In case you needed

any more evidence that hedge funds are dying

off and becoming ETFs (or family offices), ex-Bridgewater staff are listing a new risk parity ETF that partly copies Bridgewater’s investing style.

The RPAR Risk Parity ETF (RPAR), which begins trading next week, will be actively managed and the first of its kind in the United States. (There appears to be one in Canada, however, courtesy of Horizons).

It will be portfolio managed by Toroso Investments and have trust services provided by Tidal ETF Trust.

But the intellectual property comes from a boutique consulting firm called Advanced Research Investment Solutions, which is flush with Bridgewater alumni.

Risk parity is an investment strategy that tries making as much money as possible while taking as little risk as possible. It does this by investing in a wide array of asset classes – gold, equities, bonds, currencies – based on how volatile the assets are and how they correlate with one another.

This fund is bringing hedge fund strategies to ETFs

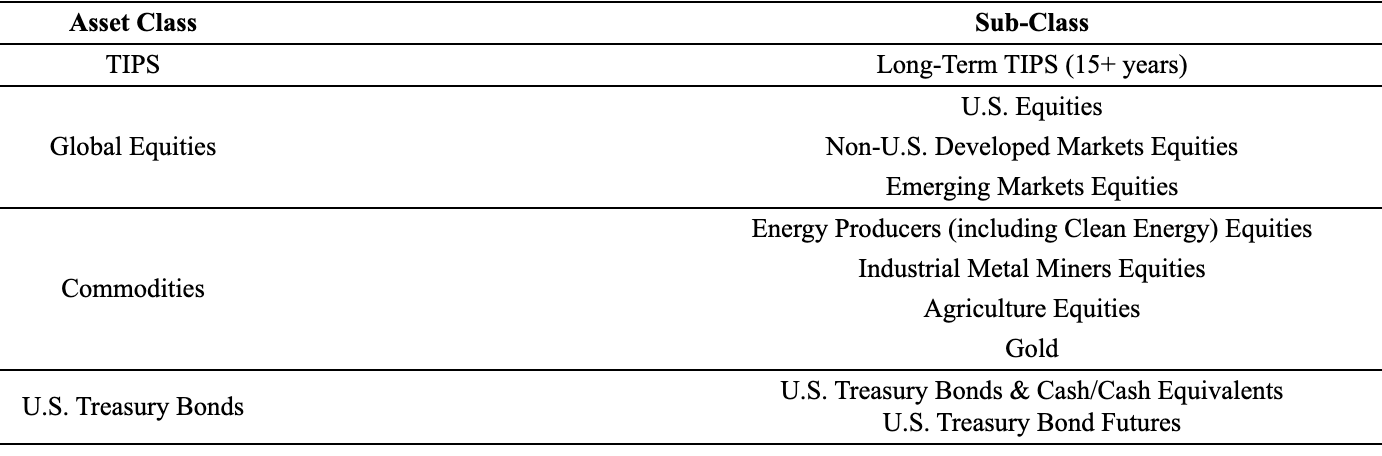

RPAR will try and do this by investing in four asset classes: TIPS, global shares, commodities and treasuries.

The commodities it buys will either be gold ETFs or commodity companies – such as energy companies. It will not buy commodities futures, from what we can tell in the prospectus. Bridgewater, the hedge fund that made risk parity investing famous, is one of the world’s biggest owners of gold ETFs.

The prospectus does not give an expense ratio.