As ESG zealots wail, crypto ETP issuers arrive with haste – yet, they only come bearing half-truths and half-solutions – just enough to appease the tantrum. Perhaps hard done by, long-term sustainable crypto ETP solutions are on the horizon but until then, patience will be required.

Described as “energy angry” in 2018 by current European Central Bank (ECB) President Christine Lagarde, crypto and ESG have been at loggerheads for some time.

Bitcoin has come under particular scrutiny for its energy-intensive proof-of-work (PoW) consensus mechanism used for mining.

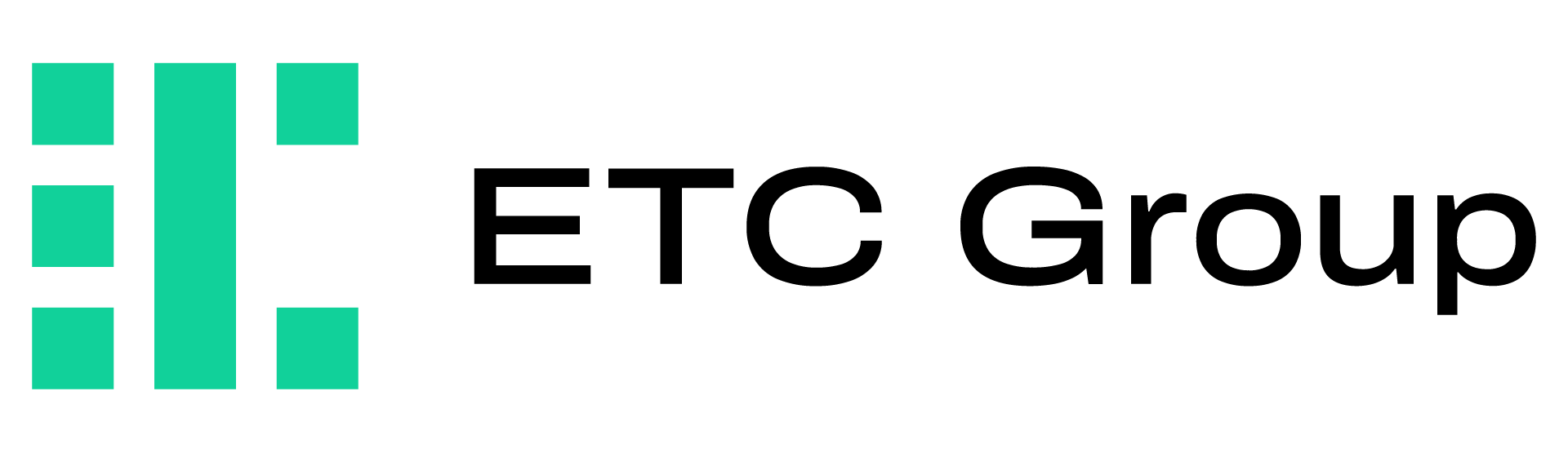

Estimates from the ECB suggest the electricity consumption of bitcoin mining operations between 2015 and 2022 were first equal to that of the Netherlands, before rising during the 2021 bull run and 2022 sell off to the same electric consumption as the entirety of France (see Chart 1).

In light of growing climate concerns, regulation such as the EU’s amended MiFID II – that started on 2 August – requires financial intermediaries and asset managers to request the ESG preference of clients.

Although not explicitly banning PoW, the newly-accepted markets in the crypto-assets (MiCA) framework has called for a more sustainable crypto industry, with a crypto environment impact report to be published in 2024.

“There is a willingness in society, at all levels, to move towards a more sustainable economic foundation,” Christian Katz, CEO at Helveteq, told ETF Stream.

Half-solutions

As environmental awareness rises among regulators, ESG-themed products have become ever more in vogue. Looking to kill two birds with one stone, ETP issuers have looked to capitalise on rising ESG sentiment and the lucrative business of cryptocurrencies.

As Roberto de Isidro, a digital asset research analyst at Global X, told ETF Stream: “The crypto industry has a growing number of projects that focus on social and climate challenges and we believe the asset class is ESG-friendly.”

Perhaps the most natural crypto-ESG product would be ethereum. The second-largest crypto by market capitalisation is in the middle of transitioning from a PoW to a proof-of-stake (PoS) consensus mechanism, where depositors validate transactions not computer power.

