The investment case for China has long been established. The country has experienced an accelerated economic expansion and is on course to becoming the largest economy in the world. Although near-term GDP growth is expected to moderate from previous years, the International Monetary Fund is still predicting growth of 4.8% and 5.2% in 2022 and 2023 respectively, which compares to its forecasts of 3.9% and 2.6% for advanced economies.

Despite its prominence in the global economy, China represents a remarkably small proportion of international investors’ portfolios. In 2020, international institutional investors' total China exposure was only 4.6%, according to Greenwich Associates.

Perhaps some explanation for this low allocation can be placed upon the relatively recent opening of access to onshore Chinese markets to international investors via programmes including Stock Connect and Bond Connect. But now that there are established pathways for foreign investors to access China’s onshore equity and bond markets, we think there are a number of exciting opportunities to uncover.

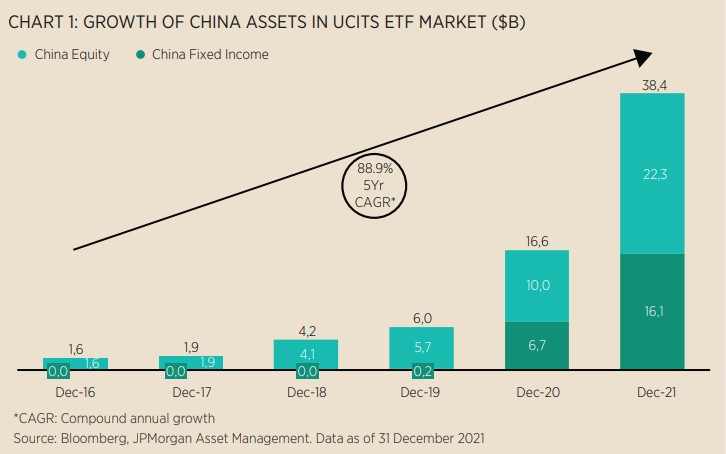

As investors wake up to China’s onshore opportunities, the ETF market is playing an important role. Over the last five years, exposure to Chinses assets via UCITS ETFs has grown almost 89% on a compound annual growth basis. We expect the market for China ETFs to continue expanding.

A transforming equity market

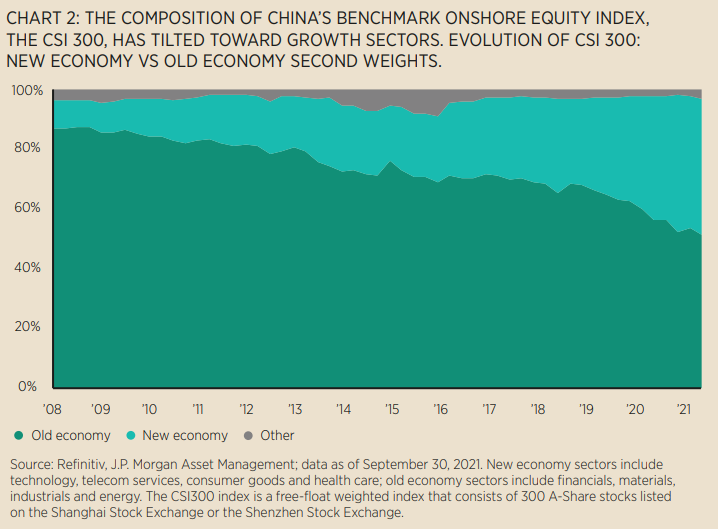

China’s equity market is shifting towards sectors that are aligned to its transition to a more consumption and innovation-driven economy, and away from sectors that are more reliant on investment and exports.

The beneficiaries of China’s economic transformation include consumer goods, technology, health care and high-end manufacturing. We expect these shifts to continue, potentially offering China investors more exposure to these high-growth sectors compared to emerging markets overall.

China’s onshore equity market is particularly interesting. Many investors do not differentiate between offshore (Chinese stocks listed on international exchanges, mainly in Hong Kong and New York) and A-Shares, which trade in mainland China. 2021 was a stark reminder that these markets can diverge. Offshore equities were hit by government regulatory changes that targeted technology and real estate sectors. While offshore Chinese stocks struggled, onshore equities delivered positive returns, albeit more muted than global equities, as China tapered its stimulus. With China now set to ease monetary policy at the margin, while major developed market central banks are raising interest rates, we think China could once again diverge from the global business cycle.

