Equity markets are overconcentrated. Mega-caps are driving the performance of the S&P 500, however, investors could be in for a rude awakening if inflation stays higher-for-longer and market sentiment turns.

Despite cracks appearing in the financial system, H1 was defined by the outperformance of risk assets including the tech giants as investors bet on falling inflation and central banks easing their hawkish monetary policies.

The ‘magnificent seven’ of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla have driven returns of the Nasdaq 100, which is up 31.8% this year.

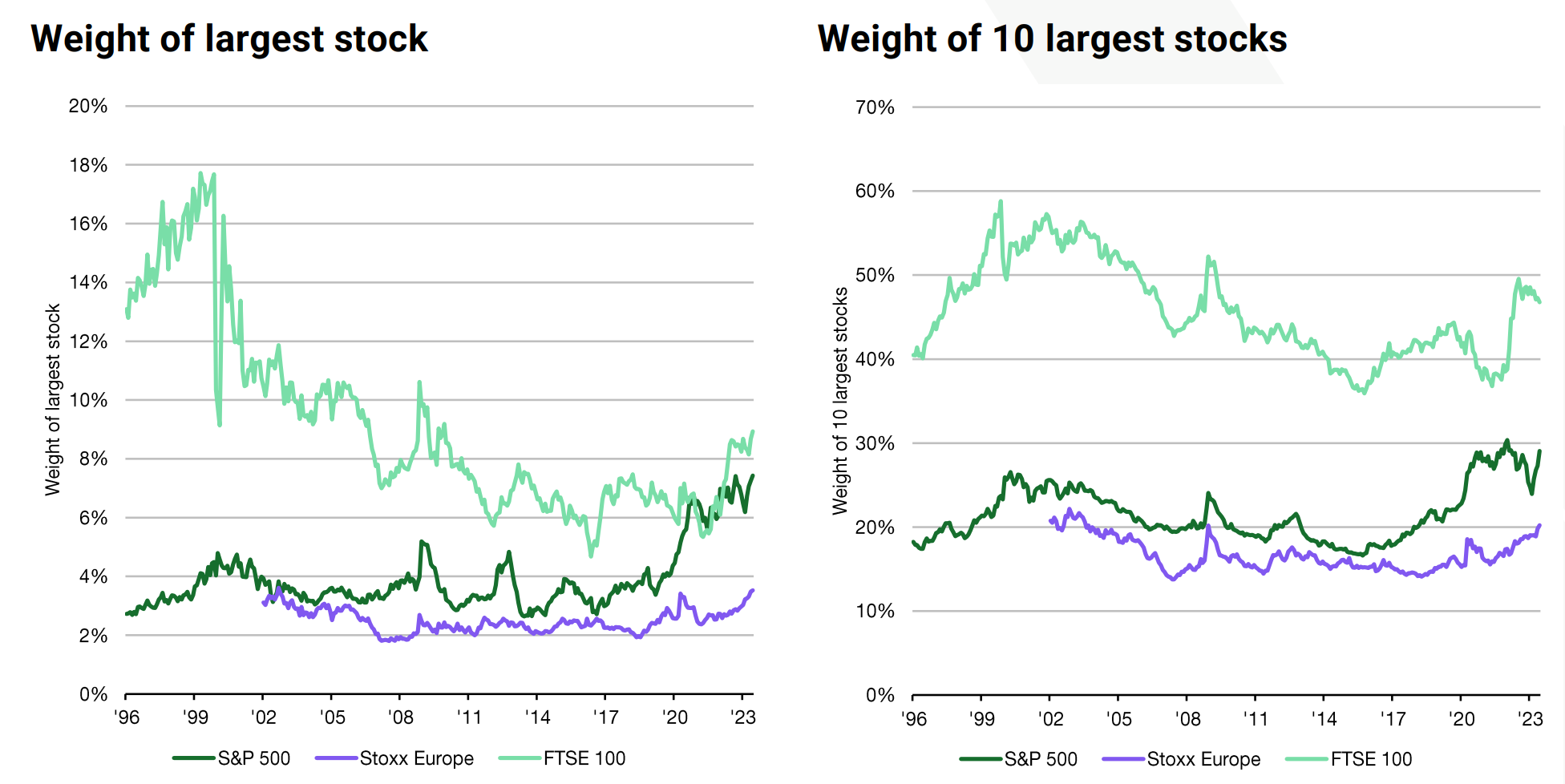

Chart 1: Indices are becoming ever more concentrated

Source: Liberum, Datastream

However, with the likes of Nvidia up 195% so far this year, Nasdaq has been forced to address overconcentration issues by undertaking a “special rebalance” due to a breach in index weighting rules.

