The battle to be Europe’s second-largest ETF issuer behind BlackRock is on after DWS captured more than double Amundi’s inflows in Q3.

According to data from ETFbook, DWS saw $7.5bn UCITS ETF inflows in the third quarter – almost 20% of all exchange-traded product (ETP) flows – taking its overall assets under management (AUM) to $164bn.

The strong inflows were driven by demand for the firm’s equal-weight S&P 500 ETF, the Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW), which recorded $1.7bn inflows over the quarter amid fears of overconcentration risks.

Meanwhile, fixed income ETFs across the board continued to see strong inflows with the Xtrackers US Treasuries Ultrashort Bond UCITS ETF (X0TD) capturing $914m net new assets over the same period.

Meanwhile, Amundi, which currently houses $203bn AUM, collected $3.5bn inflows in Q3, making it the second quarter in a row the French asset manager has seen fewer inflows versus its German rival.

Amundi initially leapfrogged DWS as Europe’s second-largest ETF issuer at the start of 2022 when it completed its acquisition of Lyxor from Société Générale.

The firm continues to streamline its ETF range by merging Lyxor strategies with its own suite of ETFs.

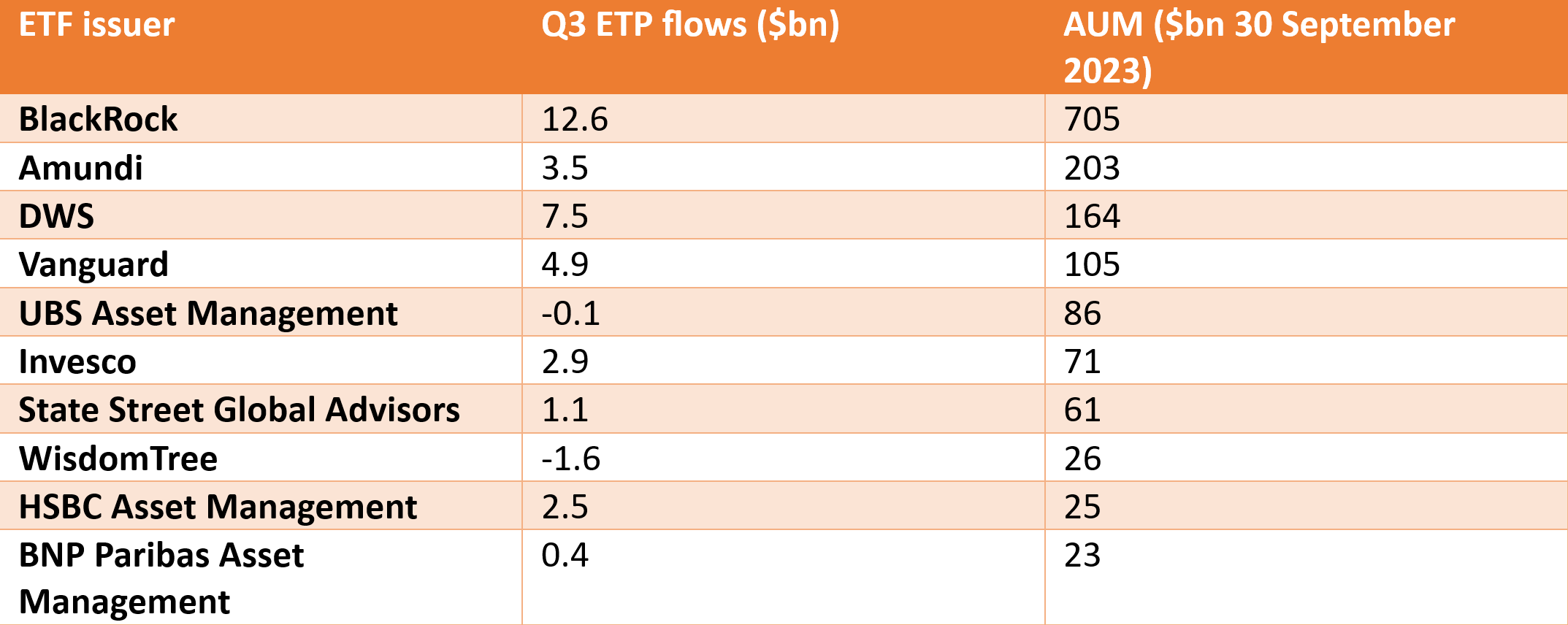

Chart 1: Top 10 European ETF issuer AUM and flows

Source: ETFbook

Despite the uncertain market environment, UCITS ETFs saw $38bn inflows in Q3 which drove overall AUM to $1.6trn.

BlackRock captured $12.6bn inflows last quarter, the most across all European ETF issuers, which drove its overall AUM to $705bn, a 44% market share.

It has been a strong year for the world’s largest asset manager amid the skyrocketing allocations to fixed income ETFs as highlighted by the record H1 inflows.

This quarter there was demand for both long and short-duration US Treasury ETFs with investors piling a combined $2.6bn into the iShares $ Treasury Bond 0-1yr UCITS ETF (IB01) and the iShares $ Treasury Bond 20+yr UCITS ETF (IDTL).

It was also another strong quarter for Vanguard which saw $4.9bn inflows over the three months amid ongoing ETF investor demand for broad market-cap weighted solutions.

Elsewhere, HSBC Asset Management posted strong inflows of $4.5bn in Q3, taking its overall AUM to $25bn.

This could have in part been driven by the firm’s decision to adopt the ETF share class structure, a move that has catapulted the UK asset manager up the fixed income ETF rankings.

Going forward, Olga de Tapia, global head of ETF and indexing sales at HSBC AM, told ETF Stream the firm will exclusively use ETF share classes to expand its fixed income range.

Invesco and JP Morgan Asset Management (JPMAM) also captured $2.9bn and $2.3bn inflows, respectively, over the three months.

At the other end of the spectrum, WisdomTree and UBS Asset Management saw the most outflows across all ETF issuers with $1.6bn and $1.2bn net redemptions, respectively.