ETFs’ share of model portfolio service (MPS) offerings declined year-on-year as investors opt for index funds amid frustrations around accessing ETFs.

According to Morningstar’s latest UK-managed portfolios landscape report, ETFs represented 12% of MPS holdings by number, down from 15.4% in 2022.

Meanwhile, index funds dominated offerings, with almost half of the 1,100 MPS analysed by Morningstar describing themselves as either passive or a blend of active and passive.

Of the top 10 most held funds, eight were index mutual funds with no ETFs.

While the number of ETFs being used in MPS offerings declined, Morningstar did not give figures on market share by assets under management.

Part of the reason for the decline is due to the lack of trading capacity for ETFs on many provider platforms which can often lead to higher costs.

Jack Turner, head of ESG portfolio management at 7IM, said: “We often use ETFs in our model portfolios, but you have to be careful with transaction costs. Sometimes this can make us lean towards mutual funds.”

James Peel, portfolio manager at Titan Asset Management, added: “We have an MPS where we use ETFs, index mutual funds and active mutual funds because ETFs can be a bit tricky in an MPS due to various operational constraints. For example, some platforms cannot accommodate fractional trading.”

Fractional trading allows investors to buy a slice of an ETF or stock for any amount, allowing access to a broader range of assets.

In a bid to overcome some of these platform issues, some ETF issuers have been launching mutual fund share classes of their ETFs to make it easier for platforms to use.

Peel added: “A few ETF issuers have launched mutual fund share classes of their ETFs and we have been exploring whether to use some of those where there is not an appropriate active fund.”

The creation of a non-ETF share class on an ETF – labelled the “inverse-Vanguard” model – allows investors to buy shares directly from the ETF issuer as opposed to buying the shares at the trading venue.

Despite this, Andrew Craswell, European head of ETF services at Brown Brothers Harriman, said larger platforms have been making “great progress” with the introduction of direct execution, giving them the ability to purchase ETF shares.

However, he added there is a “tail of platforms and advisers that still prefer to access strategies via the mutual fund approach”.

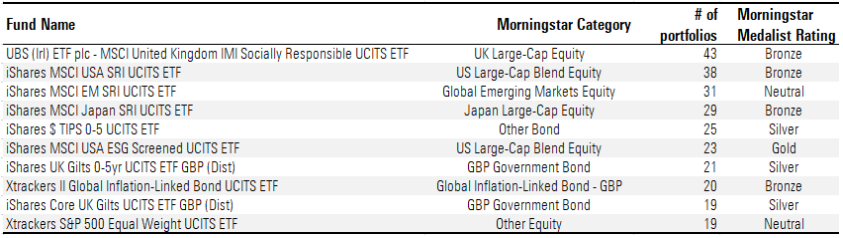

Looking at the most popular ETFs within managed portfolios, ESG ETFs dominated, with the UBS ETF MSCI United Kingdom IMI Socially Responsible UCITS ETF (UKSR) topping the charts appearing in 43 portfolios.

This was followed by the iShares MSCI USA SRI UCITS ETF (SUAS) and the iShares MSCI EM SRI UCITS ETF (SUSM) which featured in 38 and 31 portfolios, respectively.

Source: Morningstar Direct

More broadly, managed portfolio launches in 2023 have been much lower than in previous years following rapid growth between 2018 and 2022.

“A recent development affecting UK managed portfolios is the reduction in the UK's annual exempt amount for capital gains tax, which drops from £12,300 to £6000 for the 2023/24 tax year, and further to £3000 in the following tax year,” according to the report.