AUM in Canada-domiciled ETFs has grown to approximately $162bn (CAD) with inflows of $15.9bn as of the end of November this year, according to WisdomTree Canada's latest

.

While ETFs are still growing in popularity in Canada, the growth is appearing to slow down as the increase in AUM from 2016 to 2017 grew significantly higher at 30 per cent compared to the mere 10 per cent growth from 2017 to present.

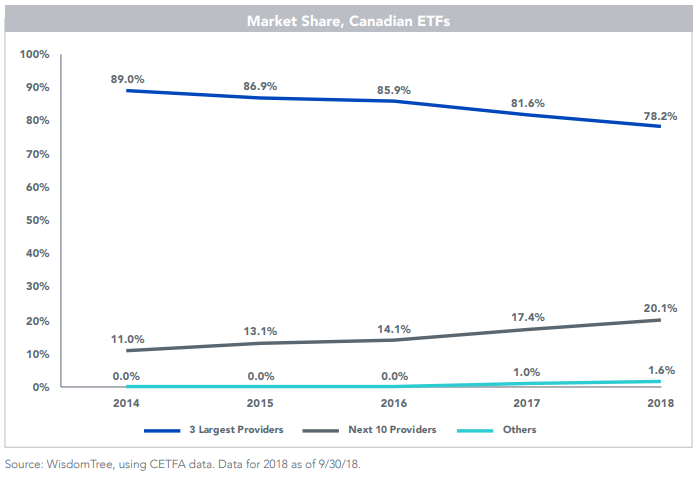

There is a promising development for Canadian issuers as a shift in power for market share continues from the leading ETF providers, as more issuers enter the market. According to the report, in 2014 the Toronto Stock Exchange identified nearly $9 of every $10 invested in ETFs to be housed with the top three providers. As of the end of Q3, Canada's next 10 largest providers (which includes WisdomTree) account for over 20 per cent of the industry's AUM, up nearly three percent from 2017 and six per cent from 2016.

What does 2019 have in store for Canada?

ETFs have been chipping away at the substantial mutual fund market share for many years and is expected to continue. Potential catalysts to accelerate the transition being a bear market or a market correction. However the Funds Institute of Canada calculates that there is still over $1.5tn invested in to general mutual funds as of Q3. This will require a lot of chipping away from ETFs to reach the same scale at its current rate.