S&P 500 and FTSE 100 have had a tough time throughout October and have since struggled to recover to their initial positions. But as explained in Amundi's latest

, the leading ETF market, the US, is still showing heavy inflows for Equity ETFs which is resulting in the global market strengthening, according to Deutsche Bank's latest research.

The report says that the US equity funds have performed a U-turn on its 2 weeks of modest outflows by facing $2.6bn in inflows. This is in contrast with Europe which faced flows of -$1.3bn, the tenth consecutive week of outflow as the market remains relatively volatile. Asia hasn't been so active in the equity markets either with China having inflows of only $0.7bn and Japan saw no inflows at all, says the bank.

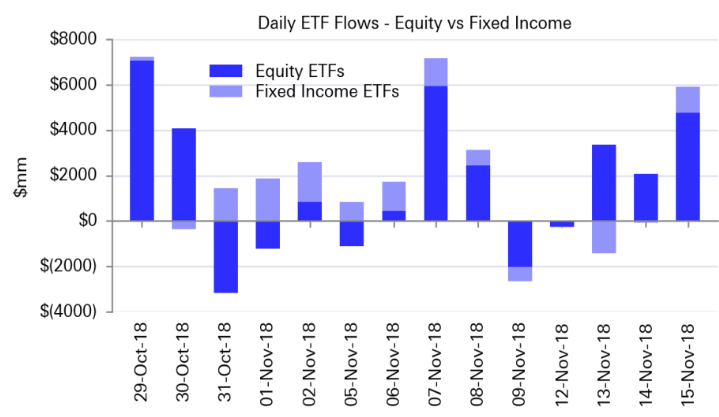

Source: Deutsche Bank Research

Equity has been a key driver in the recent ETF inflows despite the recent bear-run says Deutsche Bank. Whilst the European markets has caused some spikes in the inflow of fixed income ETFs, equity has maintained a steadier inflow, dominated primarily by the US market.

There are several reasons why investors are shifting focus on to equity ETFs. Pseudo-futures, asset allocation and sector have all seen a significant increase over the past couple of weeks with asset allocation being the most consistently high over this time period.

The report also says that single-stock shorts were included in the major selloff throughout October. In contrast, ETF shorts have received noteworthy attention as managers increase their beta hedging.