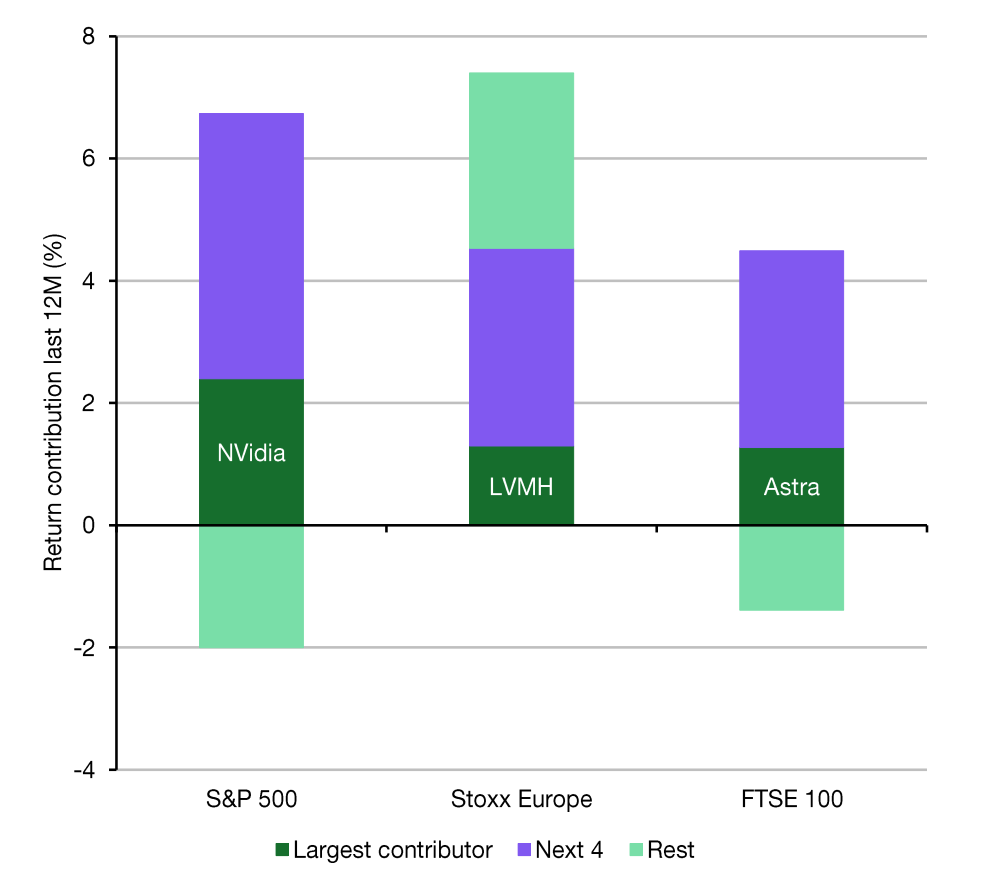

Furthermore, Nvidia has driven approximately 33% of the total returns of the S&P 500 over the past 12 months, as at the end of May, according to Liberum, while the next four largest contributors led to the rest of the index’s performance.

Chart 2: Contribution to total index return to June

Source: Liberum, Datastream

“By becoming more concentrated, investors are dependent on the timing of the performance of these mega-cap stocks in the S&P 500,” Joachim Klement, investment strategist at Liberum Capital, told ETF Stream. “If these stocks underperform, there will be the opposite effect, even if the other 495 stocks in the index do well.”

Investors are becoming increasingly aware of the potential risks of overconcentration as highlighted by the recent demand for equal-weight ETFs.

According to data from Bloomberg Intelligence, the Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW) has seen $454m inflows over the past two months, as at 12 July.

“The most defensive approach is to equal weight your index,” Klement continued. “It is the simplest way to invest and it is an extremely robust way to create outperformance that is stable, even when unexpected events occur.

“Equal-weight ETFs outperform because they implicitly overweight value and small-cap stocks in an index, two factors that have a risk premium attached over the long term.”