Amundi’s luxury goods ETF proved resilient during the high inflation environment last year and has benefitted from the outperformance in risk assets so far in 2023.

The $508m Amundi S&P Global Luxury UCITS ETF (LUXU) has returned an impressive 16.2% this year, as at 22 February.

While some blockchain thematics have far outgunned this year, most have still lost between a third and two-thirds of their value over the past 12 months, whereas LUXU remains near parity with where it was a year ago.

Amundi’s luxury strategy tracks the S&P Global Luxury index of 80 companies selected based on market cap and luxury exposure scoring, from subsectors including leisure, apparel, distillers and vinters, home furnishings and vehicle manufacturers.

Company weights are capped at 2%, 4%, 6% and 8%, respectively, based on their luxury exposure score which S&P Dow Jones Indices (SPDJI) notes is “subjective” and “based on qualitative factors” such as companies’ business description, revenue segment and market perception.

The weights of each stock are managed by SPDJI’s index committee. The result is a benchmark that weights a considerable 83.5% to consumer discretionary stocks, with top allocations awarded to jewellery and leather goods conglomerate Richemont, beverage conglomerate LVMH Moet Hennessy, Hermes and Mercedes-Benz.

While much of the consumer discretionary sector took a hit in 2022 as consumers cut non-essential spending, the luxury portion of the market remained resilient as their wealthy clientele’s behaviour was less impacted by economic events and in fact, most brands were able to pass on additional costs to their clients to preserve their margins.

A key example of this was LUXU top-three weighting Hermes which reported Q4 revenue jumping 23% and increased prices across all markets by an average of 7% versus the previous year.

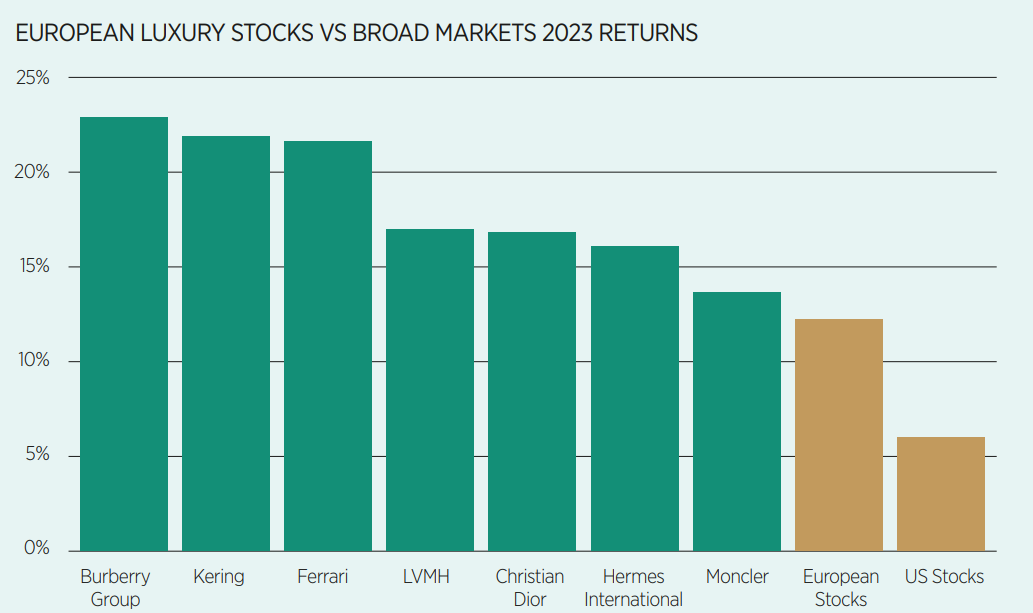

Such trends explain why European luxury stocks were outperforming broad European benchmarks by around 3% and US stocks by 9% by 20 February, according to Ken Shih, head of wealth management for Greater China at Saxo Bank.

Source: Saxo Bank

Shih added another tailwind for luxury goods has been the China reopening trade, with investors believing the release of wealthy Chinese consumer demand will support discretionary luxury goods spend in 2023.

Saxo’s luxury basket of 23 companies grew their revenue by an average of 21% over the past year despite the “challenging market environment”.

While Shih questioned the presence of Mercedes, Tesla and Estee Lauder in LUXU’s top 10 constituents, the two automakers returned 16% and 83% over the first seven weeks of the year, respectively.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.