ESG issues, from climate change to business reputation, present increasingly fundamental risks to investors. Even in just the last few years, we have seen that inadequate management of ESG risks can destroy both company value and standing. Some of the biggest threats to businesses come under ESG issues – environmental, social and governance. With the rise of social media, there is now the added risk that companies which have taken centuries to build could be destroyed in an afternoon.

The BofA Global Research team recently estimated more than $600bn of market cap for S&P 500 companies has been lost to “ESG controversies” in the last seven years alone.[1] Identifying the highest scoring ESG companies, screening for controversies and excluding companies involved in controversial business activities, is useful for avoiding ESG risks by steering towards companies with more resilience to long-term, material ESG issues. However, this approach alone does not consider the full picture of a company’s sustainability, critically, the financial stability of a business.

There is still a lot of debate over whether ESG investing delivers outperformance over the long-term. Research around this is still limited, owing to the relatively recent ESG boom, meaning some data sets have only been around for the last five to 10 years. During this period, we have had an aggressive bull market, which has also made ESG alpha harder to measure, as it is difficult to discern whether outperformance is specific to a rising market.

On top of this, choosing the stocks that will succeed or fail based on their ESG profile alone does not take account of all the potential risks or opportunities a company faces. ESG analysis helps to identify risks that would not be found on a company balance sheet, but when we are considering the overall sustainability of a company, we should not overlook the financial statements.

Many investors question the tradeoff between ESG concerns and returns, however this does not necessarily need to be a compromise and investing according to ESG principles should not mean sacrificing returns. Combining an ESG approach with a fundamental investing strategy should provide investors with a more holistic angle, taking into consideration all aspects of a company’s outlook. This could theoretically offer investors a superior long-term investment strategy and potentially more sustainable returns over time.

ESG and quality: A match made in heaven

ESG and quality considerations can be seen as two sides of the same theme when it comes to investing: sustainability. Both approaches tend to tilt towards higher quality companies with stronger balance sheets and lower volatility. Both strategies seek to protect against the downside risk – be it through identifying companies that demonstrate stronger financial fundamentals or those with strong management teams, environmental policies and overall ESG performance.

Although ESG factors are less quantifiable to measure, particularly when attempting to measure their effect on valuation, a company’s awareness of ESG risks and opportunities is often linked to its ability to protect its competitive position and deploy its capital at higher rates of return. By contrast, weak governance can affect the long-term value of a company and destabilize corporate strategy.

Therefore, an ESG approach complements a quality strategy so well. Both approaches look to protect against downside risk by identifying higher quality companies with sustainable competitive advantages that should deliver higher risk-adjusted returns over time.

Quality street?

In the face of market uncertainty, investors tend to flock into quality names: companies with higher and more stable revenues, low debt ratios and other measures of sustainable earnings. Conventional wisdom is that these companies are better placed to withstand market volatility, and investors often view exposure to quality to protect against a downturn. As an investment approach quality does not get nearly as much attention as growth (buying fast-growing companies) or value (buying cheap companies).

