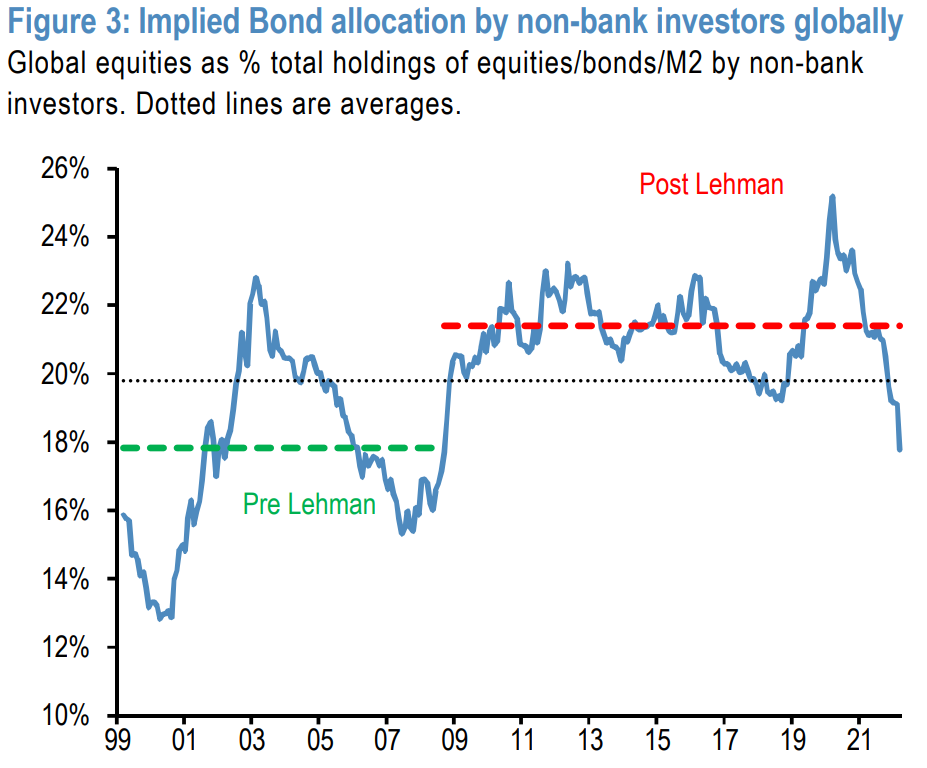

Fixed income allocations have fallen to their lowest level since the Global Financial Crisis (GFC) with liquidity drying up and the low-yield environment in a whirlwind year so far in 2022, according to research from JP Morgan.

In its recent Global Markets Strategy report, the bank estimated bonds made up just 18% of global non-bank investor portfolios at the end of Q1 this year, the lowest level since 2008.

Source: Bloomberg and JP Morgan

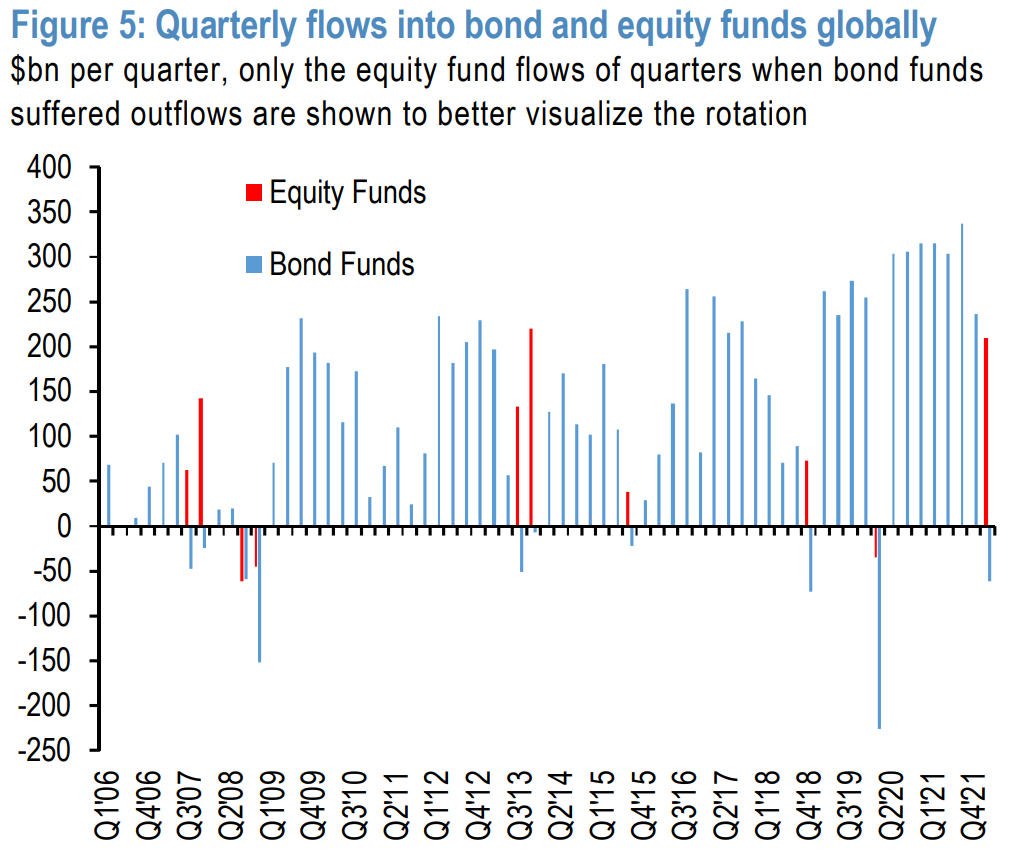

The US giant argued 14 years of relative bond overweights have been erased since the latter stages of 2021, with equity funds seeing continued inflows while bond funds sold off at their fastest pace within a quarter since the start of 2020.

