Getting the timing right for ETF listings is always difficult. But DWS seems to have nailed it.

DWS is adding another arrow to its core ETF quiver, listing a European ETF that excludes the UK - right in time for parliamentary Brexit turmoil.

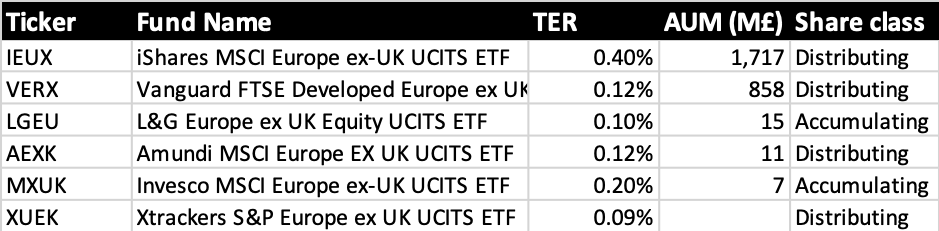

The Xtrackers S&P Europe ex UK UCITS ETF (XUEK) will physically track the S&P Europe Ex-UK Large Mid Cap Net Total Return EUR Index. It will charge a mere 9 basis points, making it the cheapest product on market.

The listing comes two months after LGIM listed a similar product, but at a one basis point a year higher fee.

With this listing, almost all the major ETF providers have some kind of Europe ex-UK ETF available on the London Stock Exchange.

Analysis - the UK is a really great place

"Nobody likes me everybody hates me I'm going to eat some worms" - may as well be the song of British investing the past three years. But for all the Brexit and Corbyn hullaballoo the UK is a great place to invest your money. British businesses are some of the world's most established (Barclays, HSBC, British American Tobacco, BP are all over 100 years old). FTSE 100 companies draw 75% of their revenue from overseas, meaning they're truly diversified. (S&P 500 companies only draw 37% of theirs from outside the US).

Long term, at least, the UK looks like a buy (and at the moment, decent value).

But an ex-UK European ETF also makes a lot of sense. They can be great for British investors who want European exposure but are already satisfied with their current UK equity holdings. They've been very popular too and contain more than £2bn under management. At a cut throat cost of 9 basis points, XUEK is competitively priced.