While there are opportunities within China’s onshore market, there are a number of inefficiencies. Retail investors make up 42% of the holding value of the Chinese A-Shares free float and contribute over 80% of its trading volume. The speculative nature of retail investors means this market is often moved by rumours rather than company fundamentals and has a high turnover.

While traditional index ETFs are unable to mitigate the impact of the market’s high turnover and the short-term investment horizon of its investor base, these market inefficiencies create opportunities that can be exploited by active ETF managers with local market knowledge, a long-term investment horizon that looks through short-term volatility, and a rigorous valuation framework.

Driving efficiencies

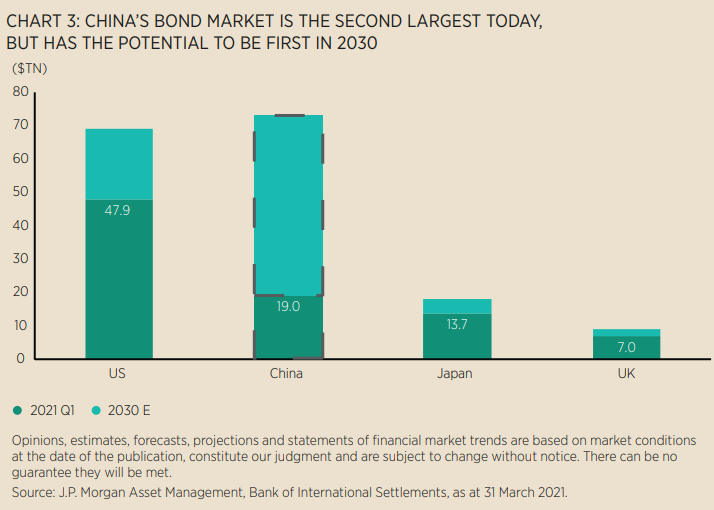

China’s economic growth has also translated to its onshore bond market, which is broadening and diversifying, to form an important opportunity for investors. China’s bond market is really made up of a series of smaller markets representing one very large opportunity, ranging from government bonds listed locally to hard currency bonds issued in Hong Kong by Chinese companies.

Chinese companies have been aggressive users of international credit markets, resulting in a broadening and deepening of the opportunity, with new issuers and new sectors reflecting a greater depth and ultimately a more efficient marketplace.

Further driving efficiencies is government regulation. Reforms, such as the government providing fewer implicit guarantees to state-owned enterprises, should translate over time into more efficient pricing of risk. That would lead to higher default rates, tipping the mix of bonds toward higher-quality companies and spread compression. The next few years could be particularly volatile as reforms are rolled out but, like many of China’s new reforms, they should give way to a more stable future market.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here

DisclaimerThis is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Shares or other interests may not be offered to or purchased directly or indirectly by US persons. The latest available Prospectus, the Key Investor Information Document (KIID), any applicable local offering document and sustainability-related disclosures are available free of charge in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Units in Undertakings for Collective Investment in Transferable Securities (“UCITS”) Exchange Traded Funds (“ETF”) purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incure fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority.* For Belgium only: Please note this ETF is not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (AutoriteitvoorFinanciëleDienstenenMarkten/Autoritédes Services et MarchésFinanciers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. The Shares may be offered in Belgium only to a maximum of 149 investors or to investors investing a minimum of EUR 250,000 or to professional or institutional investors, in reliance on Article 5 of the Law of August 3, 2012. This document may be distributedin Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this documentmay not be used for any other purpose nor passed on to any other investor in Belgium.** For Belgium, Switzerland and Italy only: Available share classes are country dependent. Please contact your client advisor for further details.For France only: Investors should note that, relative to the expectations of the Autorité des Marchés Financiers JPMorgan Research Enhanced ESG ETF suite above present disproportionate communication on the consideration of non-financial criteria in its investment policy (Cette presentation convient aux investisseurs parlant couramment anglais).

09wg221404093954