Over the last few years, there has been a rapid rise in explicit exposure to ESG focused funds across the investment landscape. It is, without doubt, one of the most popular tilts being adopted by portfolio managers, with Nutmeg no exception. While the popularity of the strategy continues to prevail, it is important to reflect and consider any liquidity-based trade-offs, relative to traditional market-cap strategies.

At Nutmeg, we introduced our 10 globally diversified socially responsible portfolios in 2018. We solely invest in ETFs leveraging their transparency, diversification and consistency before applying our in-house screening process as part of the portfolio construction phase. It is fair to say, we were one of the early proponents of an ESG focused strategy among ETF investors, allowing us valuable insight into the development of the sector’s liquidity profile.

To take a step back, the liquidity of ETFs is a function of the on-screen order book, depth of the off-screen market and liquidity of the underlying basket. However, perhaps most importantly, is the appetite of market makers to transact in any given product that provides liquidity. Within the sphere of capital markets, that appetite is a direct derivation of perceived risk. If risk perception is high, prices are unlikely to be favourable, the desire for volume by any given market maker is subdued and the corresponding liquidity low.

Risk is of course subjective. For some, novelty and the adoption of fresh unknowns will not align with internal risk appetites. For others, the inability to hold enough data from which to power and build relevant pricing models will often lead to a proportionately worse outcome – in this case the quality of execution.

So, how does this feed into ESG focused ETFs and their liquidity profiles?

The vast majority of market makers will look to hedge positions taken onto their book whether entirely or partially. Hedging strategies are built on correlations. And understanding dependable correlations is built on experience of the product in question – knowing where and what to use as a proxy across the various stages of the market. With any new product, fund or sector, these relationships are loosely estimated with understandably low confidence and the resulting negative impact on pricing.

In addition, there are points to consider directly with ETFs. When an ETF is in its infancy, the chances of a market maker having to create or redeem off the back of an order is high. For a sustainability-focused fund tracking UK equities such as the UBS ETF MSCI United Kingdom IMI Socially Responsible UCITS ETF (UKSR), redemption and creation costs are -2bps and +50bps respectively (owing to stamp duty) before we consider any intraday costs of hedging.

Let us examine both of these price influencers.As the market for a given fund matures and volumes increase, the probability for two-way flow on the sell-side increases as does the corresponding lending market.

In addition, those dealers who are not authorised participants for the specific funds are now able to begin their involvement and capitalise on the increasing two-way flow. Once interest and volumes in the underlying index or basket increase, so too do the products based upon it giving a broader landscape of hedging opportunities. Taken as a whole, these conditions ease the ability for an ETF to be traded in the secondary market rather than the primary, dramatically improving quotes.

On the hedging side, established funds and indices provide an easily accessible derivatives market with which the risk of ownership and directional movements can be hedged out effectively. A FTSE 100 ETF like the iShares Core FTSE 100 UCITS ETF (ISF), for example, offers a highly liquid futures market. The same is not true for those funds that provide an unusual tilt, for example, smart beta or factor style investing. In lieu of a traditional futures market, the market maker must derive their own hedging strategy often without a high level of liquidity in the early stages, typically leading to higher costs.

One of the most regularly traded ETFs within our ESG portfolios is UKSR. The ETF provides exposure to the MSCI UK SRI Investable Market index covering large, mid and small-cap stocks of the UK equity markets while ensuring the maximum concentration of a single company within the index can be no more than 5%. The ETF applies additional screening to select only those companies with strong sustainability profiles.

Without the prevalence of these ETFs back in 2018 and their relative lack of volume, market makers were still finding their feet and honing their respective strategies. The resulting variation in prices is clearly visible below.

Source: Nutmeg

The graph tracks our fills over time from the mid-price of the ETF. While the expectation across the market would be to achieve execution at the screen price (bid/ask), here at Nutmeg we benchmark ourselves against the mid, since it offers the closest approximation to the fair value of the product. A negative reading indicates buying or selling above or below the mid-price respectively. A positive number would suggest buying underneath the mid for example.

Observing the first half of the data, the lack of consistency is clear. The spread of execution is fairly broad although for reference, the average screen spread across this period was 33bps, peaking at 97bps. As the product and surrounding market matured, with market makers improving their strategies and evolving their risk appetites, pricing begins to tighten and the frequency of execution at or close to the mid becomes the default expectation, all else remaining equal. This is illustrated by the blue trendline using a 10-day moving average.

As March 2020 approaches and market volatility increases off the back of the COVID-19 pandemic, spreads widen, risk increases and the efficacy of execution relative to fair value reduces. Unfortunately, the issue here is not with the ETF’s liquidity profile, but rather the market more broadly. We witnessed this across the landscape, irrespective of the product in question. What is clear though is when the volatility began to subdue and a sense of normalcy returned, spreads tightened and a more consistent execution regime resumed, demonstrating the evolution of the underlying market and its sense of maturity once more.

The level of confidence and understanding of the product has evidently increased, market participants are more comfortable dealing in the space and the data illustrates this well.

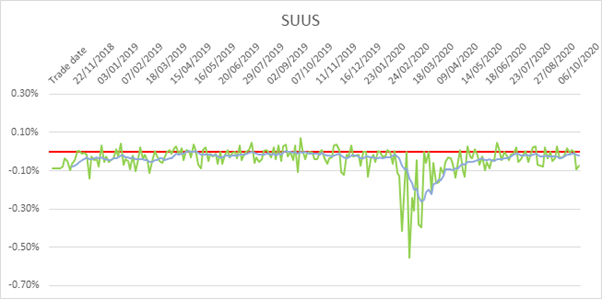

The relationship we observe with the market on UKSR is broadly visible across the funds used within our ESG focused portfolios – as the market has developed, so too has the propensity for market makers to become more competitive. The iShares MSCI USA SRI UCITS ETF (SUUS) is another popular ETF used at Nutmeg which looks to track the MSCI USA SRI index. We see below a near mirror image of how UKSR evolved over the period:

Source: Nutmeg

During the early stages, spreads are wider and the consistency of execution at or close to the mid is less regular. Although as before, we see a gradual tightening of prices up until the associated market volatility arrives in early March 2020, in line with the evolution and progression of the underlying market.

ESG ETFs score major victory during coronavirus turmoil

To summarise then, as to whether we have witnessed a liquidity trade-off in this space – the results are fairly evident. The data suggests and our experiences confirm that any newly established sector of the market, without strong levels of precedence, bring with it a number of hurdles against their respective liquidity profile. The efficacy of liquidity is ultimately demonstrated by the ease and relative lack of cost that products can be traded at.

In the specific case of ESG-focused ETFs, there were challenges in the early stages although I would argue that correlation does not equal causation and the challenges were a function of a product in its infancy rather than due to those funds having a tilt towards sustainable investing. It is perhaps more telling that given the comparatively youthful nature of the sector, just how quickly the spreads and quotes have become significantly more competitive – a strong testament to the popularity and speed of adoption across the sector.

Will Askew is a senor trader at Nutmeg