The state of European sustainable finance has evolved rapidly in recent years. The EU Taxonomy regulation established criteria for classifying sustainable activities, allowing for fund managers to evaluate the extent to which investments in companies’ economic activities are environmentally sustainable.

The Sustainable Finance Disclosure Regulation (SFDR) endeavours to bring greater transparency to investors on sustainability factors and how sustainability risks are integrated in fund manager’s investment processes. More recently, requirements to integrate sustainability considerations in investment products through the MiFID II have been implemented.

Collectively these regulations have had an impact on the European ETF market, ranging from product launches, to flows and the levels of transparency they provide to end investors.

We estimate that just under €400bn out of €1.4tn under management in Europe are invested in Article 8 and 9 ETFs, or strategies with some sustainability-related focus in portfolio construction. Almost a third of ETF-based capital in Europe is therefore relevant in the context of, and impacted to some degree by the EU taxonomy, SFDR and MiFID. In this piece, we briefly explore how the European funds universe performs across these streams in terms of disclosures and investability.

EU Taxonomy

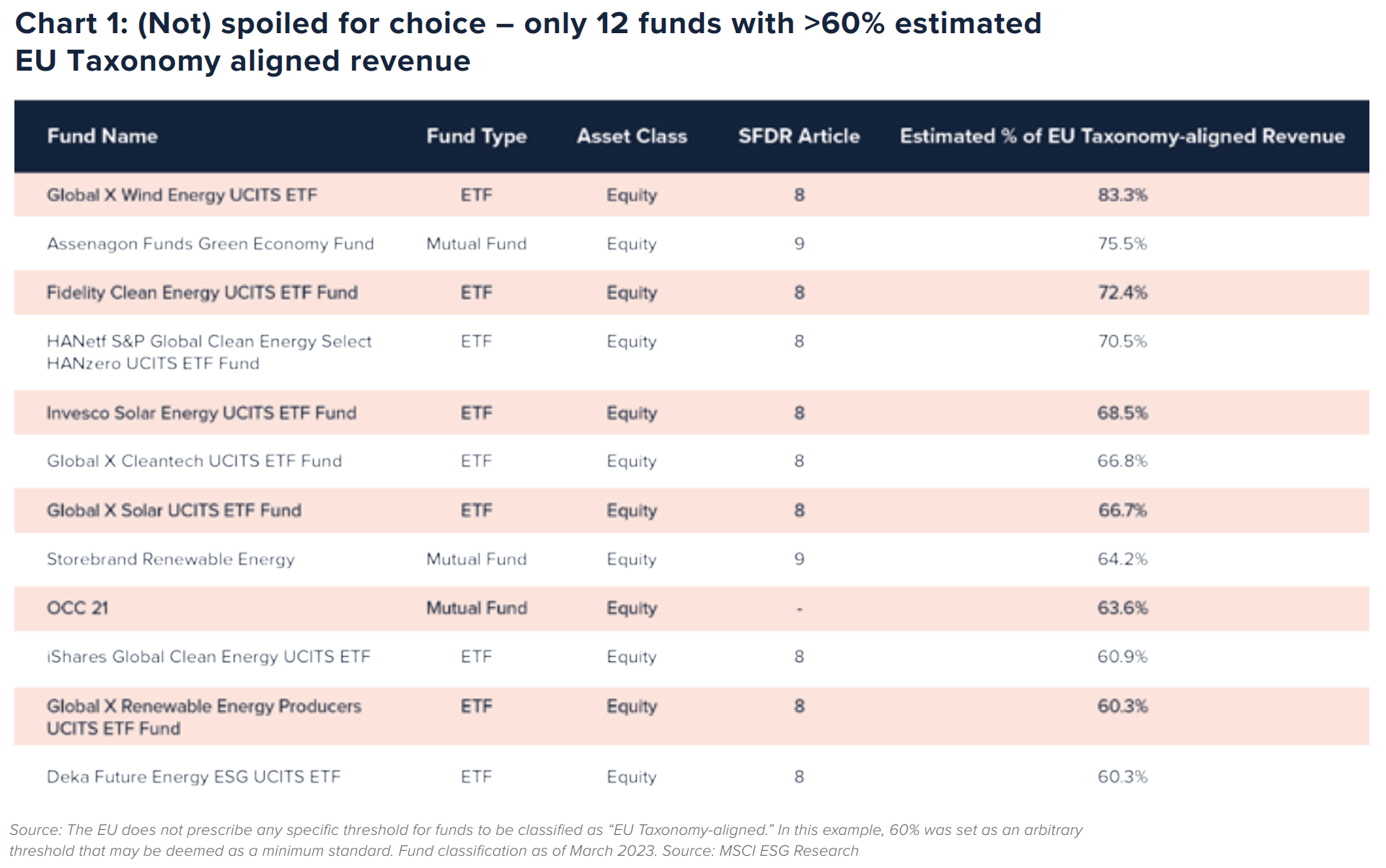

The EU Taxonomy centres upon financial market participants reporting the percentage of environmentally sustainable investments using consistent and comparable definitions. Based on data disclosed by funds in the European ESG Template (EET), as of 30 April, MSCI ESG Research found that the overwhelming majority of Article 8 and Article 9 ETFs stated “no intent” vis-a-vis EU Taxonomy alignment in the EET reporting. Notably, the majority of high taxonomy-aligned funds were classified as Article 8 funds under SFDR, with only two being Article 9, which may appear counterintuitive to impact-focused fund selectors.

All of this can be attributed to the ‘work-in-progress’ nature of the EU Taxonomy or to the level of stringency set for sustainable activities.

Although reporting volumes have increased, company disclosure data for EU Taxonomy eligibility and alignment criteria remain low. In either case, it leaves sustainability-minded ETF investors with a limited pool of options, which may be challenging for mandates that require a minimum level of EU taxonomy alignment while balancing diversification needs.

SFDR

SFDR, enacted in 2021, requires financial market participants including wealth managers to disclose how they integrate sustainability risksalongside how they consider the potential adverse impacts of their investments on sustainability factors. SFDR also requires funds to be categorised based on their level of sustainability.