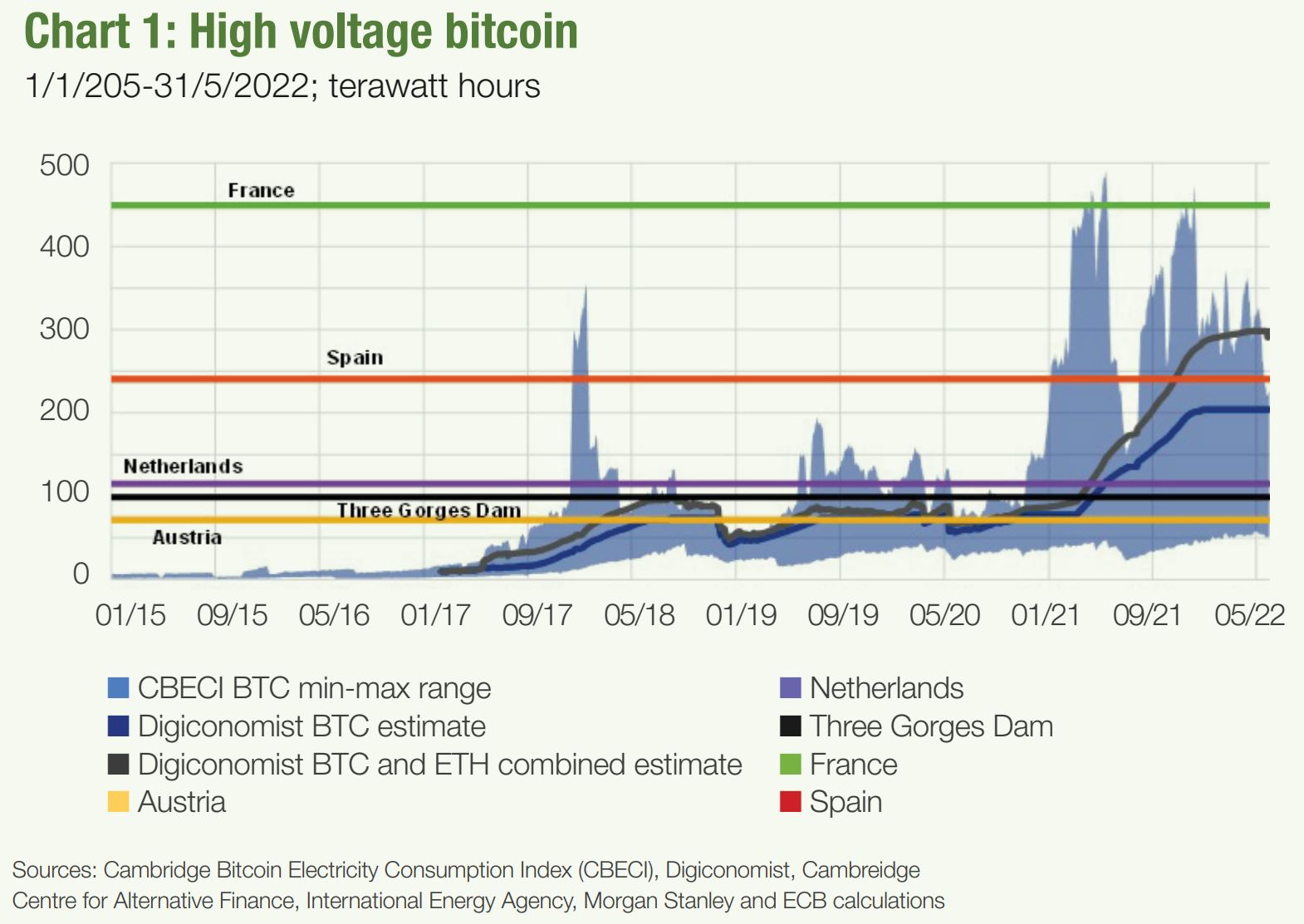

According to the Ethereum Foundation, the transition from PoW to PoS is expected to decrease energy use by 99.95% (see Chart 2).

“There are no truly sustainable ETP products other than proof-of-stake solutions,” de Isidro added.

Although ethereum makes a strong ESG use-case, bitcoin still constitutes 40% of the crypto industry’s $919bn market capitalisation, according to data from CoinMarketCap, and is the most traded asset among institutional investors.

In April, Swiss ETP issuer Helveteq launched the first carbon-neutral ETPs on the SIX Swiss Exchange, the Helveteq Bitcoin Zero ETP (BTCO2) and the Helveteq Ether Zero ETP (ETH2O).