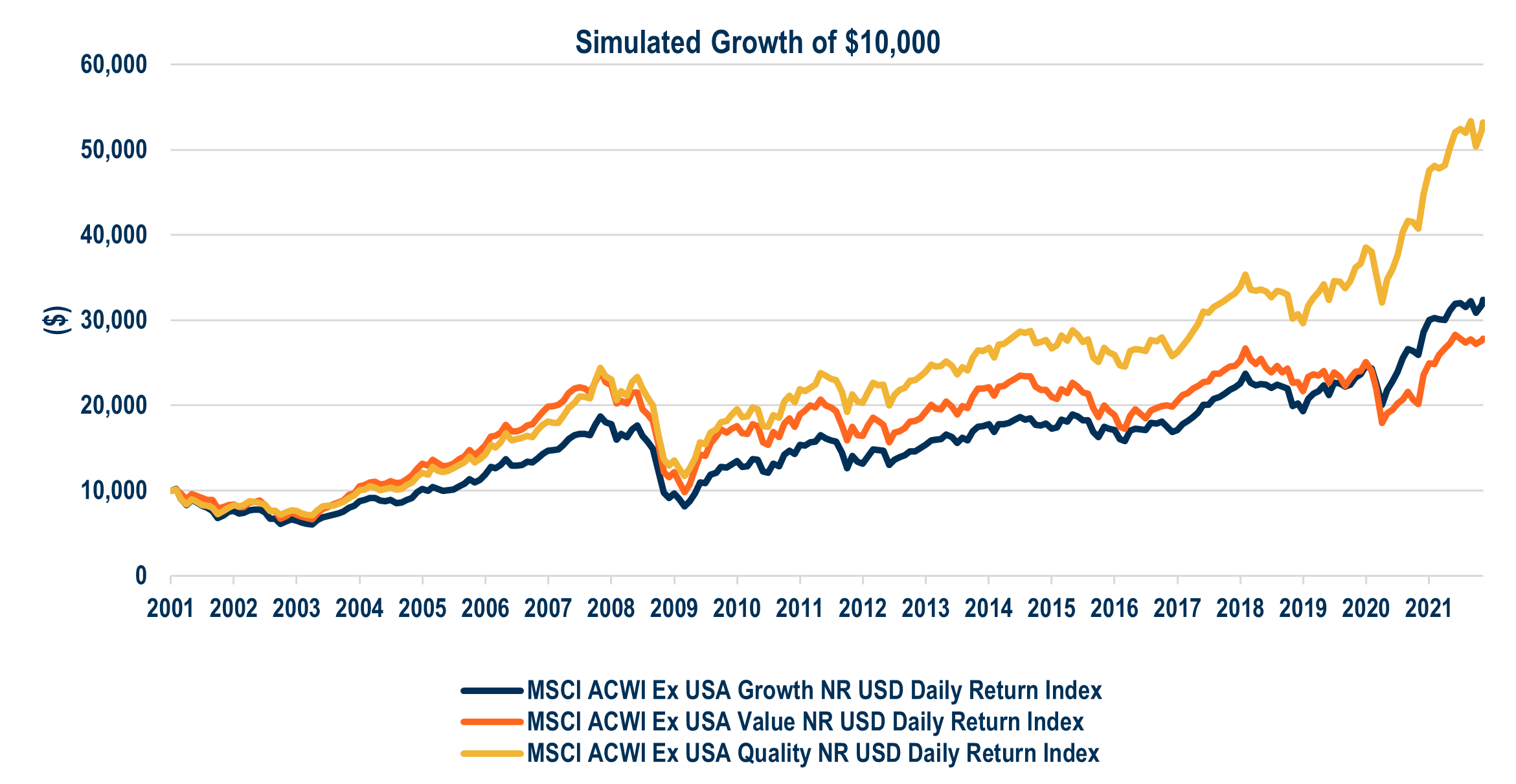

However, as the chart below shows, quality has performed better than both approaches since 2001 (when MSCI began tracking it). So, in the endless debate between value vs growth as investment strategy: we would suggest focusing on the approach which has outperformed them both. Additionally, ESG and financial quality factors have been shown to be uncorrelated, suggesting that well-rated ESG companies are not always high-quality companies. This means the combination of quality and ESG could be a stronger indicator of high returns than either quality or ESG investing alone.

Source: First Trust and FactSet, as at 9 November

ESG and quality: One strategy

The First Trust Global Capital Strength ESG Leaders UCITS ETF (FCSG) combines First Trust’s time-tested quality and low volatility factor investing with MSCI’s best-in-class ESG methodology in one transparent and liquid UCITS ETF.

The blend of First Trust’s rules-based approach coupled with MSCI’s ESG Leaders strategy looks to generate long-term sustainable returns. FCSG also seeks to lower downside risk through a combination of its focus on high quality companies selected by lowest volatility while ensuring only the top scoring ESG companies are included in the portfolio. Since launching earlier this year, it has outperformed both its benchmark and the MSCI ESG Leaders index (see performance table below).

One month

Three month

YTD

One year

Five years

Since fund inception*

Fund performance

Net asset value (NAV)

-5.27%

0.09%

N/A

N/A

N/A

12.73%

Index performance

MSCI ACWI ESG Leaders index

-4.35%

-0.73%

N/A

N/A

N/A

8.62%

MSCI ACWI NTR index

-4.13%

-1.05%

N/A

N/A

N/A

8.07%

*Fund inception date: 9 March 2021

Gregg Guerin is senior product specialist at First Trust Global Portfolios

[1] BofA Global Research, ESG Matters: When bad news hits good companies, 24 June 2020. A case study of ESG controversies found that major ESG-related controversies for large US companies were accompanied by peak-to-trough market capitalization losses of more than an estimated $600bn in the last seven years alone, against a backdrop in which the S&P 500 grew by 6% on average.

Disclaimer

This marketing document is directed at Professional Investors only and is not for Retail Investors.

This document is confidential and is intended solely for the use of the person or persons to whom it is given or sent and may not be reproduced, copied, or given, in whole or in part, to any other person.

This document is issued by First Trust Global Portfolios Management Limited (“FTGPM”) of Fitzwilliam Hall, Fitzwilliam Place, Dublin 2, D02 T292. FTGPM is authorised and regulated by the Central Bank of Ireland (“CBI”) (C185737). The Fund is not regulated by the CBI. Nothing contained herein constitutes investment, legal, tax or other advice and it is not to be solely relied on in making an investment or other decision, nor does the document implicitly or explicitly recommend or suggest an investment strategy, reach conclusions in relation to an investment strategy for the reader, or provide any opinions as to the present or future value or price of any fund. It is not an invitation, offer, or solicitation to engage in any investment activity, including making an investment in the Fund, nor does the information, recommendations or opinions expressed herein constitute an offer for sale of the Fund.

The Fund is an open-ended sub-fund of the First Trust Global Funds PLC (the “Company”), an umbrella UCITS fund with segregated liability between sub-funds, incorporated with limited liability as an investment company with variable capital under the laws of Ireland with UCITS registered number 514357.

The material in this document is not comprehensive and must therefore be read in conjunction with the Fund’s prospectus, which contains material information not contained herein, including the terms of investment and information regarding investment risks and restrictions, fees and expenses and conflicts of interests. Potential investors should pay particular attention to the risk disclosures in the “Risk Factors” section of the Fund’s prospectus. No assurance can be given that the Fund’s investment objective will be achieved or that the Fund will generate a positive return. Contact FTGPM or visit www.ftglobalportfolios.com to obtain a Prospectus and/or Key Investor Information Document (available in English).

Shares of the Fund are not available for sale in any state or jurisdiction in which such sale would be prohibited. The shares of the Fund have not been registered under the US Securities Act of 1933, as amended, and the Fund is not registered under the US Investment Company Act of 1940, as amended. Neither this material nor the Fund’s shares are available to or suitable for US persons.

Risks

The Fund’s shares may change in value and may go down as well as up. You could lose money by investing in the Fund.