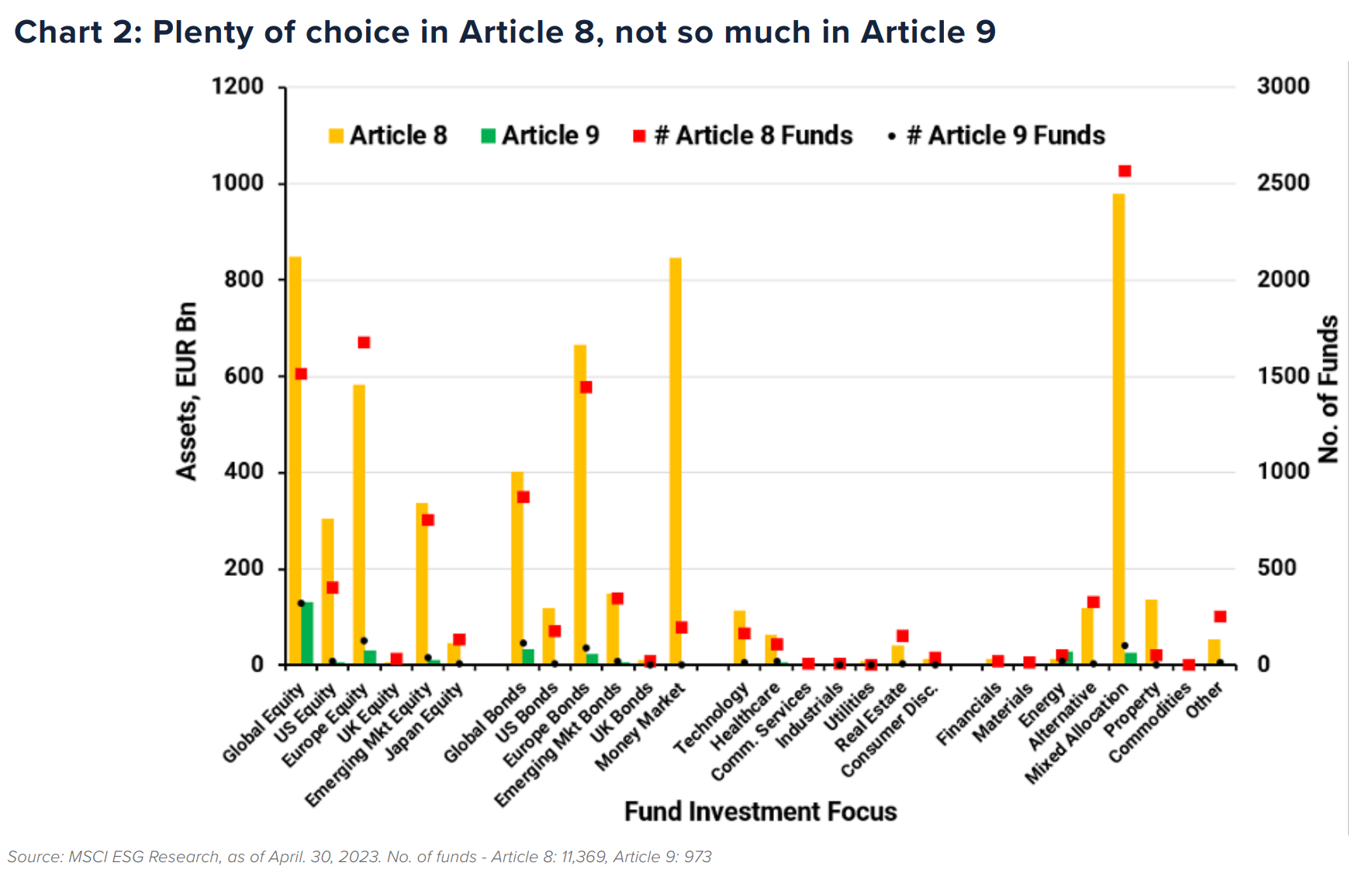

Article 8 and Article 9 funds now collectively account for over €6trn assets (55% of Europe fund assets). As at the end of February 2023, there were 12x more Article 8 funds than Article 9 available for investors and those funds collectively hold 18x the assets. This imbalance may continue, as updates in regulatory guidance have driven reclassifications of funds. Our analysis indicated that approximately 20% of SFDR classifications in European funds changed over the previous year, with a net migration from Articles 6 and Article 9.

On fund types, global equity strategies dominated across both Article 8 and Article 9 funds, however, there was more diversity of choice in asset class, geographic and sectoral focus for Article 8 funds – an important consideration for wealth managers constructing portfolios from funds, and catering to clients with more ambitious sustainability preferences.

