The relationship between ETF issuers and authorised participants (APs) has been highlighted as an area that needs “potential regulatory oversight” in recent academic research that found there are “significant” hidden costs tied to custom ETF creation baskets.

The research, titled The hidden cost of corporate bond ETFs, found corporate bond ETFs listed in the US, on average, pay 48 basis points a year in “hidden costs” resulting from custom creation baskets.

As many fixed income ETFs track thousands of bonds, custom ETF baskets enable issuers and APs to create a sample of the holdings that mirrors the performance of the ETF without having to source every underlying security.

According to research conducted by Christopher Reilly of Boston College, custom ETF creation baskets allow APs greater flexibility to include securities that are set to “substantially” underperform the underlying index.

“Corporate bond ETF managers allow APs to deliver only a subset of the assets in portfolios that ETFs wish to track. These rule modifications embed a hidden cost that ETF investors incur,” the research said.

“By allowing APs greater flexibility, ETF managers…allow APs to interact strategically with ETF portfolios at the expense of ETF investors.”

Custom ETF baskets has been a subject of fierce debate since the Bank of International Settlements (BIS) released a paper in March 2021 which suggested ETF issuers could prevent contagion risks by offloading less liquid securities in custom redemption baskets.

Further analysis conducted by ETF Stream found ETF issuers and APs are engaged in a game of cat and mouse in the creation-redemption process with APs looking to offload bonds they no longer want to warehouse on their books into ETF creation baskets.

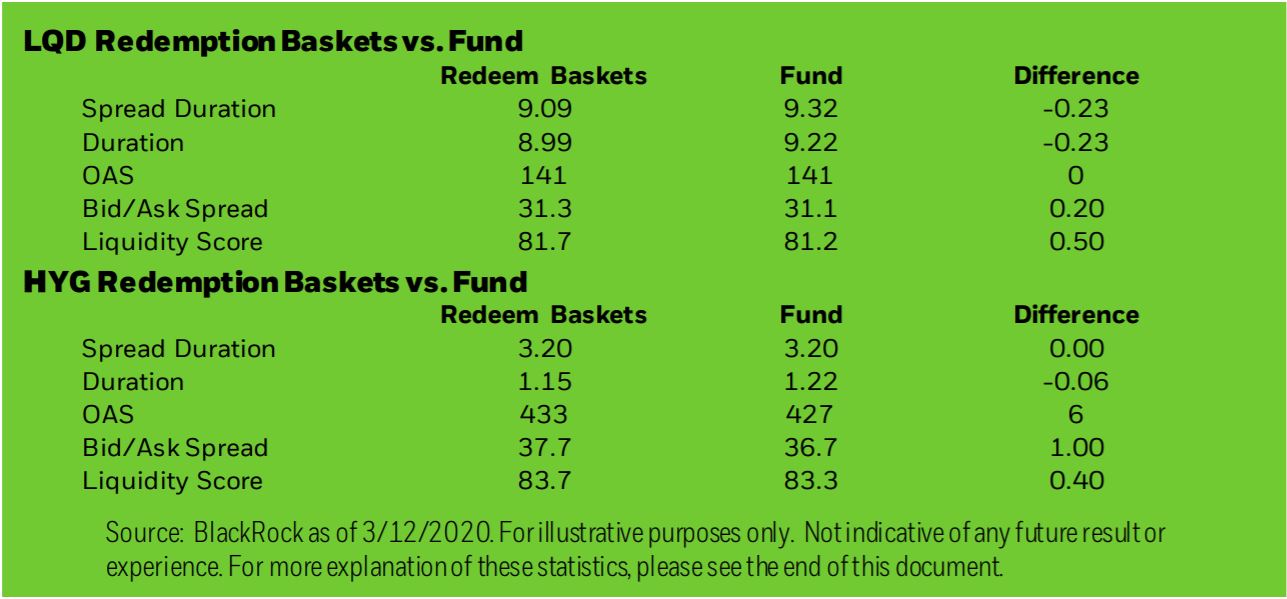

However, BlackRock hit back by revealing the custom ETF baskets given to APs have very similar characteristics to the ETFs themselves, especially during the liquidity crunch in March 2020.

Chart 1: Custom redemption basket composition vs fund comparison for LQD and HYG (2/18/20-3/12/20)

The academic research, which studied corporate bond ETFs in 2019 with a combined $200bn assets under management (AUM), argued ETF issuers face a “trade off” between minimising tracking error on the one hand through like-for-like baskets and encouraging more creation-redemption activity through custom baskets which leads to smaller premiums and discounts but higher costs for investors.