Despite the successful launch of Helveteq’s two carbon-neutral ETPs, Katz noted: “It is not the easiest problem to solve but we must try to be part of this movement and offer our clients sustainable investment solutions.”

The Helveteq website explains that the ETPs have “mechanisms” to calculate the carbon emissions emitted as the products grow in size. Subsequently, the carbon use is then compensated by Helveteq’s investments in credits of private projects that reduce the carbon footprint of the ETPs.

Similar strategies have been used by ETC Group, which started offsetting the carbon footprint of its $577m BTCetc Bitcoin Exchange Traded Cryptocurrency (BTCE) in July through similar sustainable investment projects.

Others that have joined the commitment to carbon neutrality include 21Shares, and their investments into Swiss-based carbon emissions offsetting firm MyClimate, and Valour, which announced the debut of its Bitcoin Carbon Neutral ETP on the Frankfurter Boerse last month.

“Right now, the closest that we can get is through a sustainable ETP based on proof-of-work protocols is if energy providers offer renewables to miners,” Carlos Gonzalez, an analyst at 21Shares, told ETF Stream.

Early Revolut employee and current founder of blockchain sustainable energy company Tesseract Energy Alan Chang agreed with assessments like the one made by Gonzalez: “You do not need some greenwashing, carbon economy, go-plant-a-tree-in-the-amazon-concept to go net-zero. This can be done properly with the right technology,” he said.

Sustainable bitcoin

For Chang, the current issue with bitcoin’s energy inefficiency is a question about “consumption” and “production”.

As he explained: “You could wash your clothes less or get an A+ washing machine…great! You need to produce sustainable and cheap energy.”

If affordability is one part of the equation, the cost for two-thirds of renewable energy sources were lower than coal, the cheapest fossil fuel energy source, according to data from the International Renewable Energy Agency. In the report, electricity from onshore wind fell by 15%, offshore wind by 13% and solar by 13% compared to 2020.

The second part of the equation is “beautiful” blockchain technology, Chang explained. Permissionless with peer-to-peer capabilities, blockchain further increases the affordability of renewable energy through its low transaction costs.

Not only that but firms could “select their own energy mix”, Chang added, a quintessential part of Tesseract Energy’s vision for “democratising energy”.

“As a bitcoin miner, you do not always have control over your energy mix and your banking on the grid which uses whatever mix. What if a renewable energy company gave you that choice? “ Chang asked.

