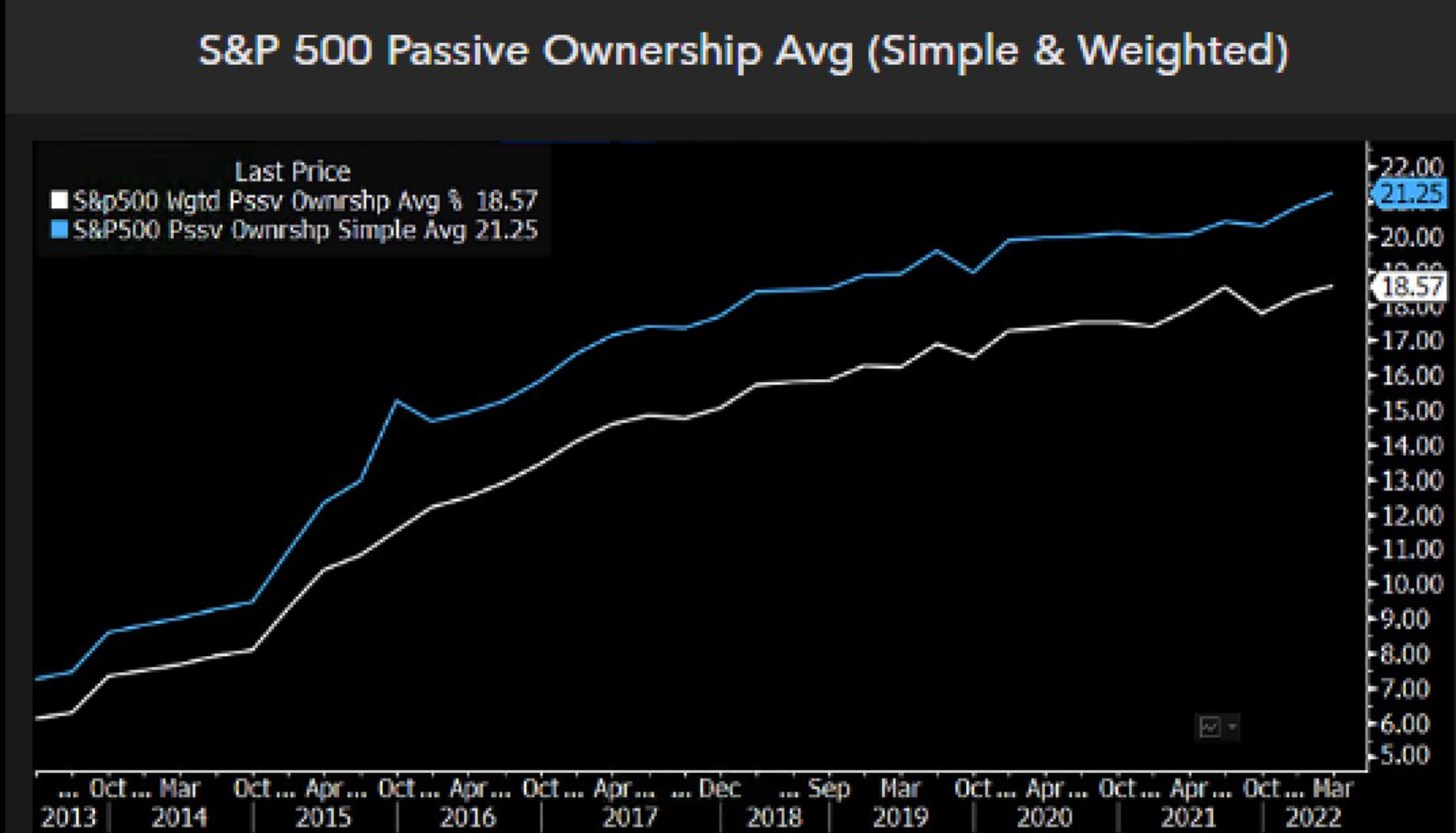

After recent data showed the average ownership of S&P 500 constituents by passive funds doubled in the last seven years, it is surely unlikely this explosive growth can be maintained.

Bloomberg Intelligence data shows ownership of the US large-cap index by index-tracking vehicles hit 21.3% at the end of Q1 this year, or 18.6% on a weighted-average basis, up from just a percent seven years after index funds were invented in 1976.

Source: Bloomberg Intelligence

A 2019 report in The North American Journal of Economics and Finance, HEC Montreal associate professor, Vincent Gregoiré, highlighted why this is an issue: index inclusion and exclusion affect security valuations – and this dynamic increases with the amount of assets tracking an index.