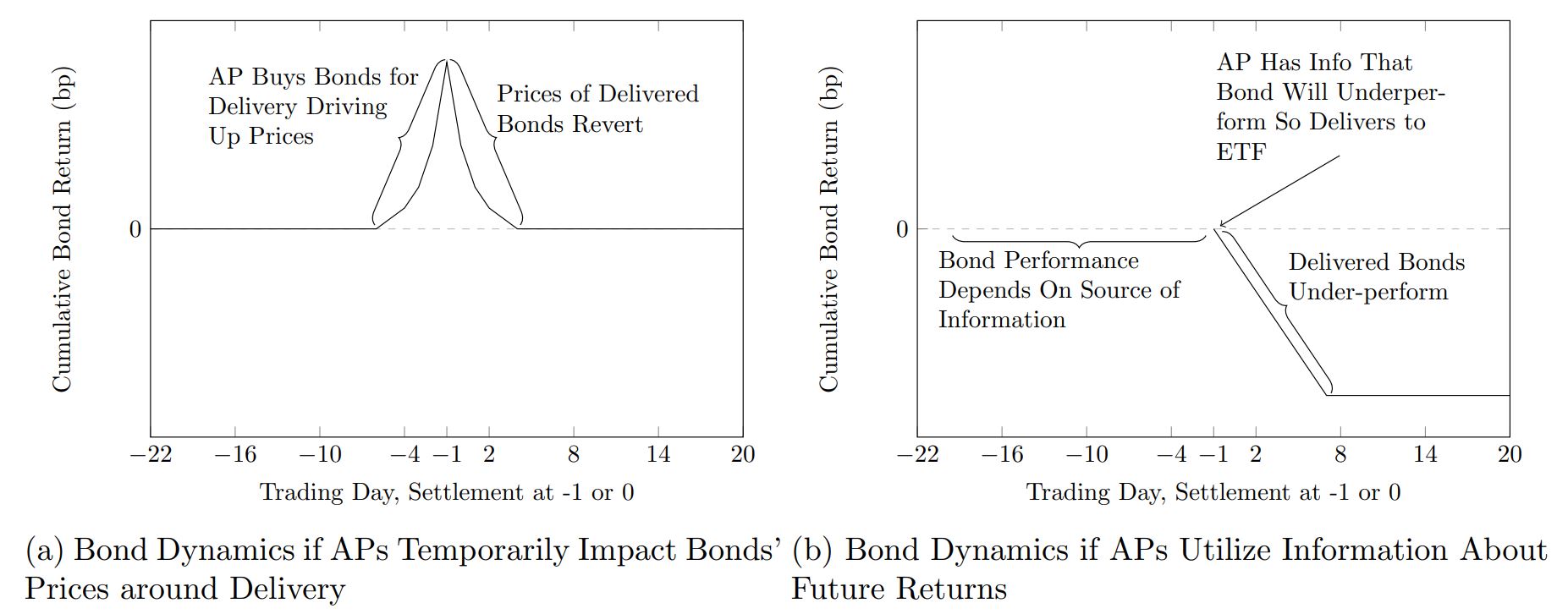

When documenting how APs could offload underperforming bonds into a creation basket, the report said these firms – many of which are large banks – can utilise information to forecast future changes in a bond’s value.

Furthermore, it said APs can include bonds in a creation basket that may be overvalued due to prices not being accurately reflected by the market.

“APs deliver bonds that earn lower future returns to ETFs,” the report warned. “APs may behave strategically to utilise the implicit liquidity provided by the share-creation process to offload inventory in periods of market turmoil after experiencing balance-sheet shocks.”

Chart 2: Conjectured bond-return dynamics amid custom ETF creation baskets

Source: Reilly, 2022

Despite the advantages of custom ETF creation baskets such as lowering the amount of bonds needed for APs to source and engaging in heartbeat trades in the US for tax purposes, Reilly stressed the embedded hidden costs in some creation baskets mean it is an area regulators should be monitoring.

Earlier this year, the International Organisation of Securities Commissions (IOSCO) highlighted the relationship between ETF issuers and APs in the latest ETF good practices.

The global watchdog said ETF issuers need to “conduct due diligence” on APs and avoid exclusive arrangements as this could impact “the effectiveness” of the arbitrage mechanism.

As Reilly said in the paper: “While these custom creation baskets allow ETFs to engage in activities such as heartbeat trades to defer taxes that benefit ETF investors, they also can embed a high cost and therefore represent an area of potential regulatory oversight or beneficial increases in transparency for ETF investors.”

Related articles