JP Morgan then compared this equity rush-bond exodus dynamic to the ‘taper tantrum’ of 2013 and said the current rift in equity and bond positions is approaching previous cycle highs of the 2006-2007 era.

Source: ICI, EPFR, EFAMA, Bloomberg and JP Morgan

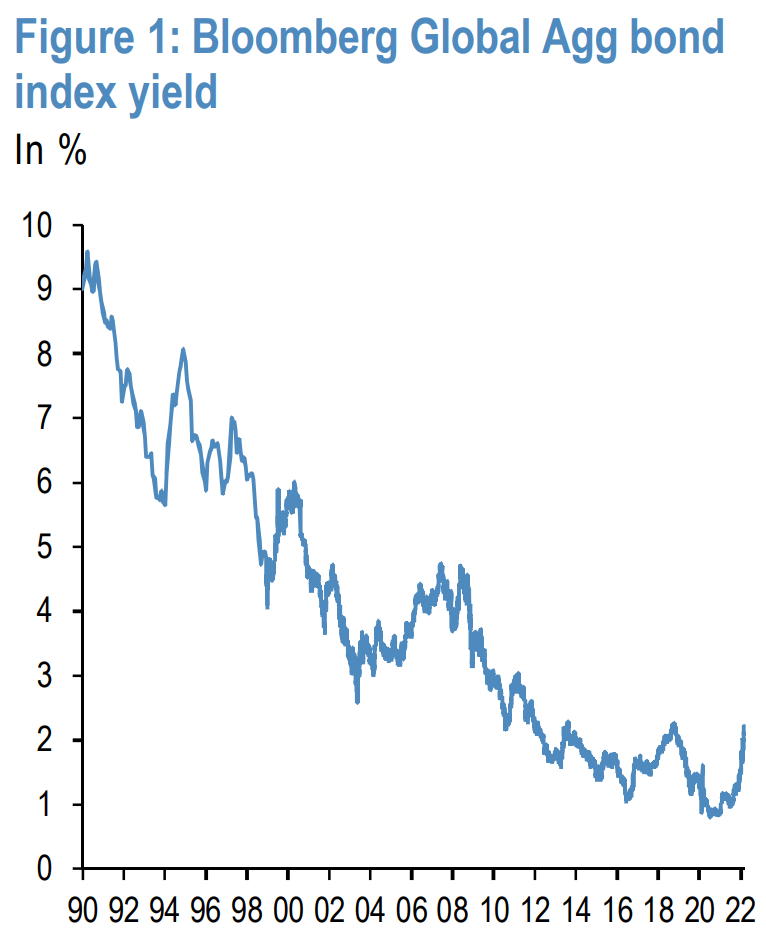

Looking at other flashing lights in the fixed income space, it added the rise in bond yields so far this year is of “historic proportions”.

In fact, the 90-basis point bounce in the Bloomberg Global Aggregate Bond index yield that occurred in less than 12 weeks this year represents the steepest hike since 1994 – when the index’s yield shot up 230 bps in the year.

Source: Bloomberg and JP Morgan

Notably, this sell-off and rates volatility has been occurring in a period of “very low” liquidity, with market depth for two-year and 10-year US Treasuries at one of their lowest levels since the GFC – second only to March 2020. However, this interplay is hardly coincidental.

Nikolaos Panigirtzoglou, managing director of global markets strategy at JP Morgan, said: “In other words, at the current juncture of very low market depth and elevated rate volatility one is feeding the other in an intense way: as rate volatility rises bond market makers step back from their market-making role and raise bid-offer spreads inducing low market depth and lower liquidity, which in turns creates even more rate volatility.”

Peter Sleep, senior investment manager at 7IM, suggested it is not time to sound alarm bells despite dramatic-sounding soundbites.

“There have been warnings about thinner liquidity in bond markets for decades and we still soldier on,” Sleep continued.“In 2008 and 2020, we saw the bond markets dry up and I am sure in the next crisis we will see the bond markets dry up again. If you look at the big banks' results in 2020 and 2021 though you will see the Fixed Income Clearing Corporation (FICC) is still highly profitable despite the thinning markets.

“The idea of spreads widening in volatile times is anything new. Did not the Bank of England look at this a few years ago and find that the wider spreads actually increased the number of market makers entering the market? That is a good thing.”

Furthermore, JP Morgan highlighted periods of “severe” bond fund outflows normally last no more than one quarter outside of crisis periods and in turn, it believes the rotation away from bonds will subside from Q2 and beyond.

Overall, it expects bond fund flows to finish the year at similar levels to 2013 – around $200bn – though this is a striking $1trn short of the bond fund inflows booked in 2021.

7IM’s Sleep continued: “The underweight to bonds has been a feature for a long time and made worse by the negative real yields. The big move up in US yields has made them more attractive but while the negative momentum is so strong, it is difficult to see consistent purchasing.

“What it does mean though is that if there is an equity correction some clients will hit harder than expected. Firstly, they have too much equity and secondly, they will have too few bonds.”

If Deutsche Bank’s and Bank of America’s recent forecasts of a US recession on the horizon are anything to go by, there may be no shortage of volatility and uncertainty to come.

Related articles