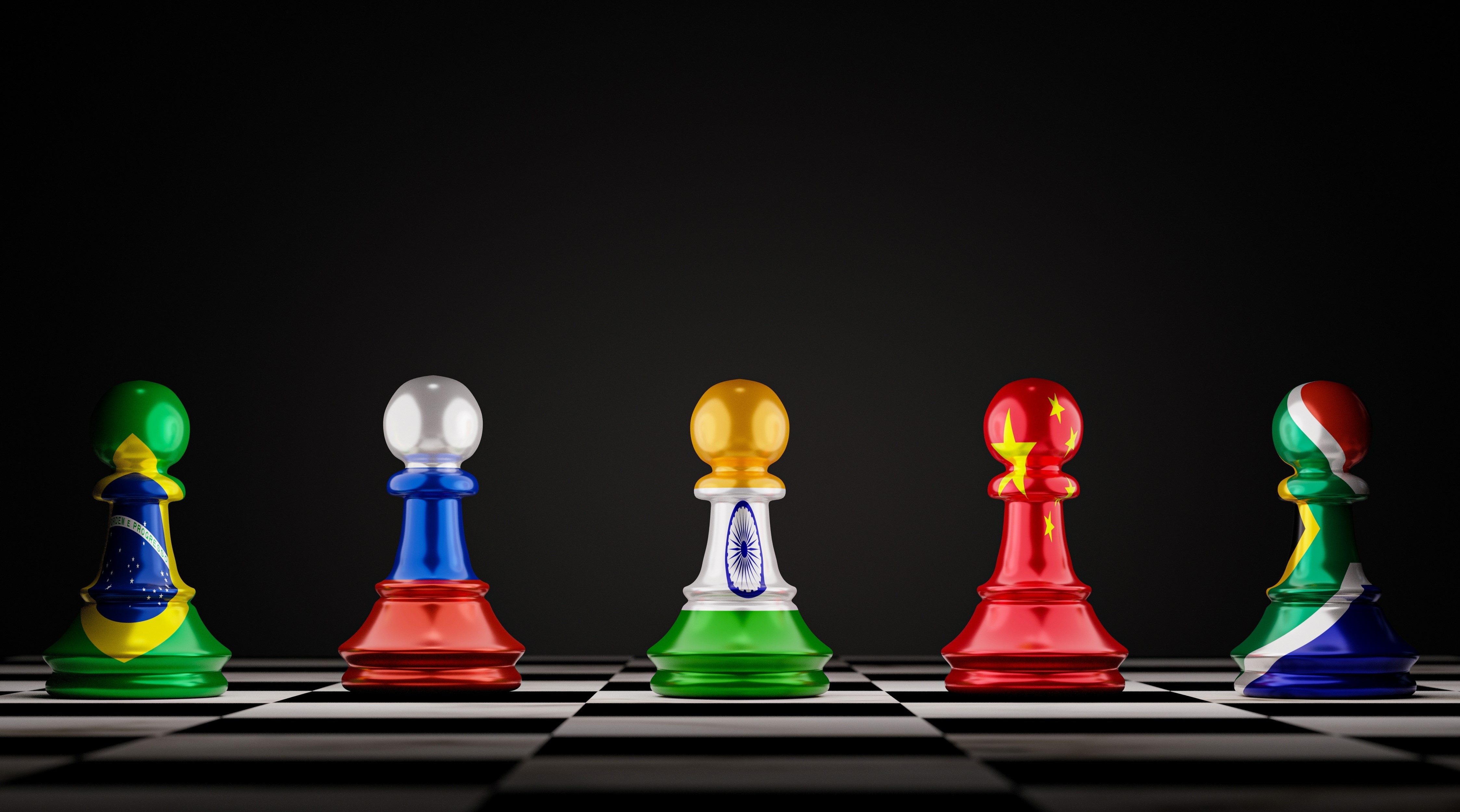

The late August expansion of the so-called BRICS nations may go down as the time countries made the transition from a connected bloc of emerging economies to a leading global economic powerhouse that rivals that of the US.

It might represent a big long-term opportunity for ETF investors who do the research to identify potential rewards and risks of the bloc that includes Brazil, Russia, India, China and South Africa. Together, those countries make up 40% of the world’s population and account for 25% of global gross domestic product.

BRICS has invited Saudi Arabia, Egypt and the United Arab Emirates to join their emerging markets bloc. Smaller, less impactful economies Iran, Argentina and Ethiopia were also approved to join.

Assuming all invitees join, at the start of 2024, BRICS will have expanded from five to 12 countries. More importantly, they will collectively represent more than 40% of global oil supply and over 70% of the land where rare earth materials are mined.

The big new prize for the BRICS in this expansion is Saudi Arabia, and its vast oil resources, which has the potential to strengthen its ties with China and India.

No wonder that dozens of nations are trying to join BRICS.

Expanding BRICS

As an example of how the BRICS expansion prompts a moment of re-discovery for investors, consider that there was a “Chindia ETF” that allocated only to stocks in China and India.

It launched in 2007, survived the Global Financial Crisis, soared during the pandemic and its price grew nearly 400% from that low point. The ETF, whose symbol was FNI, was closed and liquidated in January of this year.

Here are some ETFs that make a helpful starting point for investors who want to start thinking of BRICS more like an asset class, and less like a collection of countries far away from North America.

The iShares BIC 50 UCITS ETF (BRIC) owns stocks in Brazil, India and China. This $118m fund sells at a P/E of only 12.5 times trailing earnings, which hints at the relative value that currently exists outside of the mega-cap US stocks.

Investors can also create their own BRICS-oriented basket of equities using a group of ETFs. China, India, Brazil and Saudi Arabia all have accessible single-country index ETFs.

The largest UCITS ETF in each exposure is:

iShares MSCI India UCITS ETF (NDIA)

iShares MSCI Brazil UCITS ETF (IBZL)

It is way too early for ETF investors to get a good handle on how successful an expanded BRICS will be, and how it will compete with the US economy, the global leadership of the US dollar and the competitive position of places like Europe and Japan.

However, with economic battle lines being drawn to this extent, investors have an excellent opportunity to get ahead of what will likely become “cocktail party talk” by next year.

This article was originally published on ETF.com