Heading into 2023 investors were contending with sticky inflation, rising interest rates and a looming recession, all while coming off the back of a huge equity sell-off over the previous 12 months.

These factors weighed heavy on ETF Stream’s ETF picks at the turn of the year, along with signs it could be a turning point for markets as investors prepared for a bumpy ride.

A year later – view our 2024 picks here – inflation is trending down, interest rates appear to have peaked and a soft landing for the US economy is many people’s top bet.

As a result, US equities have rallied at various points over the past 12 months, with the S&P 500 verge of all-time highs – returning 24% – while the tech-focused Nasdaq 100 is up 54%, as at 19 December.

Meanwhile, the ‘bonds are back’ mantra hit full swing earlier in the year. While this may have been premature, some areas of the fixed income market generated positive performance.

Overall, it means 2023 was a good year for the traditional 60/40 portfolio – a concept many had written off – which has posted double-digit returns.

A year on from selecting our top ETFs for 2023, ETF Stream has decided to see how they have performed over the past 12 months.

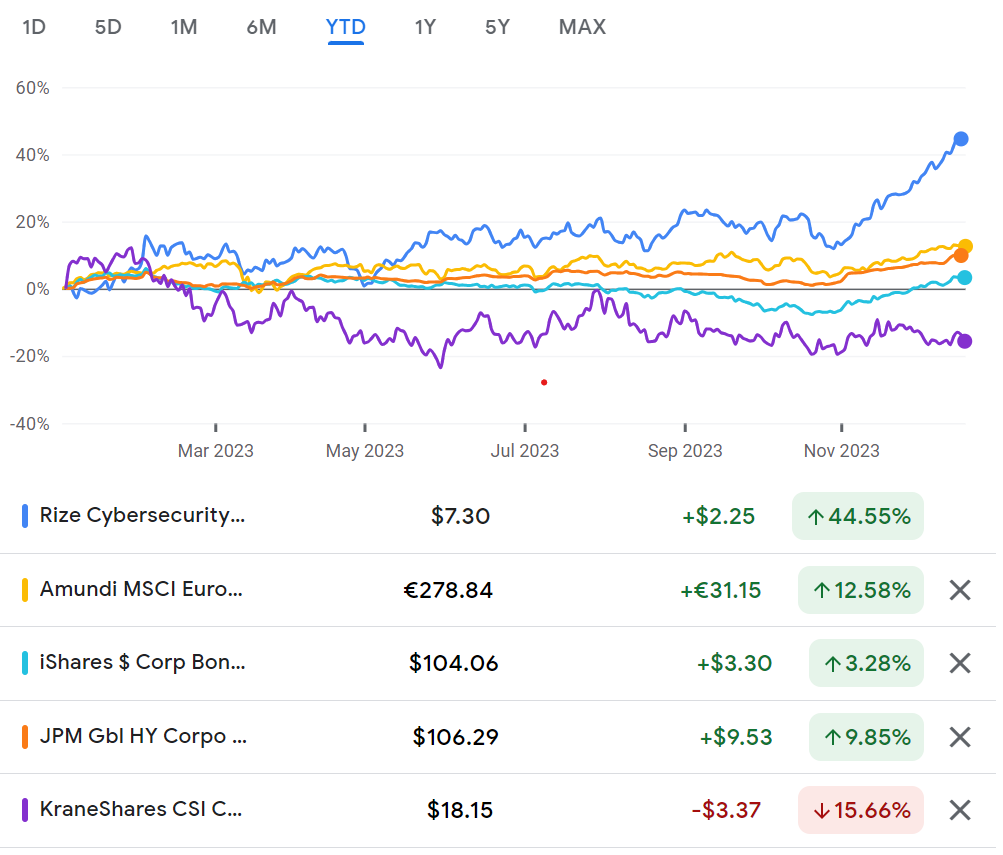

Chart 1: Performance of ETF Stream’s 2023 ETF picks

Amundi MSCI Europe Value Factor UCITS ETF (CV9): 12.6%

What we said:

“The continent faced some particularly fierce headwinds over 2022 with the war in Ukraine, inflation and rising bond yields driving down valuations across the market. However…this low valuation point could be a key driver for European equities in 2023, despite the likelihood it will be another year of volatility.”

