Yields on two-year US Treasuries collapsed over 100 basis points this week in their largest one-day fall since 2008 and biggest three-day slide since 1987, with hedge fund veteran Clifford Asness claiming “this only makes a shred of sense”.

"The two year Treasury is currently down to 3.8% with CPI inflation stubbornly staying at 6% per annum," the AQR Capital Management's founding partner

."I think this only makes a shred of sense if you think the GFC is around the corner again.

"And the equity market has held up much better which really doesn’t fit a GFC scenario.

"What am I missing?"

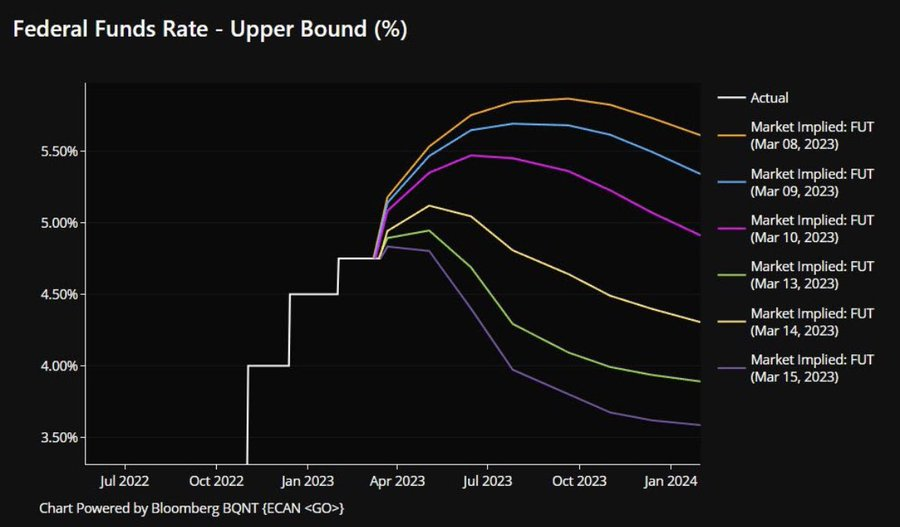

The core case behind this has been investors betting against a hawkish Federal Reserve at the next Federal Open Market Committee (FOMC) meeting next week.

Little over a week ago, Fed chair Jerome Powell responded to jobs and sticky inflation data by warning “the ultimate level of interest rates is likely to be higher than previously expected”, with the CME Group’s FedWatch pricing in a 0% probability of the funds rate remaining untouched while some outlets mused at the idea of a 6% terminal rate.

Between last Thursday and Monday this week, the collapse of Silicon Valley Bank (SVB) and the Federal Deposit Insurance Corporation’s (FDIC) deposit backstop marked a U-turn in market sentiment, with the FedWatch split on odds at the start of the week between a 25 basis points (bps) rate hike or a stay-put scenario.

This about turn in policy expectations was within five days of pundits pricing in another potential 50bps hike with a probability as high as 76%, which goes some way to explaining the drastic 125bps cut to two-year US Treasury yields – which are more sensitive to interest rate changes – between 9 and 15 March.

One Twitter user responded to Asness’s bemusement with the suggestion short-term US Treasuries could have “both soaked up the ‘fear’ trade and been a replacement for bank deposits”, a theory Asness said “makes sense” given uncertainty over the Fed’s pathway of trying to navigate fighting inflation while not jeopardising financial stability.

Asness’s reaction to the yield collapse underlines the fundamental mismatch in rates markets and core price inflation still at three-times target levels.

The Fed’s dilemma now is whether to stay the course of hiking or to heed the knock-on, lagged effects this will have. Doing so would mean continued losses for banks on their bond portfolios and tighter monetary conditions, with start-ups and prodigal tech venture firms finding it more difficult to access credit, forcing them to cut costs and potentially offload staff.

Even as the Fed’s balance sheet increased by $300bn over the last week, its fourth-largest increase over this timescale, investment banks remain split on whether the central bank will raise rates at all at its next meeting, with Nomura even expecting a 25bps cut.

Europe welcomes active entrant

Breaking up the uncertain and gloomy headlines this week was ETF Stream revealing the arrival of US asset manager Horizon Kinetics with the launch of an active inflation beneficiaries ETF.

The Horizon Kinetics Inflation Beneficiaries UCITS ETF (INFBN) is set to list on Euronext Amsterdam with a fee of 0.85%, with the product’s $1.2bn US equivalent currently allocating to 44 hard asset, capital light stocks, boasting a 19.7% return between inception in November 2021 and 15 March this year.

The ETF issuer added, however, the product has the potential to deliver “full-cycle inflation exposure”, with exposure to high quality companies often underrepresented in market cap global indices.

ETF Wrap is a weekly digest of the top stories on ETF Stream