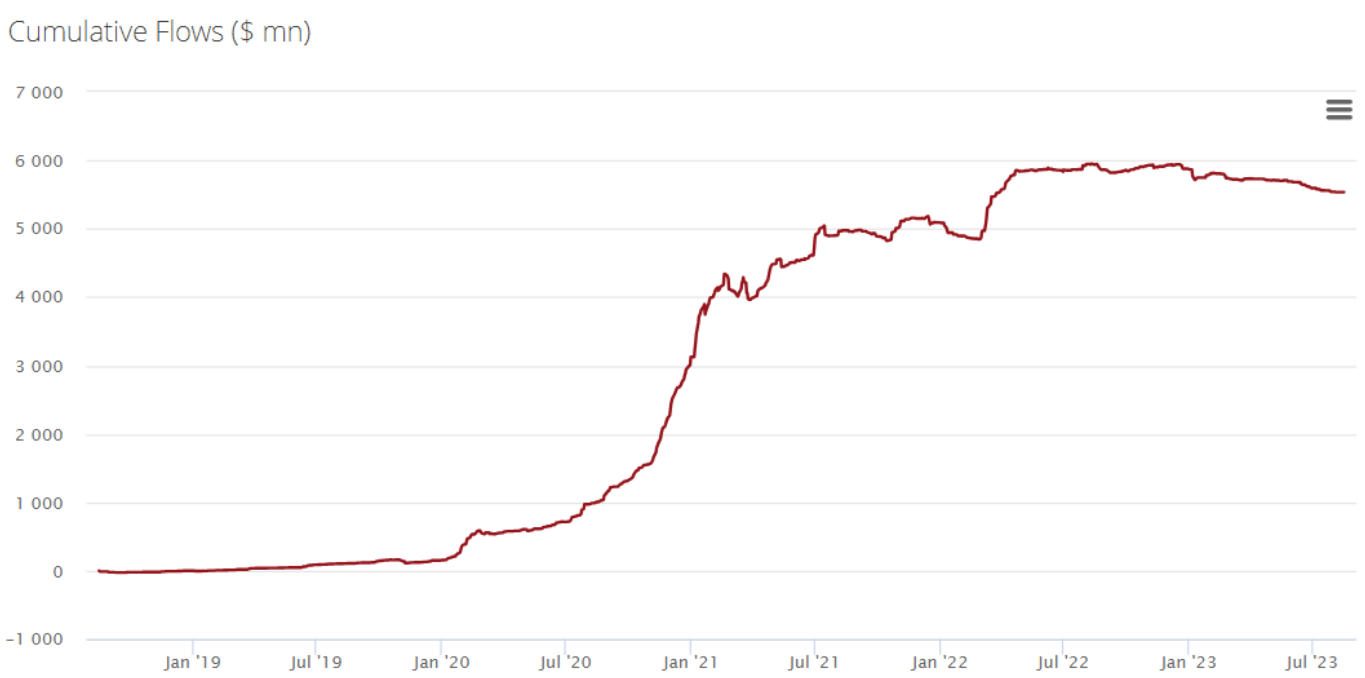

Despite these challenges and INRG dropping 22.2% so far in 2023, investors remain committed to the strategy and have in fact added a considerable $2.2bn of net new assets since the ETF began falling from its all-time-high, according to data from ETFbook.

Source: ETFbook

This is particularly impressive not only due to the market backdrop impacting all clean energy strategies, however, in 2021, INRG faced potentially existential risks as the ETF was forced to quickly change index after its scale saw it drive the performance of stocks in its previously more concentrated benchmark.

Continued inflows during a period of poor returns and structural upheaval speaks to the strength of investor conviction in the underlying theme and confidence in BlackRock as an issuer as well as the firm’s distribution capabilities in Europe.

“The need for alternative energy solutions is still compelling and the current valuations may provide an attractive entry point for those with longer investment horizons,” Lamont concluded.