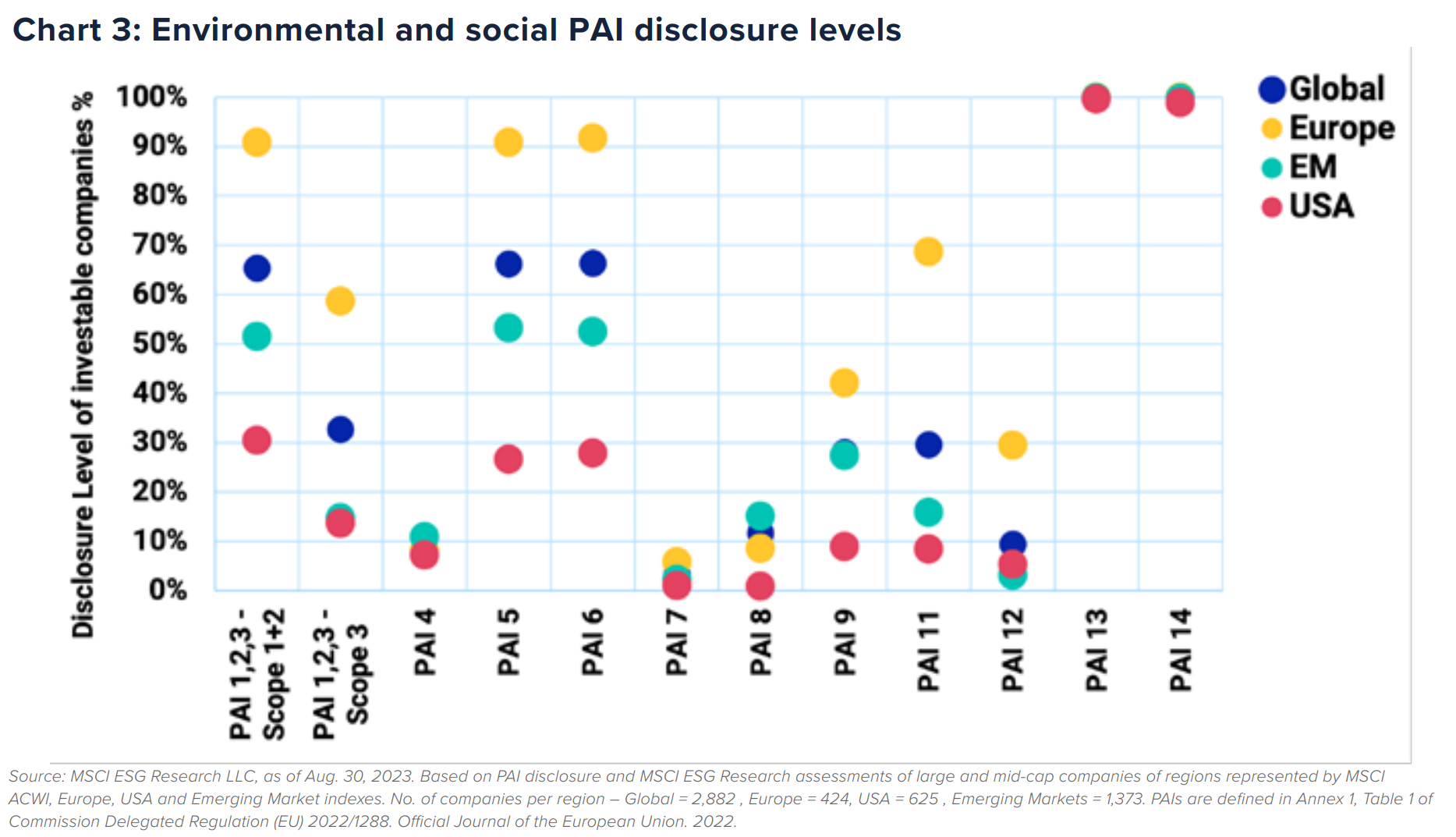

For ETF issuers seeking to create Principle Adverse Indicator (PAI) optimised funds, disclosure levels are a key determinant. Assessing the large and mid-cap investable universe revealed high dispersion on disclosure of environmental PAIs such as emissions-based metrics (Scope 1-3). European companies led the charge with over 90% of firms disclosing Scope 1 and 2 emissions.

Notably, emerging markets exhibited higher disclosure levels versus the US, across Scope 1, 2 and 3 emissions, and higher versus Europe on PAI 8 – emissions to water disclosure.

On social PAIs (11-14), gender pay gap reporting was low across the board with 3.1% of companies globally disclosing. Europe had the highest disclosure rates for the social PAIs 30%, and the US marginally disclosed more than the emerging markets. Board gender diversity (PAI 13) disclosure was high across regions, however, it is important to note that high disclosure does not necessarily equate to the boards of the companies having higher diversity than peers.

MiFID sustainability preferences

Under MiFID II, investment firms providing investment advice and portfolio management services are required to consider sustainability factors and risks adverse impacts of their investments. Key among the amendments introduced in MiFID II is the requirement that investment firms inquire about the individual sustainability preferences of their clients. To be able to recommend suitable products to clients, investment firms have to confirm whether a client has sustainability preferences, and if so, whether, and to what extent, one or more of the following criteria should be integrated into their investment:

Financial instruments or products with a minimum proportion of sustainable investments that qualify as environmentally sustainable under the EU Taxonomy (“Taxonomy-aligned Investments”)

Financial instruments or products with a minimum proportion of sustainable investments as defined under Article 2(17) of the SFDR (“Sustainable Investments”)

Financial products or instruments that consider principal adverse impacts on sustainability factors (“SFDR Principal Adverse Impact Indicators” (PAIs)), where those considerations are determined by the client or potential client

