Tensions between the US and China could support significant gains in rare earth metals prices which could be a boon for ETFs such as the VanEck Rare Earth and Strategic Metals UCITS ETF (REMX).

Germanium ores are rare, a byproduct of zinc output and coal fly ash. China produces around 60% of the world’s germanium. Another metal, gallium, comes from processing bauxite, the primary ingredient in aluminium production. China produces over 80% of the world’s gallium.

Germanium and gallium have many high-tech applications, from fibre optic cables and 5G telecommunications masts to military-grade thermal imaging, lasers, LEDs, satellite solar panels and rare-earth magnets in electric vehicle engines. Many semiconductors require germanium and gallium.

The US has a strategic germanium stockpile but no gallium inventories. The recent moves by the Chinese government will cause illiquid germanium and gallium prices to rise and availability to decline. Meanwhile, Chinese control of rare earth metals could make the 17 rare earth metals including the 15 lanthanides on the periodic table, and scandium and yttrium prices soar as availabilities dry up.

Why China could matter to REMX

On 3 July, Chinese officials announced export restrictions on gallium and germanium for what they called national security reasons. The move was significant but not unexpected, given the metal’s military technology applications. The restrictions could be the first step for China as relations with the US continue to deteriorate.

China’s population and growth over the past decades have made it the world’s leading commodity commodities consumer. China has spent years securing raw material supplies worldwide through strategic joint ventures and investments in commodity-producing countries.

China’s rare earth metals and REMX

China has a dominant position in worldwide rare earth metals production and processing.

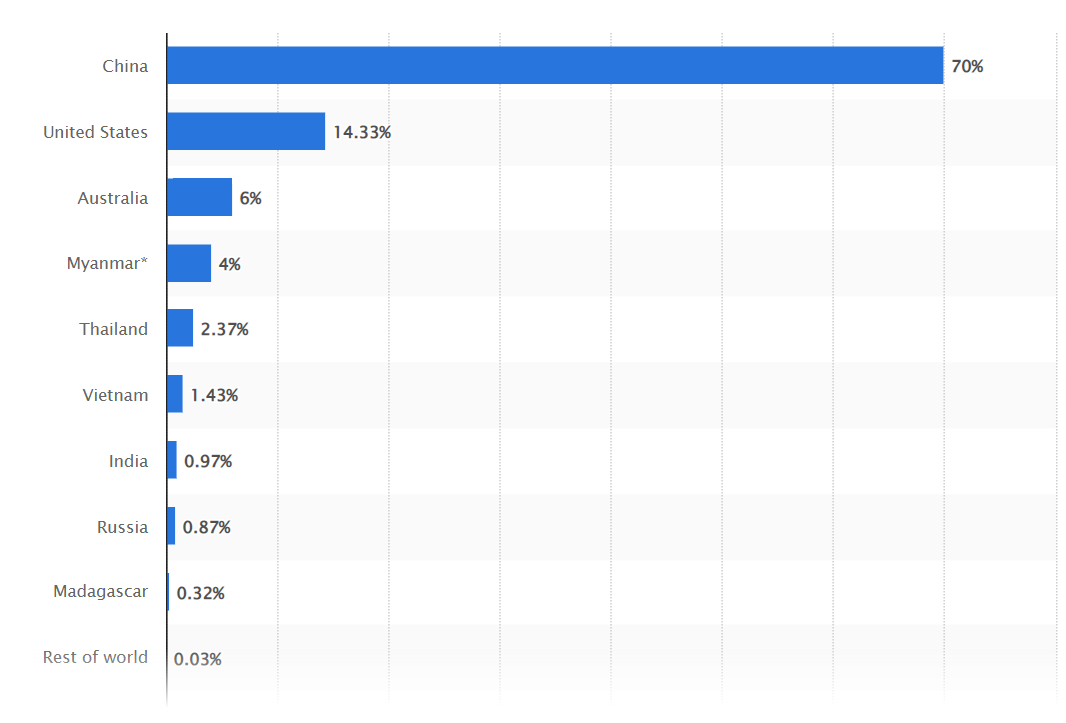

Chart 1: Distribution of rare earth production worldwide as of 2022, by country

Source: Statista

Chart 1 illustrates China’s 70% market share of rare earth metals production in 2022. Rare earth metals are illiquid commodities that do not trade on the world’s commodity futures exchanges. However, they are the raw materials that support many current and emerging technologies.