While Amundi MSCI Europe Value Factor UCITS ETF (CV9) posted returns of 12.6%, marginally outperforming the pan-Europe Stoxx 600 index (11.1%), a more granular sector or regional allocation to Europe was the real play for investors this year.

For example, the Lyxor MSCI Eastern Europe ex Russia UCITS ETF (CECL) was Europe’s top-performing strategy, soaring 44.3% year to date.

Also faring well was the European tech and financial sectors, with the Xtrackers MSCI Europe Information Technology ESG Screened UCITS ETF (XS8R) and the Amundi ETF MSCI Europe Banks UCITS ETF (CB5), returning 40.3% and 28.4%, respectively.

iShares $ Corp Bond UCITS ETF (LQDE): 3.3%

What we said:

“The increasing likelihood of a recession will see them play a more important role in investors’ portfolios over the next 12 months and are poised to offer attractive real yields, particularly in inflation starts to fall.”

The return of fixed income may not have lived up to expectations this year and investors have had a bias towards short-duration US Treasuries as interest rates remained high.

However, the iShares $ Corp Bond UCITS ETF (LQDE)has benefitted from a sharp rally at the end of October as investors bet on central banks ending their rate hiking cycle.

JPMorgan Global High Yield Corporate Multi-Factor UCITS ETF (JGHY): 9.9%

What we said:

“With this in mind, the ETF should benefit from stabilising interest rates and with a recession likely priced in, could offer more attractive yields than its investment grade and sovereign bond counterparts.”

High yield bonds finally lived up to their billing in 2023 – yielding over their historical averages for much of the past year – with the JPMorgan Global High Yield Corporate Multi-Factor UCITS ETF (JGHY) jumping 9.9%.

Despite this, the asset class has split investors with many deciding to stay away owing to tight spreads – the difference between yields in high yield bonds compared to corporate bonds.

Fund selectors looking at European high yield would have been rewarded the most, with the Xtrackers EUR High Yield Corporate Bond UCITS ETF (XHYG) returning 14.2% this year.

KraneShares CSI China Internet UCITS ETF (KWEB): -15.7%

What we said:

“Internet stocks are set to benefit hugely from the [China] reopening due to the companies’ exposure to eCommerce, online travel bookings and already distressed valuations.”

China has continued to underperform investors’ expectations this year but not many anticipated the extent to which this would happen.

Half-hearted fiscal stimulus, low output and property sector woes meant China did not see the pandemic re-opening recovery many had predicted, with the KraneShares CSI China Internet UCITS ETF (KWEB) plummeting 15.7%.

Investors will continue to be lured into the world’s second-largest economy however, with the recent $112bn stimulus package – the biggest injection of one-year policy loans ever – creating a potentially interesting entry point.

Rize Cybersecurity and Data Privacy UCITS ETF (CYBP): 44.6%

What we said:

“A recent Morgan Stanley survey of 100 chief technology officers found that cybersecurity was the least likely tech expense to face cuts in spending over the next year. Government policy in both the US and Europe is also supportive, with President Joe Biden signing the Cyber Incident Reporting for Critical Infrastructure Act of 2022 and the European Union proposing rules for cyber hygiene.”

The best-performing ETF in our 2023 picks, cybersecurity finally lived up to the hype this year.

Cybersecurity companies have seen their earnings grow substantially in 2023 and – alongside artificial intelligence – the software is taking up most businesses' IT budgets as the risk of cyber hacks increases.

The theme saw huge performance dispersion, however, with the WisdomTree Cybersecurity UCITS ETF (CYSE) topping the performance charts with returns of 64.6% versus 44.6% for the Rize Cybersecurity and Data Privacy UCITS ETF (CYBP), highlighting the importance of ETF selection and looking under the bonnet.

The verdict

Equally weighted, our 2023 picks have returned 10.9% so far this year. While double-digit returns are admirable, a globally diversified 60/40 portfolio returned 15.3%, as at 14 December, according to JP Morgan Wealth Management.