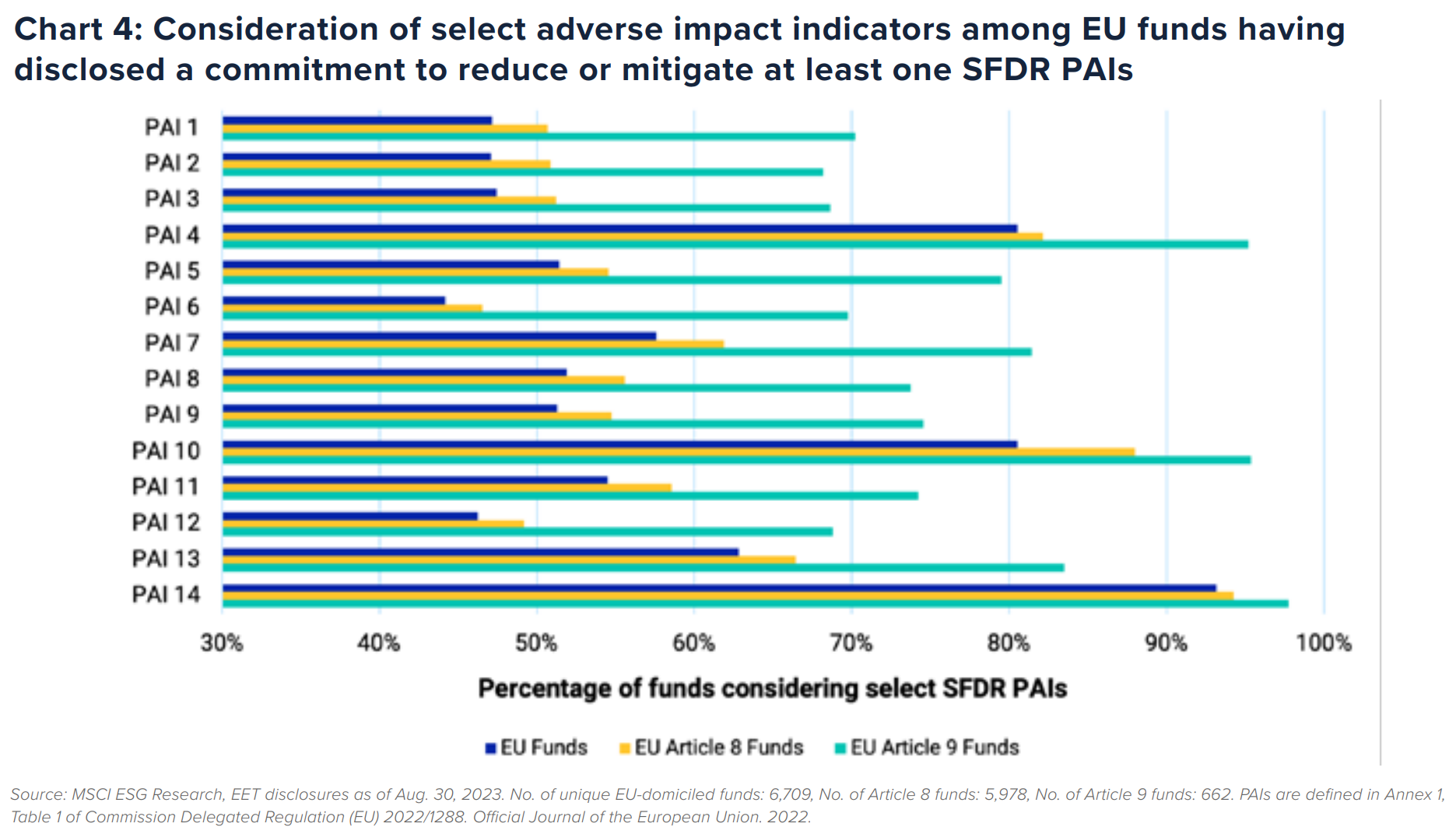

Based on data disclosed in the EET, as of 30 April, MSCI ESG Research found that over half of Europe-domiciled funds were considering (committing to reduce or mitigate) at least one SFDR principle adverse impact indicator in their investment strategy.

Consideration of involvement-type adverse impact indicators is more likely than consideration of quantitative indicators for which thresholds are not prescribed by SFDR regulation. Specifically, 80% of funds disclose considering exposure to companies active in the fossil fuel sector (PAI 4) and 93% consider exposure to controversial weapons (PAI 14).

On the other hand, approximately 47% of funds consider exposure to GHG emissions (PAI 1) and 51% of funds consider exposure to companies with non-renewable energy consumption and production (PAI 5).

Across the board, EU-domiciled Article 9 funds have committed to manage or mitigate PAIs more so than funds without sustainable investments as their objective, likely driven by the requirement to assess the portfolio against the principle of “do no significant harm” by considering the PAIs.

The state of disclosures, product choices and sustainability preferences will continue to evolve as the regulatory environment in Europe remains in flux.

While that presents a confluence of challenges for ETF market participants from portfolio construction to sustainability reporting, opportunities may also arise as investors become more attuned to how sustainability risks are integrated in the investment decision process.

Rumi Mahmood is vice president, ESG and climate research, at MSCI

This article was first published in ESG Unlocked: Is it time to draw the curtain on 'ESG'?, an ETF Stream report. To read the full report, click here.