REMX could explode if prices soar

If China’s germanium and gallium export restrictions are the first step in cutting off the US and its allies from critical commodities under its control, rare earth metals could be next.

The US administration issued a February 2022 fact sheet on Securing a Made in America Supply Chain for Critical Minerals. The US and Europe are scrambling to accumulate these commodities through domestic production and strategic purchases.

However, Chinese export restrictions impacting rare earth metals could cause prices to skyrocket and availabilities to decline.

REMX benefits if China extends restrictions

REMX, which tracks the MVIS Global Rare Earth/Strategic Metals index, currently invests in 28 companies producing and processing rare earth and other strategic metals.

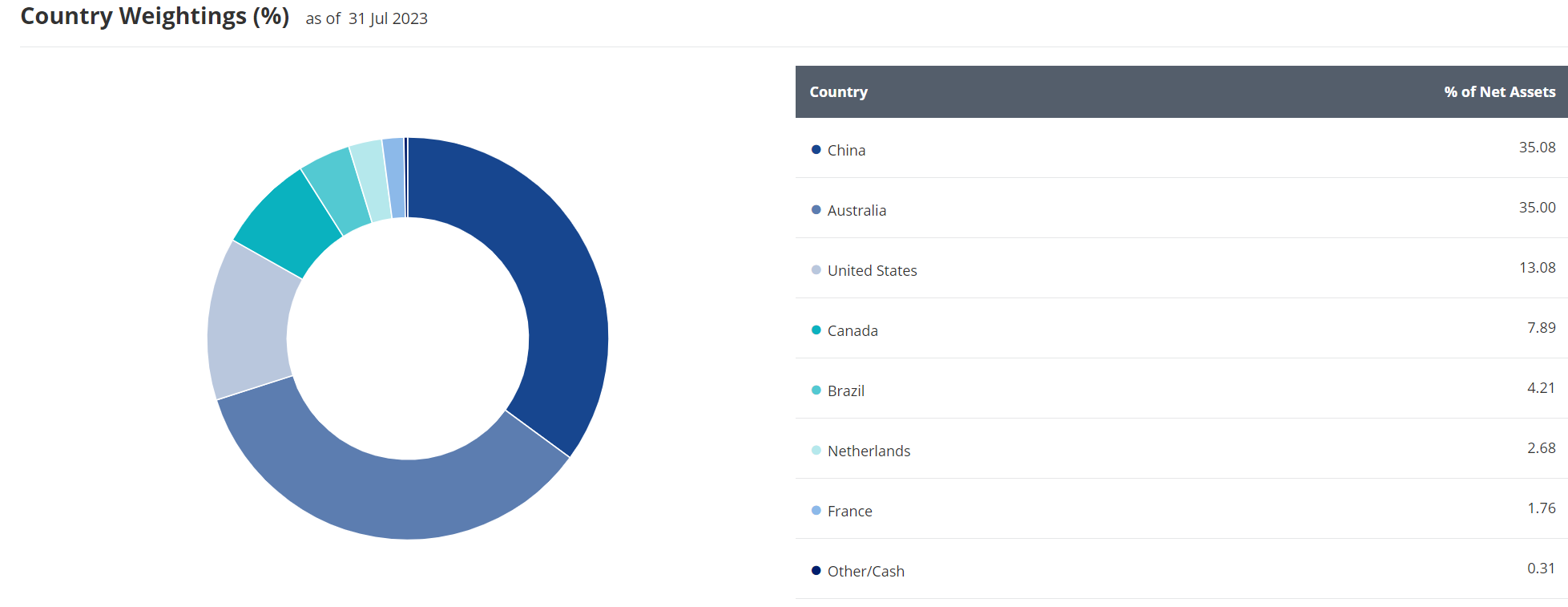

Source: VanEck

Some 35.1% is currently invested in Chinese companies. However, REMX has over 48.8% invested in Australian and US producers and processors.

Having launched in September 2021 with a total expense ratio (TER) of 0.59%, REMX has gathered $139m assets under management (AUM).

If and when China announces export restrictions on rare earth metals, REMX could spike higher as investors realise the metals prices will soar and availabilities could become scarce.

This article was originally published on ETF.com