The prevailing macro narrative among investors is higher interest rates for longer amid stickier inflation and a resilient US economy.

So, what might a higher-for-longer new world look like? I have spent the last few weeks scanning strategy and forecasting reports galore to develop some simple concepts of what this might all mean.

It is also essential to understand the drivers of this new economic order:

The alleged “neo-liberal order” dies. Put another way, this equates to the decline of a multilateral free trade system and its replacement by trading blocks, tariffs, and aggressive industrial policy. Many governments make this policy decision, and it is usually, though not always, associated with more ‘populist’ politics, frequently of a nationalistic hue. This does not mean that globalisation is dead and that trade will collapse; it simply means that globalisation will reconstitute itself.

An ageing population drives up government spending, as do demands for more defence spending. Again, this can have a populist hue but can equally be a problem even for technocratic governments with nare a populist in sight. We live in an era of big government.

Increased geopolitical tension as a new divide between the West and an authoritarian axis opens up. This powers increased defence spending, reinforces trade fragmentation and also helps power central bank policy decisions such as China’s central bank investing in more gold.

The first point (the end of hyper-globalisation) and the third point (superpower rivalry) result in an increased emphasis on industrial policy. This is, in turn, reinforced by the climate change, net zero agenda, which forces governments to consider extensive reindustrialisation to make the transition.

How might these trends play out on a more practical level? I would list the following possible trends:

Upward sloping yield curve as investors, especially bond vigilantes, keep an eye on monetary inflation resulting from excessive fiscal expansion.

UK real rates could stay positive, as discussed above. This might have a negative impact on government deficits and undermine corporate investment.

Possible real income growth? If the labour market remains hot, then there’s no reason to think that wage inflation will slip below 4-5% a year. Immigration levels have helped provide cheaper labour and have helped ease labour market constraints, but the political pressure to get these levels substantially below net migration of 500k is massive (for any UK party), and this tightening of immigration will help fuel wage inflation. In fact, we might have a few years of real income growth. Some of this might find its way into an increased savings rate (higher interest rates) and some into more service sector spending. This could help power a resurgent UK service sector.

The housing market, on paper, should be much weaker in a positive real rates world, but supply constraints are still very obvious. And although immigration rates might decline because of populist pressure, they are not likely to diminish vastly, keeping a lid on any metropolitan market price declines. Expect a few years of subdued house price markets, with increases and decreases vying with each other. This might also help improve the UK savings rate. In real terms, though, UK house prices will probably fall back and, by the end of the decade, could be 10 or even 20% lower.

National security and social spending will increase. Both of these are given and probably unavoidable.

As mentioned above, higher interest rate payments will act as a drag on government spending, keeping bond market investors nervous

The long-term effects of previous QE will catch up with us. At some point, all that cheap government debt issued in the early to late 2010s will need to be refinanced. We will pay the price for QE, and the bill keeps going up.

Deficits will remain high unless austerity is properly explored, which I doubt

Tariffs will increase, which will push up inflation

Watch out for bond market rebellions possible, especially in Italy

Defence ETFs

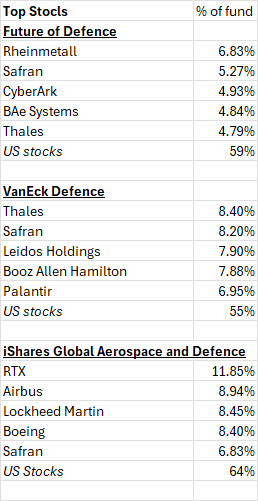

This time last year, I discussed the growing range of defence and aerospace ETFs on the London market. At the time, there were two ETFs, HANetf's Future of Defence UCITS ETF (NATO) and the VanEck Defense UCITS ETF (DFNS).

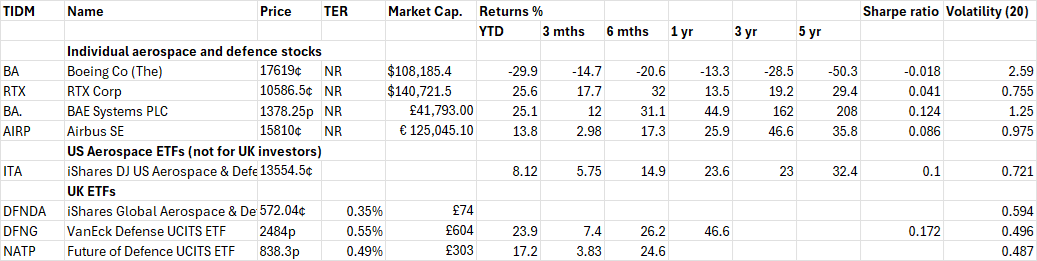

Both have had a solid year, with DFNS up 46%, whereas NATO, which launched in early June, is up 31%. They have now been joined by a third ETF, this time from BlackRock based on their very successful US Aerospace and Defence ETF. The iShares Global Aerospace & Defence UCITS ETF (DFND) is more of a global sector ETF with less emphasis on defence and more on aerospace, and it is cheaper with a TER of just 0.35%.

DFND is also much more conventionally a US-focused, major defence contractor fund. Its biggest holding is the giant RTX business at 11.9% of the fund, followed by Airbus and Lockheed Martin.

Performance-wise, the table below shows a mixed picture when we compare the ETFs with individual mega large-cap stocks such as RTX and our very own BAe Systems. I have one simple test. Would you have been to own the broad ETF or individual stocks such as RTX or BAe?

On a 12-month basis, I would suggest there was a real benefit from being diversified across stocks, whereas on a year-to-date basis, you might have been better off individually owning BAe. In fact, from my small sample, BAe Systems looks like it has been an excellent investment.

We will see more defence and aerospace investment over the next few years, so there might be more upside. BAe, for instance, trades on 20.4 times forecast earnings with analysts pencilling in 20% turnover growth – RTX also trades at around 20x forecast earnings but has lower pencilled-in forecast sales growth. BAe also looks more capital efficient with an ROCE of 12.3%, a decent number for such a capital-intensive business.

David Stevenson is founder of ETF Stream