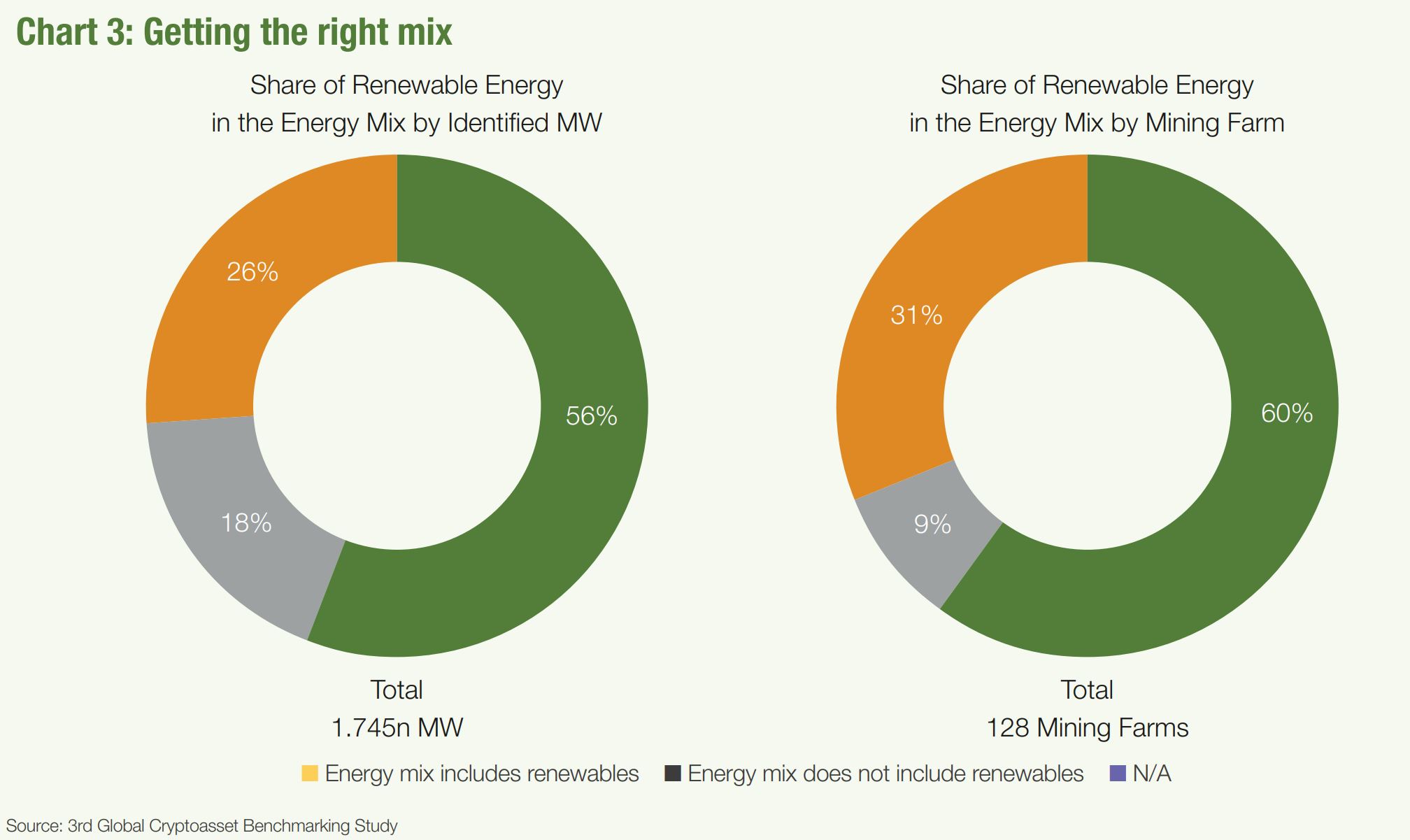

Data from the third Global Cryptoasset Benchmarking Study published in 2020 indicates 56% of the identifiable energy mix for crypto miners was made up of renewable energy sources. In July this year, the Bitcoin Mining Council reported that renewables now make up 60% of the mix (see Chart 3).

Benchmarking study

Bradford van Voorhees, founder of the Sustainable Bitcoin Protocol, goes one step further by stating bitcoin PoW mining is, and can be, “climate positive”, meaning bitcoin can actually carbon emissions.

For instance, renewable energy firm Crusoe uses methane from garbage landfills across the US to power computers and data centres. In March, Exxon partnered with Denver-based Crusoe to mine bitcoin in North Dakota, with work starting in 2021.

Other examples include PRTI, who are looking to capitalise on the 300 million car tires discarded to landfills in the US annually as a source to fuel bitcoin mining.

“You could just have a bitcoin miner hook up their portable mining device and use the energy from landfills or other waste products to produce clean energy for their mining operations,” van Voorhees explained. “We are in discussion with ETF and ETP issuers. Once we solve how the energy used to mine bitcoin is produced, proof-of-work is the far superior system to proof-of-stake.”

Do not forget the ‘S’ in ESG

For Gonzalez, it is clear that the current carbon-offsetting bitcoin ETP solutions are no more than a band-aid and not a long-term strategy.

“Current ETP products are not directly solving the problem of ESG. We believe in sustainable crypto, but a truly sustainable crypto ETP on proof-of-work is just not possible”, Gonzalez said.

However, he noted that critics of bitcoin and crypto energy use tend to only focus on the ‘E’ part of ESG.

“The social governance components of ESG are often underestimated. Crypto can solve many of the flaws of centralised and traditional finance,” he said.

Data from the World Bank suggests that 1.7 billion people are unbanked, with a working paper from the CAREC institution noting that out of the 1.7 billion unbanked citizens, 1.1 billion own a smartphone.

Additionally, 79% of adults in developing countries have access to an Android or Apple mobile device.

For inflation-torn nations such as Venezuela or war-ravished nations like Nigeria, citizens often have to rely on crypto accessed over their smartphones to transfer money or preserve the value of their savings.

Research from Chainalysis suggests the greatest growth for crypto adoption is occurring in less economically developed countries, with 16 out of the top 20 crypto adopters stemming from outside Europe.

In particular, small retail payments in Sub-Saharan Africa were responsible for powering the crypto adoption, accounting for 80% of crypto payments of less than $1,000, according to Chainalysis.

Crypto is a long-term winning asset class. With responsible regulation and technological renewable energy advancements, there is no doubt that ETP issuers will be able offer crypto products that solve the ‘E’, ‘S’ and ‘G’ components of ESG.

This article was first published inESG Unlocked: Europe out in front, an ETF Stream report

Related articles