“I present theoretical explanations and empirical evidence suggesting that comovement within index stocks increases with the relative wealth of indexers, which can explain the rise of comovement in S&P 500 stocks that began in the 1970s,” he argued.

The worry now is if the ownership of benchmark constituents – such as those in the S&P 500 – by passive funds increases, market efficiency will diminish. Furthermore, the fact assets housed in ETFs alone shot up from $4trn at the time Gregoiré published his paper, to $10trn by the end of last year.

Ben Johnson, director of global ETFs and passive strategies research at Morningstar, previously told ETF Stream we are a long way from a “dog wags tail kind of scenario” and that “index strategies are by definition price takers” while “discretionary managers still exist to take advantage of any mispricing”.

However, the chorus warning of passive’s power to move markets continues to find support.

Vincent Deluard, economist and global strategist at StoneX Group, suggested last year that as much as 27% of the S&P 500’s p/e ratio hike from 15x to 38x in thirty years could be attributed to the rise of passive funds such as the SPDR S&P ETF Trust (SPY), which launched in 1993.

Should concerns about passive ownership and market inefficiency prove just – and passive growth continues at rapid pace – there must come a point where regulators are forced to step in to stimy the economics of indexing.

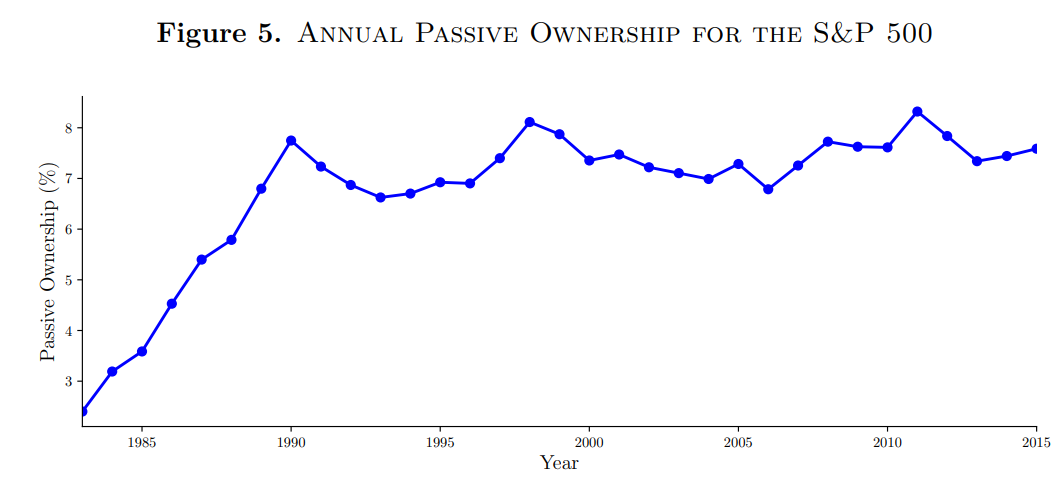

Aside from this gloomy outcome, another route could be that after such a roaring decade, the relative rate of passive growth simply cools off in the coming years, and their stock ownership remains rangebound as it did in the S&P 500 between 1990 and 2015.

Source: The North American Journal of Economics and Finance

ESMA has a busy week

The European Securities and Markets Authority (ESMA) had its Central Securities Depository Regulation (CSDR) and securities lending fees in its sights in a busy week for the funds watchdog.

First, it decided to kick the can down the road on a controversial element of the CSDR – the mandatory buy-in regime – which obliges a seller to foot any additional cost of sourcing securities from a third party, in the event it fails to deliver the securities itself.

Cash penalties for settlement failures remain in place but mandatory buy-ins have been put on hold for three years.

Next, ESMA signalled its intention to take securities lending agents and ETF issuers to task after it reported agents keep between 10-50% of revenues from lending transactions, while issuers only pass on 50-65% of gross revenues to clients.

These fee split arrangements “merit further investigation and analysis”, it said.

Another Russia ETF bites the dust

In the latest but unlikely final episode of ETFs and the Russian invasion of Ukraine, Invesco announced it would terminate its Invesco RDX UCITS ETF (RDXS) on 21 June.

The move comes around three weeks after the benchmark provider Wiener Boerse discontinued RDXS’s underlying index – which was followed by the ETF’s swap counterparty calling time as it no longer had a valid reference point.

RDXS becomes the second Russia-focused equity ETF to be terminated after BlackRock announced it would halt its Russia and Eastern European ETFs last month. More may yet follow in the coming weeks.

ETF Wrap is a weekly digest of the top stories on ETF Stream

Related articles