Emerging market (EM) ETFs have taken a hit after issuers start to write off the value of their Russian securities following MSCI’s decision to remove them from its emerging market indices at a price of $0.

The move has forced the hand of ETF issuers that are unable to dispose of their Russia holdings from their emerging market ETFs but that wish to eliminate tracking error as a result of deviating from the benchmark.

Earlier this month, the world’s largest index provider said it would remove Russian stocks from its emerging market indices when markets closed on 9 March, following consultation with market participants after it labelled the market “uninvestable”.

Although not a huge weighting within MSCI’s emerging market indices – Russia accounted for roughly 3.2% of MSCI’s emerging market benchmark prior to its removal – it is not an insignificant loss for issuers forced to write off millions of dollars of investment.

A ban on the sale of Russian stocks by foreign investors means issuers are not able to dispose of the securities while regulatory questions remain around not pricing them at "fair value".

Monika Dutt, director of passive strategies research for Europe at Morningstar, said wiping out the stocks at $0 could create regulatory concerns, as it doesn't represent fair value for the securities still in the dark due to the ongoing closure of the Moscow Stock Exchange.

She said: “MSCI will use a price of close to $0 and that's interesting because is that the value of the Russian securities? If you are holding these securities, as an asset manager you would probably not want to assume that they are worthless.

“From a regulatory standpoint, I think they would need to give a fair value indication of the value of that particular security.”

DWS, which had a 3.1% holding in Russia its $5.9bn Xtrackers MSCI Emerging Markets UCITS ETF (XMME) at the end of January, said its weighting was now 0% following the “valuation from the index provider and internal pricing process”.

Likewise, the $4.6bn iShares MSCI EM UCITS ETF (IEEM) has also marked its Russia holdings a 0% despite remaining in the portfolio.

Dutt added the problem for issuers now is how to remove these securities from the portfolio.

“One of the challenges is how do you sell the securities that are in those portfolios, given the current conditions,” she said.

Volatility in the NAV

MSCI’s decision followed a period of pricing uncertainty for emerging market ETFs as market makers struggle to value Russian stocks.

This led to wild dispersions in the net asset values (NAVs) of the ETFs with some trading at a discount and others at a premium as market makers were left to guess the value of Russian stocks following the shuttering of the Moscow stock exchange.

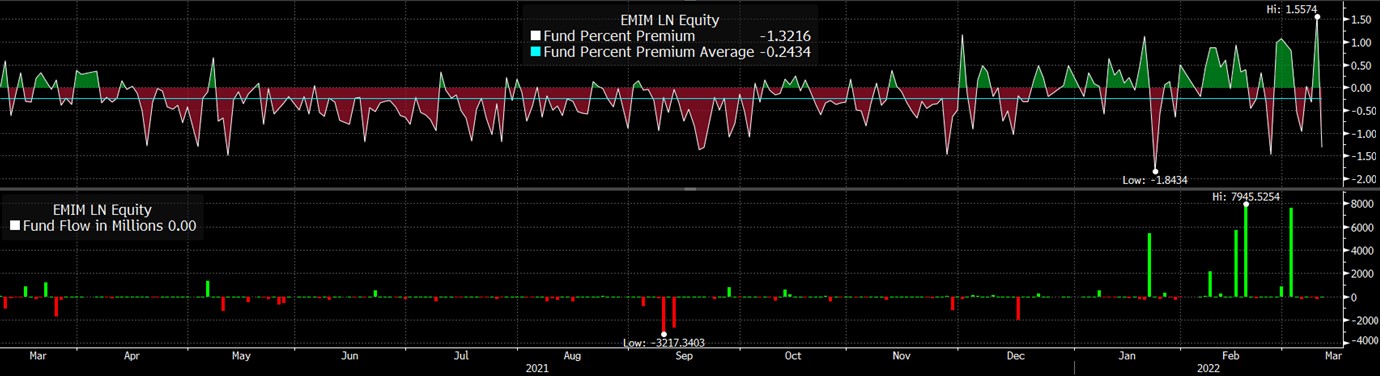

Source: Bloomberg Intelligence

Europe’s largest emerging market ETF, the $16bn iShares Core MSCI EM IMI UCITS ETF (EMIM), saw a NAV dispersion of over 3% between the end of February and early March (pictured above).

Furthermore, IEEM was trading at a premium of 1.2% on 9 March before swinging to a 1.2% discount a day later.

Despite this, the volatility of the NAVs of ETFs tracking MSCI emerging markets indices seems to have cooled down in recent days with many trading at a discount of 1.6% to 2%.

While many emerging market ETFs are already showing the one-time hit created by valuing their Russia stocks at zero it is still unchartered territory for many of these products, with questions likely to be asked when the Russian stock market opens.

Dutt added: “Even if you are in a position where you do want to sell those underlying assets, whether they are equities or whether they are bonds, you may not necessarily be able to and asset managers are now considering their next steps.”

Related articles