The European Securities and Market Authority (ESMA) has found funds that claim to contribute towards the United Nation’s Sustainable Development Goals (SDGs) “do not significantly differ” in their contribution to the targets versus their non-SDG or ESG peers.

In a new report titled, Impact investing – Do SDG funds fulfil their promises?, Europe’s financial regulator said “impact washing”, including the misuse of the SDGs, is now a key issue in its bid to tackle greenwashing by Europe’s asset managers.

ESMA said the broad scope of the goals, the absence of harmonised and standardised reporting requirements for private sector holdings and the difficulty in assessing a single firm’s contribution towards the SDGs left them vulnerable to greenwashing.

“These challenges can pose risks to investors, if they feel misled about the funds’ sustainability claim, and are thus of relevance to ESMA’s investor protection objective,” it said.

“Our analysis raises investor protection concerns as the funds claiming to contribute towards the SDGs do not appear to differ significantly from other funds in their exposure.”

Analysing over 14,500 active funds in Europe – consisting of 187 SDG funds – the regulator found the differences between SDG and non-SDG funds' contribution towards the initiative were “not statistically significant”.

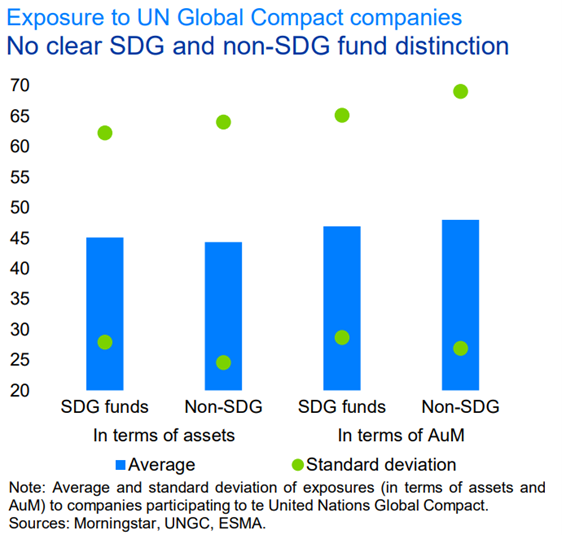

For example, the average exposure to companies participating in the UN’s Global Compact initiative is higher for SDG funds when looking at the number of assets – 45.1% versus 44.3% for non-SDG funds – but lower when looking at the share of assets under management (AUM), 46.9% versus 48.0%, respectively.

Chart 1: SDG and non-SDG funds

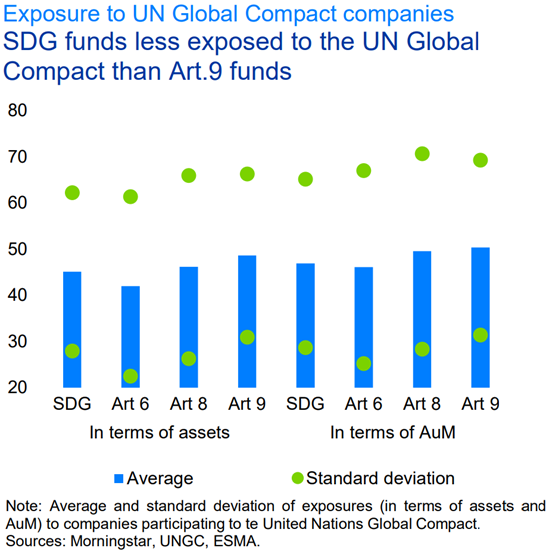

It also found SDG funds have an “intermediate position” between non-ESG and ESG funds, and contribute to the SDGs less than both Article 8 and 9 funds under the Sustainable Finance Disclosure Regulation (SFDR).

Chart 2: SDG and Article 8 and 9 fund exposure

Its findings follow huge growth in demand for sustainable investments with SDG fund assets under management (AUM) tripling from roughly €25bn to €75bn between 2020 and 2021, according to Morningstar data.

In the last year, both DWS and Franklin Templeton have launched ETF ranges explicitly linked to the SDGs, while issuers including BlackRock, Legal & General Investment Management (LGIM) and BNP Paribas Asset Management also have products aligned to the goals.

Concerns have been raised about the viability of aligning the goals to an investment framework, particularly using ETFs, in addition to whether investors can have any real impact investing via listed stocks.

ESMA noted that claiming to contribute towards SDGs should require taking steps beyond exclusionary metrics based on sectoral or geographical characteristics and added a more “careful evaluation” of assets was needed.

“Moving forward, it will be crucial that market mechanisms and clear rules ensure that sustainability frameworks, such as the SDGs, are not misused when employed as a reference tool for sustainability objectives,” it said.