More than $360bn assets are currently invested in ETFs classified by their issuers as ESG. But with more than 500 ESG ETFs launched over the past decade, how can investors find the ones most suitable to them? Here, we will explore and help define the broad range of ESG approaches.

Breaking down the jargon

This broad term "ESG" refers to a wide range of funds that consider environmental, social and corporate governance issues as part of their security selection and allocation methodology.

The basic concept dates back over a century, but a more recent development has been in passive ETFs that follow ESG indices based on specific rules rather than an individual’s decision-making.An ESG index is normally derived from a standard market-cap weighted index (the parent index).

However, you can have two ESG indices constructed from the exact same universe of stocks, but they may be substantially different from each other due to the approaches they take.

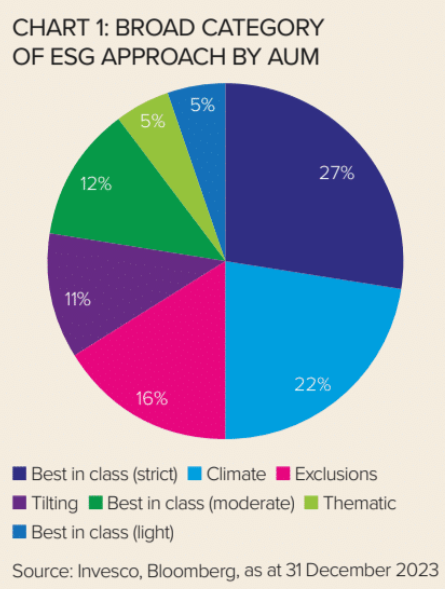

ETFs that follow a strict “best in class” approach are the largest part of the ESG ETF market in terms of assets under management. However, “climate” ETFs gathered the most assets in both 2022 and 2023.

As we look at the different approaches, we will focus on the underlying indices being followed, as most ESG ETFs are passively managed.

Different approaches, different objectives

The first stage of constructing any ESG index will be to remove any securities of companies involved in what the index provider has defined as controversial activities or industries, normally including the likes of controversial weapons, coal and tobacco.As a general rule, the more securities that are removed, the more the ESG index performance is likely to deviate from that of the parent index.

Indices adopting an exclusions approach typically follow a two-step process:

1. Remove any securities from the parent index based on a business activity criteria;

2. Reweight the remaining securities (usu-ally by their market capitalisation).

The intention of an exclusions approach is to construct an index profile like that of the parent index but without any securities considered unacceptable, as defined by the index provider in the index methodology.

This type of approach will almost certainly lead to an index that includes securities with low ESG scores or that are involved in business activities that may be excluded by stricter ESG approaches. ETFs that follow an exclusions-based index may be referred to as taking a “lighter-touch” ESG approach

.Indices adopting a tilting approach will also aim to provide similar characteristics as the parent index but with a methodology intended to improve the overall ESG score or other relevant metrics such as, for example,lowering carbon intensity. As mentioned, the first step in the approach taken by these indices will often be the same as for Exclusions:

1. Remove any securities from the parent index based on business activity criteria;

2. Apply a tilting factor to remaining securities based on ESG scores (usually relative to peers);

• Increase weight of those with above-average scores;

• Reduce weight of those with below-average scores.

The index methodology will define the targets and explain the mechanics of the tilting. The tilting approach effectively rewards companies that are producing favourable ESG results and punishing those lagging behind.

Indices adopting a best-in-class approach are typically designed to focus on the companies exhibiting the highest ESG characteristics within their sectors, while totally excluding the lowest ESG performers.

Again, the approach typically begins with exclusions:

1. Remove any securities from the parent index based on business activity criteria;

2. Remove all securities below a predefined threshold based on ESG score;

3. Reweight remaining securities according to index methodology, which may involve optimisation or some other techniques with the aim of reducing tracking error. The performance of these indices could normally be expected to deviate more from their parent index than other ESG approaches, depending on how many constituents are removed.

The “lightest” best-in-class approaches may aim to capture around 75% of the parent index whereas the “strictest” versions could aim to capture only the top 25% of the market weight, based on ESG scores.

The stricter the selection criteria, the more its performance is likely to deviate from the parent index.Indices categorised as having a climate objective will generally adhere to the principles behind the EU’s regulatory frame-work for climate-related investment funds.

The European Commission established the Paris-Aligned Benchmark (PAB) and Climate-Transition Benchmark (CTB) to provide investors with increased transparency into how indices that carry these designations plan on achieving their objectives related to greenhouse gas (GHG) emissions and the transition to a lower carbon economy.

• PAB indices are designed to meet the long-term goals of the Paris Agreement on climate change. A PAB index must have at least a 50% reduction in GHG emissions compared to its parent index and meet a 7% year-on-year reduction.

• CTB indices are considered to be less strict than PAB indices. For instance, a CTB index has different thresholds, such as a 30% minimum reduction in GHG emissions compared to its parent index (less than the PAB minimum of 50%).

Finally, thematic indices. These strategies differ as they’re more likely to be concentrated on a narrow part of the market rather than offering broad exposure. They will typically aim to capture those companies that are contributing to or benefiting from a powerful, long-term trend.

Conclusion

Hopefully, this has provided you with a better understanding of the different approaches taken by the indices an ESG ETF may aim to follow. No approach is “better” or “worse” as each aims to fulfil different objectives. The most important consideration for investors is which approach meets their objectives, both in terms of ESG and financial performance. The next step is to find an ETF that can deliver that index performance as cost effectively as possible.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

Investment risks

The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Important information

Data as at 31.10.2023, unless otherwise stated. This is marketing material and not financial ad-vice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition,investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them.Issued by Invesco Investment Management Limited, Ground Floor, 2 Cumberland Place, Fenian Street, Dublin 2, Ireland. Regulated by the Central Bank in Ireland.