“Solid economic growth, increased risk appetite and the availability of attractive investment opportunities” has sparked significant fund flows into emerging markets, according to Chetan Sehgal, lead portfolio manager at Franklin Templeton Emerging Market Investment Trust.

The US Federal Reserve announcing it will no longer raise interest rates and the US-China trade negotiations underway has increased interest into the emerging markets, but there still remains a risk the negotiations could turn sour and affect the developing economies.

FTEMIT says emerging markets is still a key area of interest for the company. Asia is a particularly significant region given the improvement of corporate governance in South Korea, increased penetration in India and technology in Taiwan. There has been numerous technology-based ETFs coming to market in recent months and industry experts remain cautious yet optimistic about the industry.

Three events are pointed out by FTEMIT which it believes will have an impact on the development of emerging markets. These events include the first general election in Thailand for five years. The results will be announced in May, but preliminary results suggest a coalition government is likely, according to FTEMIT. The company believes the domestic economy will gain support following a potential rise to the country’s minimum wage and infrastructure development.

India is also leading up to a general election which carries out next quarter. India was one of the fastest growing emerging economies in 2018 (7.3% GDP growth), aided by the policies put in place by the prime minister back in 2014. These policies are said to absorb and shock results which come from the election and would only affect the economy short term.

Finally, the US Fed has said there won’t be any rate hikes until 2020 which encouraged a rise in risk appetite in tandem with the market’s rally in Q1. The International Monetary Fund forecasts emerging markets to grow 4.5% in 2019, outdoing developed markets which is expected to grow only 2%.

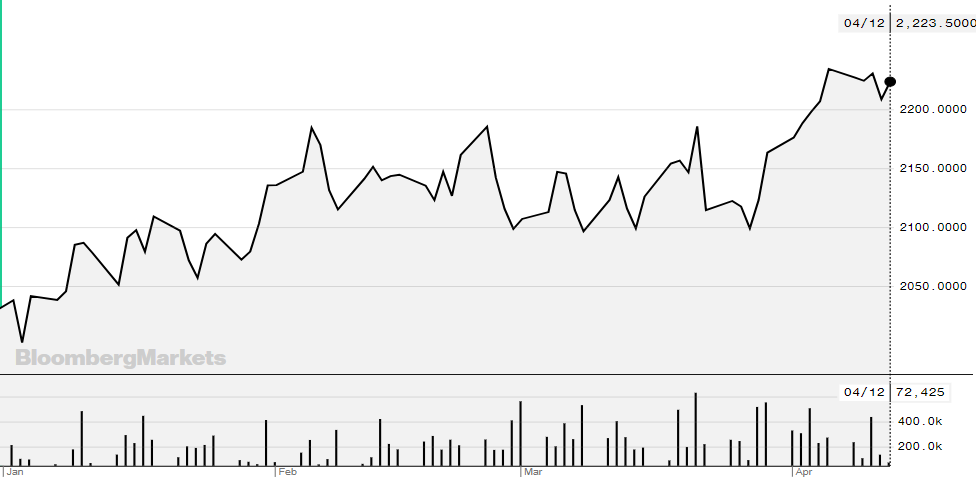

Source: Bloomberg

The iShares Core MSCI EM IMI ETF (EMIM) (above) is a prime example of emerging market investment products rebounding from a difficult Q4. EMIM fell 9.6% in October but has since recovered, climbing 15.6% since its lowest in Q4 2018. Year-to-date, the $13.7bn fund has risen 9.6%.