ETF investors are “less concerned” by the recent swathe of fund downgrades under the Sustainable Finance Disclosure Regulation (SFDR) than active buyers, Morningstar research has found.

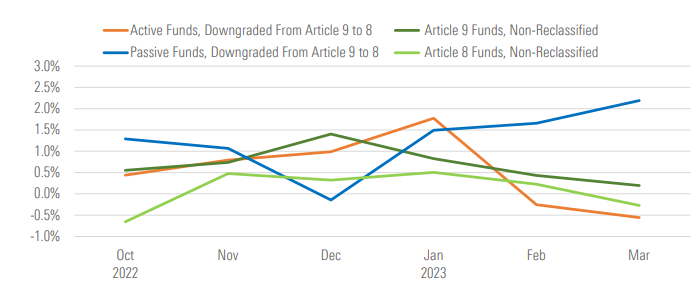

According to the index provider’s Q1 SFDR report, ETFs downgraded from Article 9 to Article 8 have continued to post a positive organic growth rate – growth of flows relative to assets – while their active counterparts declined.

Roughly $57bn of assets across more than 70 ETFs were reclassified from ‘dark green’ Article 9 to ‘light green’ Article 8 in Q4 2022 ahead of the ‘level 2’ SFDR update on 1 January, according to Bloomberg Intelligence.

Despite this, downgraded Article 8 ETFs grew by over 2% in Q1.

Monthly organic growth rates for active and passive funds reclassified from Article 9 to 8

Source: Morningstar

Hortense Bioy, global director of sustainable research at Morningstar, said: “This suggests SFDR classification is more likely to influence active fund buyers than passive fund buyers.

“Passive investors may be less concerned about the SFDR classification of a fund and be more committed to the fund’s specific index strategy.”

She added a majority of the passive Article 9 funds that were downgraded track Paris-Aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs).

While the early signs suggest active investors are more influenced by the downgrades, Morningstar said a longer period is needed to draw concrete conclusions.

“The observation period is very short. We have just three months of data so further analysis would be needed to draw any conclusions,” Bioy added.

However, billions of euros worth of downgraded ETFs could potentially be re-upgraded by asset managers after the European Commission delivered a long-awaited clarification on the regulation.

Last month, the European Commission said both PABs and CTBs could be deemed to provide ‘sustainable investments’.

The European Union said it would not be introducing a minimum standard for ‘sustainable investments’, instead allowing asset managers to set their own standards.

As well as creating confusion across the industry, Bioy said Article 9 will be diluted as a result of the move.